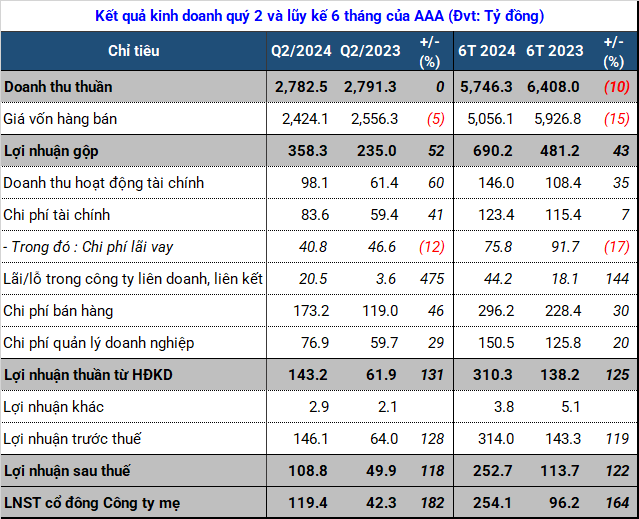

Quarterly revenue dipped slightly to around VND 2,800 billion in Q2, but the plastics company benefited from lower production costs, resulting in a 52% surge in gross profit to VND 358 billion.

According to AAA, stable resin prices facilitated both manufacturing and trading activities, leading to improved gross profit compared to the previous year. The overall gross profit margin reached 12.9%, a significant increase from 8.4% in Q2/2023 and the highest in 21 quarters, second only to 14.3% in Q1/2019. The gross profit margins for the trading and semi-finished products segments were 7.4% and 19%, respectively, compared to 2.7% and 16% in the same period last year.

| Quarterly financial results of AAA for 2019-2024 |

In addition to plastics, revenue from services (VND 70 billion) and real estate (VND 39 billion) also showed positive growth, increasing by 55% and 36%, respectively, despite their relatively small contributions.

The company attributed the improved financial performance to the higher profits of its associated companies, which contributed VND 20.5 billion, a 475% increase. AAA also recorded a significant surge in foreign exchange gains of VND 68 billion, six times higher than the previous year. However, this was offset by capital transfer expenses amounting to nearly VND 30 billion.

AAA posted a net profit of nearly VND 120 billion, a 182% increase, despite a 46% rise in selling expenses (VND 173 billion) and a 29% increase in administrative expenses (VND 77 billion). This profit figure, although lower than the VND 135 billion recorded in Q1/2024, remains one of the highest in many years.

As a result, net profit for the first half of 2024 increased by 164% to VND 254 billion, the highest since the company began operations, second only to the VND 346 billion recorded in the first half of 2019.

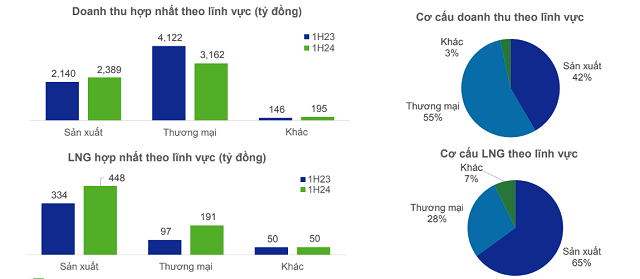

Meanwhile, cumulative revenue for the period declined by 10% to over VND 5,700 billion, mainly due to lower trading volumes, which caused a 23% decrease in revenue from this segment (accounting for 55% of total revenue). As of June, AAA had achieved 48% of its annual revenue target and 67% of its net profit goal.

Source: VietstockFinance

|

As of June 30, 2024, the company’s total assets amounted to approximately VND 12,200 billion. Cash, cash equivalents, and investments held to maturity accounted for VND 3,500 billion, or 29% of total assets. Notably, investments held to maturity stood at VND 1,300 billion, with an additional VND 1,100 billion invested during Q2.

Similarly, short-term loans and receivables decreased by VND 653 billion to VND 106 billion. This balance had increased from VND 63 billion to VND 696 billion in Q1. Short-term and long-term unearned revenue in the industrial park segment increased from VND 1,600 billion at the beginning of the year to over VND 2,000 billion due to additional land transfers in the An Phat 1 Industrial Park.

AAA‘s investment activities picked up significantly in the first half of 2024. The company invested VND 394 billion in the acquisition, construction, and development of fixed assets and other long-term assets, compared to nearly VND 20 billion in the same period last year.

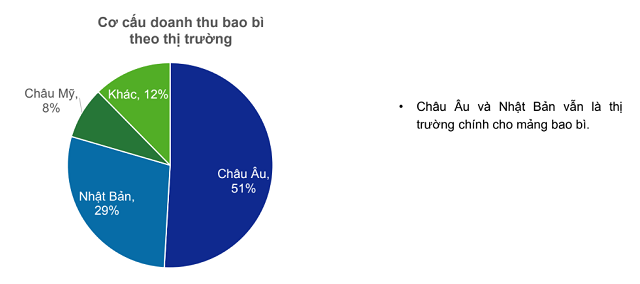

The company’s growth drivers for 2024 are expected to come from its core business of manufacturing plastic packaging, resin, and additives; accelerating land transfers in the An Phat 1 Industrial Park; and enhancing the efficiency of its resin trading segment.

Regarding the expansion of the An Vinh Industrial Packaging Factory and the construction of a resin and plastic products factory (Factory 8), AAA anticipates that these projects will contribute an additional VND 1,300 billion in annual revenue when they operate at full capacity in 2025.

In the real estate segment, the An Phat 1 Industrial Park commenced operations in 2023 and achieved an occupancy rate of 85% as of May 2024.

Source: AAA

|