Domestic and International Growth

On July 30, Vinamilk, the Vietnam Dairy Products Joint Stock Company (stock code: VNM), announced its Q2 financial report, with consolidated revenue reaching VND 16,665 billion, surpassing the previous record of Q3 2021 (VND 16,194 billion) to become the highest-revenue quarter. This quarter also saw the company’s highest growth rate for 2022, with a 9.5% increase year-on-year.

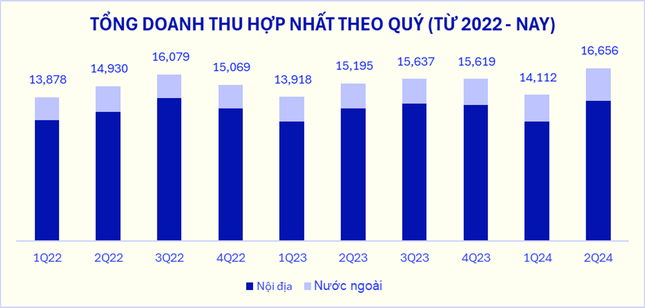

Vinamilk’s Consolidated Revenue Chart.

This outstanding performance was driven by both domestic and overseas business operations, with growth rates of 5.8% and 29.9% year-on-year, respectively.

Breaking down the revenue sources, the overseas market contributed a significant 18.5% to the Q2 consolidated revenue. Export sales reached VND 1,740 billion, a remarkable 37% increase compared to the same period last year, outpacing the 5.9% growth achieved in Q1.

The company’s foreign branches in Cambodia and the US recorded a combined revenue of VND 1,384 billion in Q2, reflecting a 21.8% year-on-year increase and surpassing the 9.6% growth of the previous quarter.

Meanwhile, the domestic market, the primary revenue source, generated VND 11,850 billion, a 3.8% increase compared to the previous year. This growth was propelled by double-digit increases in sales of drinking yogurt, condensed milk, and plant-based milk, among other products.

For the first half of the year, consolidated revenue reached VND 30,790 billion, a 5.6% increase year-on-year, accomplishing 48.7% of the annual plan.

As a result, consolidated after-tax profit for Q2 reached VND 2,695 billion, a 20.9% increase year-on-year. For the first six months, the after-tax profit was VND 4,903 billion, an 18.6% increase compared to the same period last year, achieving 52.3% of the annual plan.

Vinamilk’s consolidated after-tax profit for Q2 reached VND 2,695 billion, a 20.9% increase year-on-year.

As of June 30, Vinamilk’s total assets amounted to VND 54,194 billion, with a debt-to-asset ratio of 14.7%.

Ms. Mai Kieu Lien, CEO of Vinamilk, attributed this exceptional performance to continuous product innovation, enhanced service quality, market expansion, operational efficiency improvements, and a vigorous strategy of renewal.

How Did Vietjet and The Gioi Di Dong Perform?

Vietjet Aviation Joint Stock Company (stock code: VJC) reported air transport revenue of VND 15,128 billion in Q2, marking a 23% increase year-on-year, along with a pre-tax profit of VND 517 billion, a significant surge of 683% compared to Q2 2023.

For the first six months, Vietjet’s revenue reached VND 34,016 billion, a 15% increase year-on-year, with a pre-tax profit of VND 1,311 billion, surpassing the same period last year by 433% and exceeding the annual plan by 21%. During this period, Vietjet served 13.1 million passengers and operated 70,154 flights.

Vietjet Aviation’s pre-tax profit reached VND 517 billion, a 683% increase compared to Q2 2023.

In Q2, Ca Mau Petroleum Fertilizer Joint Stock Company (Ca Mau Fertilizer – stock code: DCM) achieved VND 3,863 billion in revenue, a 17% increase year-on-year, and an after-tax profit attributable to the parent company of VND 569 billion, a remarkable 97% increase compared to Q2 2023. This was the highest profit recorded by Ca Mau Fertilizer in the last six quarters.

For the first half of the year, Ca Mau Fertilizer’s revenue reached VND 6,607 billion, a 10% increase, and a net profit of VND 915 billion, a 69% surge compared to the same period in 2023. Thus, the company has exceeded its 2024 after-tax profit plan by nearly 16%.

The Gioi Di Dong Investment Joint Stock Company (stock code: MWG) concluded Q2 with VND 34,100 billion in net revenue, a 16% increase year-on-year. For the first six months, MWG’s net revenue exceeded VND 65,600 billion, accomplishing 52% of the annual plan.

In Q2, The Gioi Di Dong recorded a net profit of nearly VND 1,200 billion, a staggering 67-fold increase compared to the same period last year. For the first half, the company’s net profit reached nearly VND 2,100 billion, completing 86% of the annual plan.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.