In a recent announcement, Mr. Pham Thanh Hung, also known as “Shark Hung,” Vice Chairman of CTCP Bat Dong San The Ky (Cen Land), plans to purchase 5 million CRE shares from August 6 to September 4, 2024. His intended method of acquisition is through matching orders or agreements, with a personal investment goal in mind. If successful, Mr. Hung will hold over 18 million CRE shares, equivalent to a 3.94% stake in the company.

Shark Hung’s move to acquire more shares comes as the CRE share price witnessed a 28% drop over four months (from April to the end of July) before a slight recovery. Currently, CRE is trading at VND 6,930 per share as of the morning session on August 1. Based on this price, Shark Hung is estimated to invest approximately VND 35 billion to complete the purchase.

The CRE shares remain under cautionary notice from April 10, 2024, onwards due to the auditing organization’s qualified opinion on the audited 2023 financial statements.

In a recent report on the progress of addressing the cautioned securities, Cen Land stated that for the Hoang Van Thu New Urban Area project, CTCP Bat Dong San Galaxy Land will continue to represent Cen Land and Trustlink in closely monitoring the progress and urging the investor to arrange the remaining land use fee.

Additionally, Cen Land is actively working with CTCP Hong Lam Xuan Thanh to recover receivables, mainly deposits for the purchase of products belonging to the Xuan Thanh Service and Resort Area project in Nghi Xuan district, Ha Tinh province. In the third and fourth quarters, upon receiving suitable proposals from Hong Lam Xuan Thanh, Cen Land will sign contracts for the sale of future houses for the properties that have been booked to transfer and offset the financial obligations between the two parties.

Regarding the financial results for the second quarter of 2024, Cen Land recorded net revenue of nearly VND 334 billion, a 17% decrease compared to the same period last year. After-tax profit reached nearly VND 9 billion, a reduction of over 9% compared to 2023. According to Cen Land’s explanation, the real estate market has shown positive signals but is not yet vibrant. The company’s real estate investment revenue decreased as some projects were not launched, leading to a decline in revenue and after-tax profit compared to the previous year.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

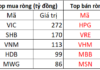

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.