The market was quite volatile this afternoon, with sellers dominating, but blue-chip stocks managed to keep the index stable. The VN-Index, at its lowest point in the afternoon session, was up just over one point, but closed up 6.45 points. The top stocks deserve the most credit for this recovery.

The VN30-Index closed up 0.88% from the reference point, while the Midcap decreased by 0.25%, the Smallcap by 0.65%, and the VN-Index by 0.52%. All 10 stocks that contributed the most to the VN-Index’s gain were from the VN30 group, adding about 10.5 points, which is more than the total increase in the index. Meanwhile, the breadth was slightly tilted towards the red, with 206 gainers and 224 losers.

The role of the blue-chip group was very evident this afternoon. A significant selling pressure emerged, lasting almost the entire afternoon session. The VN-Index hit its intraday low at 2:26 PM, up just 1.38 points. At this low, 170 stocks were in the green, while 257 were in the red. Without the support of these large-cap stocks, the index could have even dipped into negative territory.

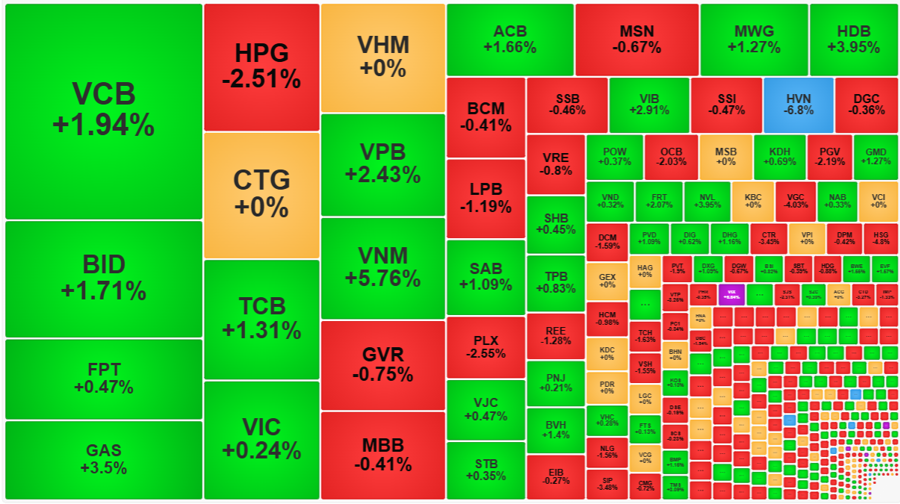

Most of the largest stocks were unaffected by the decline this afternoon. VCB remained resilient and even gained momentum towards the end, closing 1.94% higher than the reference price. VNM hit its intraday high at 2:11 PM and closed near this high, up 5.76%. BID eased slightly during the ATC session but still ended 1.71% higher. GAS also closed near its intraday high, up 3.5%. TCB and VPB, with gains of 1.31% and 2.43% respectively, were among the stocks that pushed the index higher. Statistics show that this afternoon, 14 stocks in the VN30 basket increased their morning gains, while 12 stocks declined. The index for this basket fell slightly compared to the morning session (up 0.94%).

However, some blue-chip stocks faced significant selling pressure. HPG is a notable example: Its decline in the morning session was insignificant at -0.54%, but starting around 1:45 PM, it experienced heavy selling. The price plummeted rapidly, closing 2.51% lower than the reference price. This was HPG’s sharpest intraday decline in three months. In the afternoon session alone, the stock lost 1.98% of its value with a liquidity of VND 503.2 billion. HPG also represents the steel stocks that were dumped in the afternoon session. HSG plunged as soon as the afternoon session began and hit its intraday low, down 6.99%, just seven minutes before the ATC session. HSG closed 4.8% lower. Other steel stocks followed suit: NKG fell 3.83%, TVN fell 7%, VGS fell 6.01%, and TLH fell 6.95%. The steel industry is currently facing strong headwinds from the risk of EU anti-dumping duties.

Small-cap and speculative stocks were the most affected by the afternoon sell-off. In the morning session, 69 stocks on the HoSE fell more than 1%, and by the close, this number had increased to 109. In the VN30 basket, only two stocks, HPG and PLX, fell 2.51% and 2.55%, respectively. Seven stocks hit their daily lower limit, including TCO, TLH, HBC, HVN, SMC, TMT, and SVC. Approximately 60 other stocks fell more than 2%, mainly small-cap stocks. Fortunately, the impact of these sharp declines on the index was negligible.

However, today’s afternoon session also demonstrated a significant shift in money flow as speculative stocks that had been hot during the recent rebound were subject to profit-taking. The inflow of money into blue-chip stocks was evident. Total trading value for the VN30 basket today surged 59% from yesterday, reaching VND 8,103 billion, the highest in the last eight sessions. Another statistic indicating that the market is not concerning is that, out of the high-liquidity stocks today, only a few experienced declines. Specifically, on the HoSE, among the 43 stocks with liquidity exceeding VND 100 billion, only 17 declined, of which 11 fell more than 1%. While profit-taking did occur, the impact on stocks with good liquidity was minimal.