Vietnamese stock markets witnessed a sharp sell-off in the afternoon session, with red dominating the screens. The VN-Index closed 1.96% lower at 1,226.96, while the HNX-Index and Upcom-Index dropped 2.6% and 1.63%, respectively. Total trading value across the three exchanges increased from the previous session, reaching VND 24,560 billion.

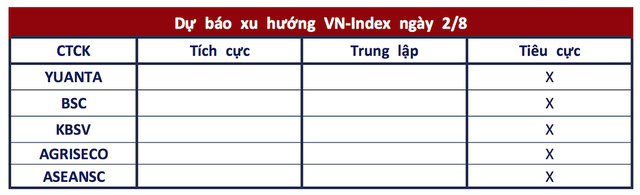

Most securities companies anticipate the VN-Index to continue its downward trajectory, heading towards short-term lows. They advise investors to reduce their positions.

Bearish Momentum Continues

(Yuanta Securities)

The market is likely to extend its losses, with the VN-Index potentially retesting the support level of 1,200-1,210. If a rebound occurs in the next 1-2 sessions, short-term risks may gradually diminish. Valuations have dropped to their lowest levels in April 2024, and with forex risks cooling off, the 1,200 level is seen as a strong support zone, offering better short-term opportunities than risks.

Additionally, investor sentiment indicators have turned more pessimistic, possibly reflecting heightened concerns over geopolitical risks.

Underlying Downside Risks

(BSC Securities)

Bottom-fishing activities were observed in the 1,220-1,225 region, but underlying downside risks remain. Investors are advised to exercise caution in the upcoming sessions.

VN-Index Likely to Break Short-Term Lows

(KBSV Securities)

The VN-Index formed a “Bearish Engulfing” pattern with surging trading volume, erasing almost all gains from the previous recovery phase. This indicates significant distribution pressure, and the index is likely to break below its recent lows before finding a footing for a corrective bounce.

1,200 Points Expected to Stem the Downtrend

(Agriseco Securities)

Agriseco Research attributes the decline to portfolio restructuring and margin deleveraging. They view the 1,200-point level, coinciding with the 200-day moving average, as a critical support zone that could halt the medium-term downtrend.

Investors Advised to Trim Positions

(AseanSc Securities)