Sacombank’s New Online Deposit Interest Rates Offer Attractive Returns

At the beginning of August, Sacombank, the Saigon Thuong Tin Commercial Joint Stock Bank, unveiled its new interest rates for online deposits, with increases across all tenures.

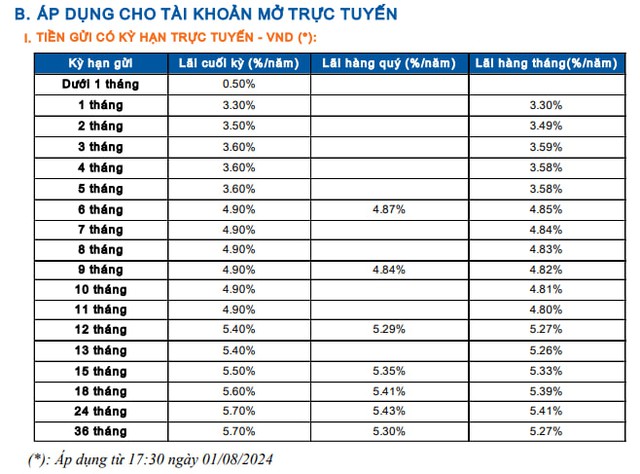

According to the updated rates, the 1-month tenure now offers a 0.3% annual increase, reaching 3.3%, while the 2-month and 3-month tenures have seen hikes of 0.4% and 0.3% respectively, landing at 3.5% and 3.6%.

The 4-month and 5-month tenures have been bumped up by 0.2% and 0.1% to a uniform 3.6%. Meanwhile, the 6-month tenure has witnessed a significant jump of 0.8%, now standing at 4.9%.

After adjustments, the interest rates for tenures ranging from 7 to 11 months at Sacombank have climbed to 4.9%, reflecting increases of 0.6% to 0.7%.

The 12- to 13-month tenure now boasts an interest rate of 5.4%, representing a 0.5% boost.

Sacombank has also substantially hiked interest rates for longer tenures. Specifically, the 15-month tenure has risen from 5% to 5.5%, the 18-month tenure has jumped from 5.1% to 5.6%, the 24-month tenure has increased from 5.2% to 5.7%, and the 36-month tenure has climbed from 5.4% to 5.7%.

Sacombank’s Recent Online Deposit Interest Rate Adjustments

Earlier in mid-July, Sacombank also made significant increases to its online deposit interest rates for various tenures, with the highest hike reaching 0.7%.

Following the latest adjustments, Sacombank now offers the highest online deposit interest rates among major private commercial banks. However, the bank has not made significant changes to its counter deposit interest rates, with the highest rate remaining at 5.2% for the 36-month tenure.

Prior to Sacombank’s move, Agribank, the bank with the largest deposit base in the system, also increased its interest rates for the first time in nearly two years, with adjustments of 0.1% across various tenures. Earlier, BIDV and VietinBank had also taken similar steps with their online deposit rates.

The interest rate hikes by these large-scale deposit-holding banks are likely to push up the overall deposit interest rate landscape in the coming months.

After dipping to historical lows, deposit interest rates began to climb back up in late March and continued to rise in April, May, and June.

In July, around 20 banks adjusted their deposit interest rates upward, including NCB, Eximbank, SeABank, VIB, BaoViet Bank, Saigonbank, VietBank, MB, BVBank, KienLong Bank, VPBank, PVCombank, PGBank, Sacombank, BIDV, ABBank, Bac A Bank, SHB, ACB, and Cake by VPBank. Notably, several banks have increased their deposit interest rates two to three times.

Analysts attribute these moves to the low growth in deposits from individuals and businesses in the initial months of the year, coupled with recovering credit growth, prompting banks to offer higher interest rates to ensure a balance in their capital sources, especially during the peak year-end period. Additionally, interventions by the State Bank of Vietnam (SBV) through bills and foreign currency sales have impacted the liquidity of Vietnamese dong among banks.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Sacombank maintains steady growth, ready to utilize internal resources to complete restructuring plan.

Sacombank has recently announced its financial results for Q4/2023. The bank has successfully achieved key business targets set by the Shareholders’ Meeting, with a pre-tax profit growth of 9,595 billion VND, a 51% increase compared to 2022, surpassing the year’s initial plans. What’s remarkable is that Sacombank has fully provisioned for the unrecovered VAMC debt, demonstrating its commitment to completing the restructuring plan in a timely manner.