The market endured a period of “mental torture” until around 1:45 pm, with active buying finally emerging. Blue-chip stocks recovered earlier, pushing the VN-Index to reference levels by 2 pm, despite the breadth still overwhelmingly favoring decliners. In the final minutes, a decisive upward push created a broad-based recovery across the board.

The VN-Index hit its intraday low at 1:03 pm, down 17.2 points. The index traded sideways in the first half of the afternoon session, with stocks recovering from their lows but lacking the strength to decisively change the index’s direction. It wasn’t until around 1:45 pm that the large-cap stocks rallied strongly, making a difference.

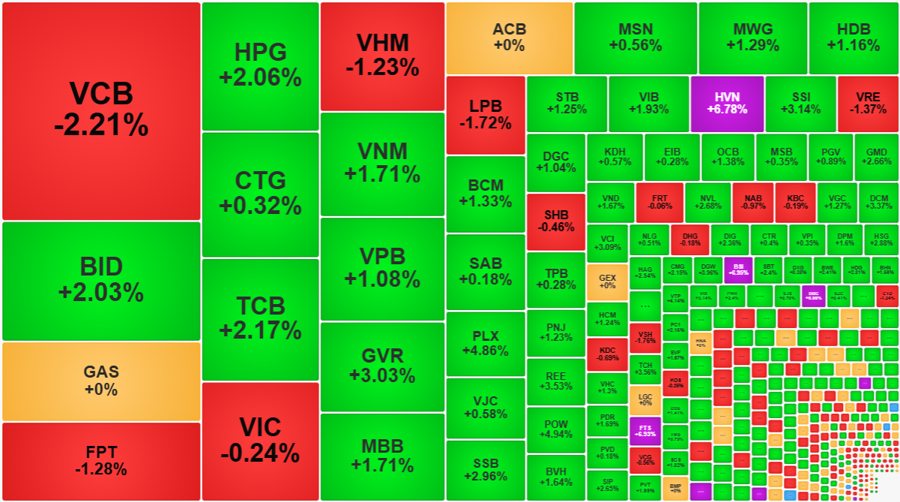

BID, HPG, TCB, and GVR were among the stocks that rose simultaneously during this period. Earlier, HVN started to climb sharply in the first 15 minutes of the afternoon session. However, as HVN’s rise was not supported by other large-cap stocks, its impact was limited. It was only when the VN30 basket of stocks showed consensus that the index changed rapidly.

All VN30 stocks closed higher compared to the morning session, with 14 stocks rising over 2% and seven others increasing between 1% and 2%. The most volatile stock was PLX, which closed the session up 4.86% from the reference price, equivalent to a 5.09% increase in the afternoon session alone. SSI rose 4.69% in the afternoon, surpassing the reference price by 3.14%. POW, which had already gained 1.14% in the morning, added another 3.76% in the afternoon, closing above the reference price by 4.94%. CTG recovered by 3.61%, ending the day up 0.32%…

The leading stocks that drove the VN-Index today were BID, up 2.03%; GVR, up 3.03%; TCB, up 2.17%; HPG, up 2.06%; and HVN, up 6.78%. The VN-Index closed up 9.64 points or 0.79%. However, if we consider the strongest recovery in the afternoon, the intraday gain reaches 2.22%.

The strength of the blue-chip stocks was evident, especially during the VN-Index’s surge past the reference level. At that time, the large-cap stocks showed their resilience, and almost all stocks in the VN30 basket turned positive. The VN30-Index closed up 0.71%, with 22 gainers and six losers, and the afternoon gain also exceeded 2%.

The breadth also improved significantly after the VN-Index crossed the reference level. At 2 pm, the HoSE had only 152 gainers and 287 losers. By 2:15 pm, the numbers changed to 169 gainers and 265 losers. Both the VN-Index and VN30-Index turned positive for the second time at 2:17 pm, indicating that non-large cap stocks were still catching up. At the close, the breadth showed a stark contrast with 267 gainers and 160 losers.

Bottom-fishing activities were quite strong, leading to a 44% increase in liquidity on the two listed exchanges in the afternoon session compared to the morning, reaching VND9,854 billion. HoSE’s liquidity alone increased by 44% to VND9,246 billion. Given the price recovery and the large number of stocks reversing to trade above the reference price, the strong liquidity can be attributed to active buying.

Among the 267 stocks that closed above the reference price on the VN-Index, 148 stocks rose more than 1%. This group accounted for approximately 61% of the total matched value on the HoSE. This demonstrates the effectiveness of the price push. The stocks with the highest liquidity and the strongest gains all recovered by 2-3% in the afternoon. Notably, stocks like SSI, DGC, VIX, DIG, HSG, PNJ, TCH, DCM, and PDR reversed by 4-6%.

The wide recovery range, coupled with strong liquidity, reflects the active participation of bottom fishers. However, overall liquidity for the day was not high, with the total matched value on the two exchanges falling by 24.4% from the previous day to VND16,692 billion. HoSE’s liquidity decreased by 23% to VND15,667 billion. On a positive note, the low liquidity and strong price reversal suggest that selling pressure has eased rather than increased.