Ms. Nguyen Hoai An, Senior Director of CBRE Vietnam, shared these figures at a seminar on “Real Estate Investment Focus in the New Context” hosted by The Leader magazine this afternoon (July 30th).

Commenting on the supply of Hanoi apartments in the past, Ms. Hoai An stated that a notable aspect was the significant concentration of mid- and high-end properties.

“The proportion of premium products reflects a new price level, especially in the premium price range. Approximately 70% of the apartments launched in the first half of 2024 belonged to the premium segment, priced at 60-120 million VND per square meter,” said Ms. Hoai An.

In its recent market report, real estate consultancy Savills noted that Hanoi saw no new apartment supply priced below 45 million VND per square meter in the second quarter.

It appears that new apartments priced below 50 million VND per square meter have virtually disappeared in Hanoi. As a result, even with a budget of around 3 billion VND, it would be challenging to purchase a new apartment in the capital.

Regarding the pace of apartment price increases, CBRE recorded relatively moderate increments in Ho Chi Minh City’s secondary market, except for central areas, with most areas only increasing by 1-2%.

In Hanoi, on the other hand, price increases were observed across the board, from the city center to the outskirts, ranging from 20-25%. Areas around the Ring Road 3 experienced more noticeable price increases compared to peripheral areas.

“In the past two years, Hanoi’s apartment market has witnessed rapid and substantial price growth. Overall, it seems that income growth has not kept up with rising property prices in major cities like Ho Chi Minh City and Hanoi,” said Ms. Hoai An.

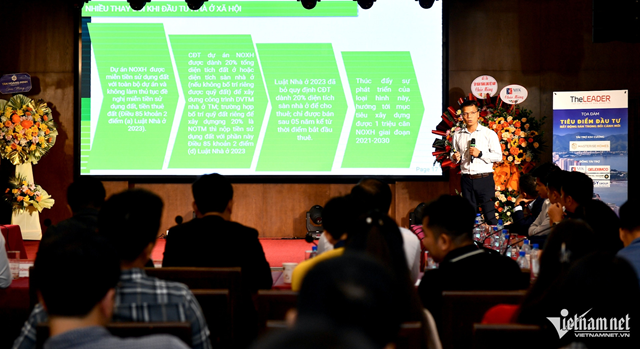

Seminar on “Real Estate Investment Focus in the New Context” on July 30th. Photo: H.A.

|

Mr. Le Dinh Chung, CEO of SGOHomes, pointed out that not only apartments but also other segments have experienced significant price increases. Currently, land prices in Hanoi’s outskirts are above 100 million VND per square meter. Houses in alleys in the city center are priced at 140-160 million VND per square meter. For low-rise real estate, the lowest price is around 200 million VND per square meter.

Mr. Nguyen Dung Minh, Deputy General Director of MIKGroup, attributed the short-term issues, such as limited supply, as one of the factors influencing selling prices.

“From now until the end of the year and the beginning of next year, the average selling price will continue to rise. With the new legal corridor, I hope to see more large land plots and actual large urban areas of several hundred hectares or more on the market,” said Mr. Minh.

Developers Confident in Social Housing, Buyers Rejoice

The upcoming enforcement of the Land Law, the Law on Real Estate Business, and the Housing Law (amended) on August 1st is expected to address many challenges and obstacles faced by the real estate market in recent times.

Mr. Nguyen Quoc Khanh, Chairman of DTJ Group, acknowledged that, in addition to new policies on land and the development of mini apartments and social housing, the laws are anticipated to cater to the needs of the people, especially as income growth lags behind rising apartment prices, which are approaching 100 million VND per square meter.

Mr. Nguyen Hoang Nam, CEO of G-Home, praised the 2023 Housing Law for its provisions that facilitate the development of social housing and alleviate the shortage of affordable housing, a persistent issue in the past.

According to Mr. Nam, even before the laws take effect on August 1st, the necessary decrees regarding social housing were already in place. Notably, resolving the issue of land pricing has significantly shortened the process of developing social housing projects.

Moreover, the relaxation of the requirement for individual buyers, with a maximum monthly income of 15 million VND, and the consideration of the combined income of spouses, not exceeding 30 million VND per month, have significantly benefited homebuyers. These adjustments demonstrate the responsiveness of the Ministry of Construction and the Government to expert opinions.

“In developed countries, one in five people lives in social housing. This statistic underscores the rationale behind the ‘20%’ rule set by the managing authorities. With the substantial legal reforms, I hope that the upcoming circulars will address all remaining challenges, giving developers the confidence to undertake social housing projects,” Mr. Nam expressed.

Hong Khanh