Shares of SMC, a leading commercial investment company, plummeted by 7% to 11,600 VND per share on the first trading session of August. This marked the third consecutive session of losses for the stock, which has seen a staggering 43% decline since the beginning of July. The excitement surrounding SMC shares seems to have fizzled out, revealing a less-than-stellar financial reality.

THE END OF THE STEEL SECTOR’S BULL RUN

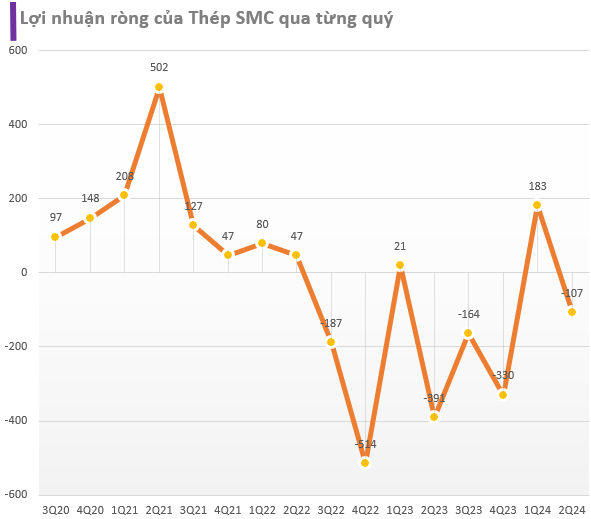

Prior to this downward trend, SMC shares had experienced a remarkable surge, doubling in value from mid-April to early July 2024. This rally occurred despite underlying risks in the company’s first-quarter financial statements, including problematic receivables, bad debts, and lackluster core business performance. SMC’s fortunes were briefly buoyed by the sale of NKG shares, which resulted in a substantial profit for the company after several quarters of losses.

However, by the end of the first quarter, efforts to recover bad debts had stalled, with significant amounts still outstanding from notable names such as Novaland and Hung Thinh.

During this period, speculative interest in the steel sector and expectations surrounding the SMC Phu My factory, a supplier of washing machine and refrigerator shells for Samsung, contributed to the stock’s ascent. The factory was expected to become profitable starting in April 2024 and was projected to produce 2 million units this year. Additionally, SMC had plans to expand its client base for this factory.

Steel processing, which accounts for 65% of SMC’s revenue, remains a key focus alongside steel trading.

Analysts at ACBS highlighted the potential impact of SMC’s planned private placement of 73 million shares at 10,000 VND per share, aimed at raising 730 billion VND. The company also intends to remove certain business lines to increase foreign ownership limits, thereby attracting more capital and facilitating debt repayment and business operations.

SMC SHARES PLUNGE AMID UNDERWHELMING FINANCIAL PERFORMANCE

In the second quarter of 2024, SMC’s revenue took a hit, dropping by 42% year-on-year to 2,240 billion VND. The company incurred a gross loss of 67 billion VND as a result of selling goods below cost.

Notably, SMC’s other income surged to over 172 billion VND, primarily due to the liquidation and sale of fixed assets, including the sale of its headquarters located at 681 Dien Bien Phu, Binh Thanh District.

Despite these efforts, SMC posted a net loss of 107 billion VND in the second quarter. As of the end of the quarter, the company had accumulated losses of over 92 billion VND.

BAD DEBTS AND LOSSES PLAGUE SMC

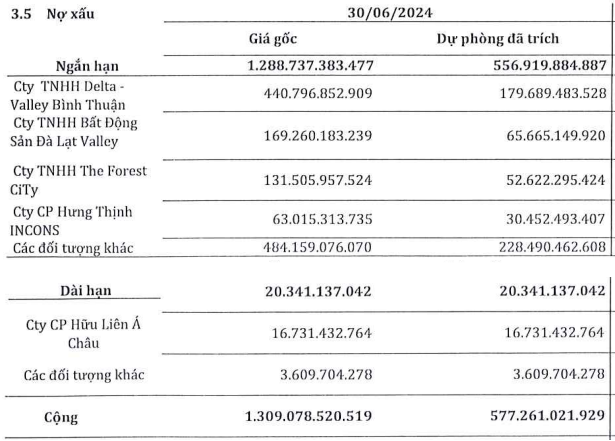

As of June 30, SMC’s short-term bad debts stood at 1,289 billion VND, with provisions of 553 billion VND. The company also had long-term bad debts of 20 billion VND, which had been fully provisioned. These bad debts accounted for a significant 25% of SMC’s total assets, with well-known names like Hung Thinh and Novaland featuring prominently on the list.

At SMC’s annual general meeting, the company’s leadership acknowledged the impact of bad debt provisions on profitability and assured shareholders that they were working diligently with Novaland and other partners to resolve these issues.

They emphasized the urgency of addressing these debts within the year, potentially before June 30, through various means such as cash collection, share swaps, or asset transfers to offset the debts. SMC’s management expressed their willingness to explore all feasible options to prevent further provisions.

Additionally, SMC faced losses from its investment in HBC shares of Hoa Binh Construction Group, which is facing delisting from the Ho Chi Minh Stock Exchange. SMC currently holds 105 billion VND worth of HBC shares and has had to make provisions of 24 billion VND, resulting in a temporary loss of approximately 23% as of the end of the second quarter of 2024. It is worth noting that Hoa Binh Construction Group conducted a private placement of shares to convert debt, and SMC was one of the creditors that participated in this debt-to-equity swap.

Established in 1988, SMC has a long history in the construction materials industry. The company underwent privatization in 2004 and adopted its current name, becoming a publicly traded company on the HoSE in 2006 under the ticker symbol SMC. SMC’s core businesses include steel trading, steel coil processing, and the manufacturing of steel products, with steel trading being the most prominent contributor to both volume and profitability.

Coteccons profits nearly 50% from investing in FPT stocks, sets aside full provision of 143 billion for Saigon Glory receivables.

In the first 6 months of this year, Coteccons achieved a net revenue of VND 9,784 billion, a nearly 5% increase, and a net profit of VND 136 billion, which is nearly 8.9 times higher than the same period last year.