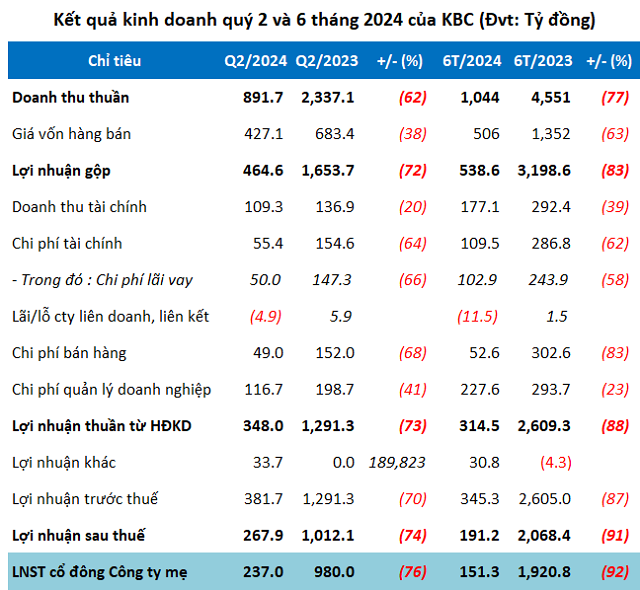

The industrial giant in the North reported second-quarter business results with net revenue of nearly VND 892 billion and net profit of VND 237 billion, down 62% and 76% respectively over the same period last year.

Source: VietstockFinance

|

Explaining the profit decline, KBC attributed it to the decrease in revenue recognition from industrial park business operations compared to the same period. In addition, financial revenue also decreased by 20%, to over VND 109 billion.

A bright spot in this period is that KBC cut total expenses to VND 221 billion, a decrease of 56%. In addition, other income reached nearly VND 34 billion, 1.899 times higher than the same period, and this sudden amount was not explained by the Company.

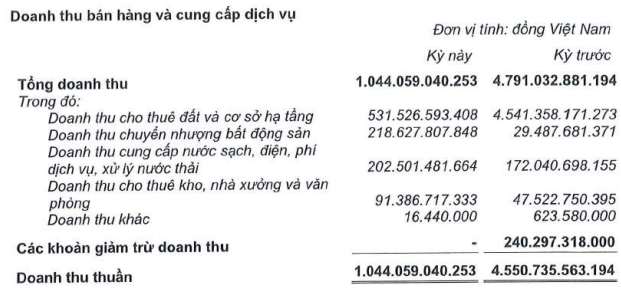

Together with the results of the first quarter, KBC‘s net revenue in the first 6 months was over VND 1,044 billion, and net profit was just over VND 151 billion, down 77% and 92%, respectively, compared to the first half of 2023. Of which, revenue from land and infrastructure leasing was more than VND 531 billion, down 88%.

Source: KBC

|

In 2024, KBC sets a target of VND 9,000 billion in consolidated total revenue and VND 4,000 billion in after-tax profit, up 47% and 80%, respectively, compared to 2023 performance. Compared to the plan, this industrial giant has achieved only 14% of the revenue target and is still far from the profit target, having achieved only 5% after 6 months.

Total assets balloon

By the end of the second quarter, KBC‘s total assets had ballooned to nearly VND 40,904 billion, an increase of 22%. Of this, bank deposits surged to over VND 6,900 billion, 8.3 times higher than the beginning of the year, accounting for 17% of total assets, and the Company is investing VND 1,855 billion in short-term investments in Hoa Sen Hotel JSC.

Inventories amounted to more than VND 12,887 billion, up 5%, mainly consisting of the Trang Cat Industrial Park and Urban Area project with nearly VND 8,311 billion, the Phuc Ninh Urban Area project with nearly VND 1,117 billion, and the Tan Phu Trung Industrial Park and Residential Area project with over VND 1,002 billion.

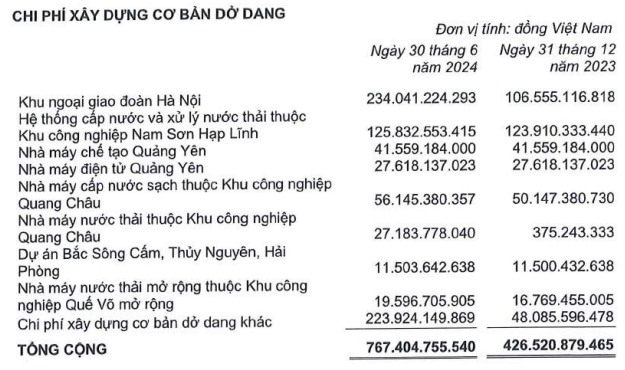

Construction-in-progress expenses also increased by 80%, to over VND 767 billion.

Source: KBC

|

KBC‘s payables also ballooned to nearly VND 20,492 billion, up 55% from the beginning of the year, due to the Company’s long-term deposit receipt of nearly VND 5,703 billion, 285 times higher than at the beginning of the year. Financial borrowings also increased to VND 4,900 billion, up 34%, accounting for 24% of total debt.

KBC proposes to privately place 250 million shares, expects to lease out 150ha of land in 2024