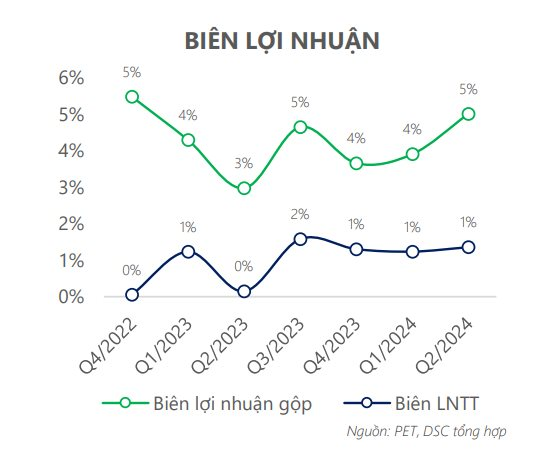

TMT Motor Joint Stock Company (TMT Motors, code: TMT) has released its Q2 2024 consolidated financial report, with net revenue reaching VND 814 billion, unchanged from the same period last year. An 11% increase in cost of goods sold resulted in a gross loss of VND 49 billion, while the company still made a gross profit of VND 52 billion in the previous year.

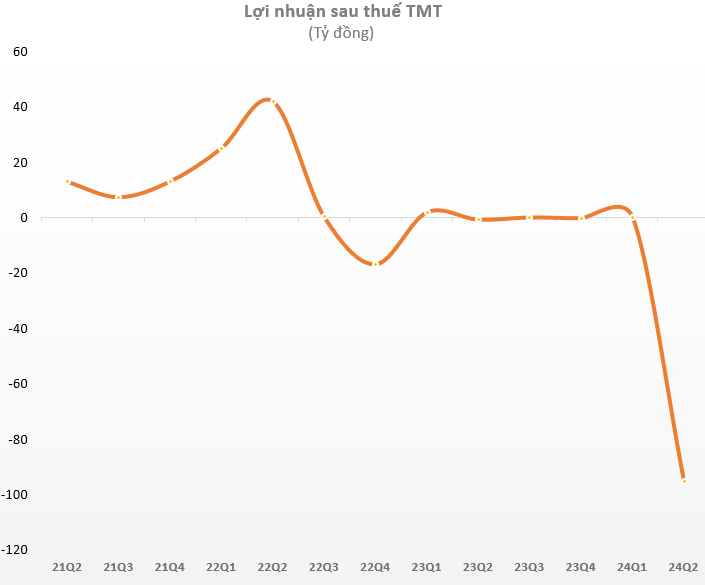

Despite a 50% reduction in financial expenses to VND 24 billion and a slight decrease in selling expenses, management expenses surged nearly sixfold to VND 13 billion. Consequently, TMT Motors reported a post-tax loss of VND 95 billion, compared to a profit of over VND 2 billion in the same period last year. This was also the quarter with the heaviest loss in the company’s operating history.

For the first six months of the year, TMT recorded net revenue of VND 1,321 billion, a 13.4% decrease year-on-year. Post-tax profit was negative, at nearly VND 100 billion, while the company still made a profit of over VND 1.4 billion in the same period last year.

According to the company’s explanation, the main reason for the decrease in post-tax profit was the challenging economic situation in 2024, with significant declines in real estate and public investment, and rising inflationary pressures, which led to a sharp drop in automobile consumption despite continuous price reductions by automobile manufacturers and distributors like TMT to clear inventory.

Following the announcement of the steep decline in business results, TMT’s stock immediately reacted by falling to the floor price of VND 9,540/share. Over the past month, the stock has lost more than 54% of its value.

TMT Motors, formerly known as Transportation Equipment Supplies Trading and Production Joint Stock Company, mainly engages in the manufacturing, assembly, and trading of automobiles and spare parts of various types. The company is well-known for its heavy-load truck brands such as Cuu Long, Tata, Howo, and Sinotruk tractor heads.

TMT Motors gained attention when it entered the electric vehicle market by manufacturing, assembling, and distributing the Wuling Hongguang MiniEV model in Vietnam. Wuling Mini EV is a popular small-size electric car from China, holding the title of “world’s best-selling mini electric car” for four consecutive years, from 2020 to 2023.

In Vietnam, the car is produced and assembled by the joint venture between TMT Motors and General Motors (GM) – (SAIC – WULING). The joint venture provides components and authorizes TMT Motors to exclusively manufacture, assemble, and distribute Wuling-branded electric vehicles in Vietnam. TMT Motors has collaborated with dealers and officially inaugurated more than 20 authorized Wuling dealerships in provinces and cities nationwide.

The standard version + 120km battery (LV1 – 120) is priced at VND 239 million, while the standard version + 170km battery (LV1 – 170) costs VND 265 million. The advanced version + 120km battery (LV2 – 120) is priced at VND 255 million, and the advanced version + 170km battery (LV2 – 170) is VND 282 million.

Despite the attractive pricing, TMT Motor’s sales performance fell short of expectations. Last year, the company sold only 591 units of the Wuling HongGuang MiniEV, equivalent to 11% of its initial sales target of 5,525 units. With this sales figure, TMT Motors achieved a net revenue of VND 2,634 billion, a 13% decrease, and completed only 55% of its plan. Post-tax profit also plummeted by 95% to nearly VND 2.4 billion, fulfilling just 3% of the plan.

Facing a sluggish market in 2023, TMT Motors set a modest sales target for its electric vehicle line in 2024 at 1,016 units, a 71% increase from the previous year’s performance but still a very low number.

Regarding its 2024 business targets, TMT Motors aims for a net revenue of VND 2,645 billion and a post-tax profit of over VND 38.5 billion, representing a 1% and 475% year-on-year increase, respectively. With the dismal performance in the first half, the company will face challenges in achieving its full-year profit target.

As of June 30, TMT Motors’ total assets stood at VND 1,501 billion, a decrease of VND 668 billion, or 31%, from the beginning of the year. Cash and cash equivalents reached VND 6 billion, a significant drop compared to the beginning of the year. Inventory as of the end of Q2 was VND 853 billion, a decrease of VND 554 billion from the beginning of the year.

The company’s total liabilities were VND 1,163 billion, a reduction of over 33% from the beginning of the year. Borrowings decreased by 55% to VND 571 billion. Owners’ equity was VND 339 billion, including accumulated losses of VND 46 billion.