In recent news, the member fund group of KIM Vietnam Fund Management Co., Ltd. reported purchasing over 546,000 VTO shares of the Joint Stock Company for Petroleum Transport Vitaco on July 25. Immediately after, the fund group continued to acquire 600,000 VTO shares on July 26.

The total number of shares purchased amounted to more than 1.1 million, thus increasing the foreign fund group’s ownership in VTO to 6.21% of the capital (equivalent to 4.96 million units) and making them a major shareholder in Vitaco.

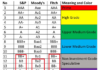

This move by the KIM fund group comes amidst a surge in VTO’s market price. The share price peaked at a decade-high of VND 15,900 in mid-July, marking a nearly 70% increase after six months before adjusting to its current state. VTO’s market price is currently trading around the VND 14,100 mark, an 11% decrease from its peak.

VTO Share Price Movement

Vitaco, a state-owned enterprise, was established by Decision No. 2585/QD/BTM dated October 27, 2005, of the Minister of Trade and Industry (now the Ministry of Industry and Trade) by transforming the Petroleum Transport Vitaco Company into the Joint Stock Company for Petroleum Transport Vitaco. The company officially started operating in early February 2006. Vitaco currently has a chartered capital of nearly VND 800 billion, of which the Waterborne Petroleum Transport Corporation – Petroleum Trading One Member Limited Liability Company, as the parent company, holds 52% of the shares.

In terms of financial results for the second quarter of 2024, Vitaco recorded a significant 314% year-on-year increase in after-tax profit to nearly VND 25 billion. The company attributed this surge in profit mainly to reduced transport activity costs (depreciation expenses for the vessel fleet). For the first six months of the year, after-tax profit reached nearly VND 53 billion, a 166% increase compared to the same period last year. With these results, this maritime transport business has achieved 62% of its annual profit target.

According to our research, KIM is the first fund management company established in South Korea, managing $52.6 billion. KIM Vietnam Fund Management Co., Ltd. is a subsidiary of Korea Investment Management (KIM). KIM Vietnam currently manages trust funds from its parent company, with an investment scale of approximately $1 billion.

Prior to the VTO transaction, the member group of KIM Vietnam Fund Management was noted to have purchased shares and become a major shareholder in several other listed companies, including Coteccons (CTD) and Long Hau Corporation (LHG). Specifically, KIM Vietnam acquired 200,000 CTD shares on May 24, increasing its ownership to 5.51%, and purchased 100,000 LHG shares on July 17, raising its stake to 6.13% of the charter capital.