In the international market, the DXY index fell 1.1 points over the week to 103.22, its lowest level in nearly five months.

On August 1, Vietnam time, the US Federal Reserve decided to keep interest rates unchanged at its July meeting. In the policy statement released after the meeting, Fed policymakers gave no clear indication of an impending cut, expressing continued concern about economic conditions while maintaining their view that more progress on inflation is needed before cutting rates.

However, the latest report from the US Department of Labor, released on August 2, showed a significant slowdown in job growth for July, while a rise in the unemployment rate fueled expectations of a more aggressive Fed rate cut to support the economy than previously forecast.

Specifically, non-farm payrolls increased by only 114,000 in July, a sharp decline from the revised June figure of 179,000 and well below the Dow Jones survey expectation of 185,000. This number was also significantly lower than the 12-month average monthly job growth of 215,000.

Notably, the unemployment rate rose to 4.3%, the highest since October 2021. The household survey painted an even more concerning picture: employment rose by just 67,000 while the number of unemployed surged by 352,000, and the labor force shrank by 214,000.

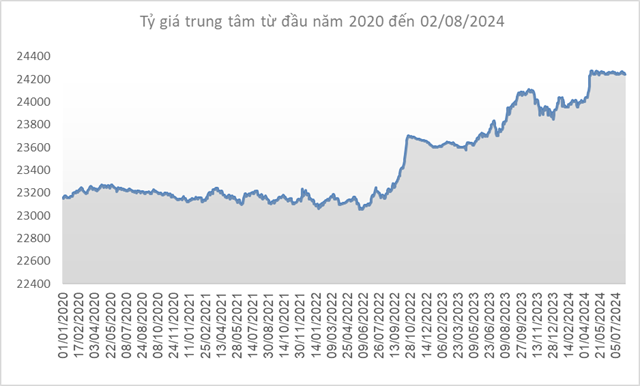

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese dong to the US dollar decreased by 7 VND/USD compared to the previous week (July 26), reaching 24,242 VND/USD in the session on August 2, 2024.

The State Bank of Vietnam (SBV) maintained the immediate buying rate at 23,400 VND/USD. Additionally, the selling rate remained unchanged at 25,450 VND/USD since April 19. This is the intervention selling rate at which the SBV offers USD to commercial banks with negative foreign currency positions to bring their positions back to zero.

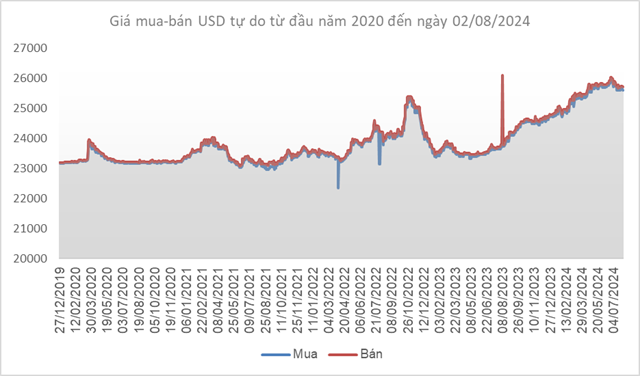

Source: VCB

|

Following a similar trend, Vietcombank’s exchange rate stood at 25,010-25,380 VND/USD (buying-selling), a decrease of up to 81 VND/USD in both directions.

Source: VietstockFinance

|