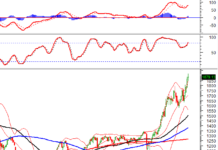

The VN-Index returned to the 1,250-point mark at the end of today’s trading session (July 31st), thanks to strong performances by several blue-chip stocks. However, intense selling pressure from speculative codes prevented the main index from fully retaining its previous recovery gains.

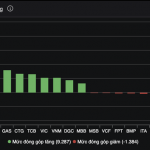

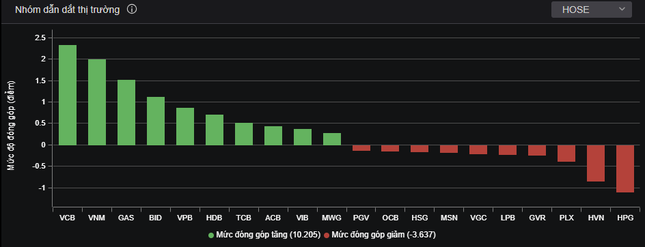

VCB, VNM, GAS, BID, VPB, and HDB emerged as market leaders, with the top 10 most actively traded stocks contributing over 10 points to the index, while their counterparts subtracted only 3.6 points.

Bank stocks dominated the market leaders, with a strong showing from banking sector stocks.

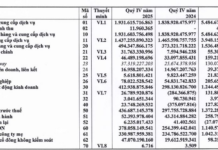

Bank stocks resumed their pivotal role, with 15 stocks trading in the green. The sector has been on an upswing recently, buoyed by substantial profit announcements from several banks. Today marked the deadline for listed companies to disclose their second-quarter financial reports, and all listed banks have fulfilled their disclosure obligations.

Vietcombank maintained its top position in the industry, reporting profits of nearly VND 20,835 billion for the first half of the year. On the stock exchange, VCB also led the market leaders, contributing over 2 points to the index.

Techcombank ranked second in the half-year profit rankings, earning over VND 15,628 billion. The Big 4 state-owned banks, including BIDV and VietinBank, also secured high positions. Notably, BID has been a significant positive influencer on the VN-Index.

In contrast, the steel sector experienced unexpected selling pressure despite relatively positive financial results. TLH and SMC plummeted to their floor prices, while HPG, NKG, and HSG also witnessed price declines. The market received news of a potential anti-dumping investigation by the European Commission into Vietnamese HRC steel. This development caused a complete reversal in the steel stocks’ performance, which had been positive following Vietnam’s initiation of an anti-dumping investigation into Chinese and Indian HRC steel imports.

Trending stocks like QCG, LDG, DLG, HBC, and HNG exhibited mixed performances. HBC remained at its floor price after receiving a delisting notice, while HNG attracted rescue funds. QCG extended its winning streak, rising for the third consecutive session amid “sell-out” conditions.

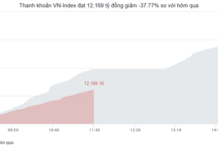

At the close, the VN-Index climbed 6.45 points (0.52%) to 1,251.51, while the HNX-Index and UPCoM-Index declined slightly. The total matched order value on HoSE surpassed VND 15,300 billion.

Foreign investors continued to offload VIC shares, resulting in a net sell position of VND 636 billion. The net sell value of VIC shares surged to over VND 900 billion.

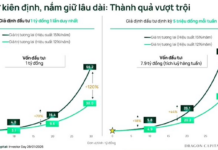

Stocks Volatile as Investors Pocket Hundreds of Millions of Dollars

On February 27th, domestic stocks continued to rise sharply, with most industry sectors moving up in unison. Stocks with large impact, especially HPG, saw a sudden turnover of more than 87.5 million shares. The market capitalization of Hoa Phat, as well as the assets of billionaire Tran Dinh Long, also increased significantly.