What caused the reversal in trend?

The Consumer Price Index (CPI) for July unexpectedly rose by 0.48% from the previous month, marking the highest monthly increase in the past five months. According to the General Statistics Office, this was primarily due to domestic fuel prices rising in line with global prices, increased demand for electricity, and adjustments in health insurance contributions based on the new base salary. Specifically, the group of other goods and services increased by 3.77%, mainly due to a 28.45% rise in health insurance premiums as the base salary was adjusted from VND 1.8 million/month to VND 2.34 million/month.

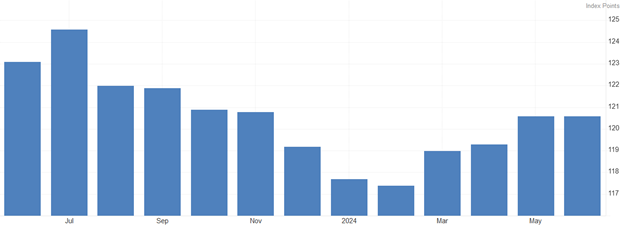

The significant increase in July pushed the average CPI growth for the first seven months compared to the same period last year to 4.12%, the highest since March 2023. This has raised concerns about the return of inflationary pressures, amidst geopolitical tensions and risks associated with the elections in the US, which are impacting global trade and keeping commodity prices elevated. In fact, domestic inflation has been trending upwards since bottoming out in August last year.

Among the basket of goods and services, the food index witnessed a striking 14.4% year-on-year increase, the highest in CPI calculation. The persistent surge in food prices over the past few months has had some impact on domestic prices. The Food and Agriculture Organization of the United Nations (FAO) Food Price Index has been on an upward trajectory since February 2024.

Certain groups of public services managed by the state also saw substantial increases over the past seven months. For instance, the group of medicines and healthcare services rose by over 8.1% year-on-year, with healthcare services alone increasing by 10.4% and maintaining a strong upward trend since November last year. This is a consequence of adjustments in medical examination and treatment service prices following the enforcement of the Law on Medical Examination and Treatment No. 15/2023/QH15 dated January 9, 2023, which led to various localities applying new healthcare service prices in accordance with Circular No. 22/2023/TT-BYT dated November 17, 2023.

Similarly, the education group witnessed an 8% increase compared to the same period last year, with educational services rising by 8.5% as some schools started to adjust tuition fees according to the set roadmap. In reality, education has been one of the groups consistently increasing since the fourth quarter of 2022, after the issuance of Decree No. 81/2021/ND-CP, which determined that from the 2022-2023 academic year, annual tuition fee increases would be in line with consumer price index movements and economic growth rates.

The sharp rise in gold and USD prices in the early months of this year also negatively impacted inflation expectations. According to data from the General Statistics Office, the gold price index for July 2024 increased by more than 29% year-on-year, while the US dollar price index rose by over 7.1%, although it has eased from its peak in May after the State Bank intervened with a series of solutions to support and stabilize the market.

As a country with a large economic openness, Vietnam is also significantly affected by exchange rate movements and global freight rates. Meanwhile, amidst geopolitical tensions in the Middle East and attacks on ships in the Red Sea since last year, the Drewry World Container Index has soared since the beginning of this year, more than doubling in the past seven months. Consequently, many types of goods and raw materials imported into Vietnam have also been affected by rising prices.

Uncertainty remains for the next phase

In a recent assessment, the State Bank of Vietnam (SBV) also acknowledged that one of the challenges facing the economy is the inflationary pressure stemming from international and domestic factors, including risks of escalating geopolitical tensions, rising transportation and raw material costs, supply chain disruptions, and interest rate differentials between domestic and international markets. The salary policy reform that took effect on July 1, although only affecting a small proportion of employees, has created expectations of price increases.

However, apart from geopolitical tensions, climate change risks are also factors that could make food prices unpredictable in the coming time, continuing to put pressure on inflation globally and in Vietnam. According to FAO, conflicts, droughts, and natural disasters are still driving food insecurity in some parts of the world, causing some regions to face the risk of severe famine. Financial Times also noted that climate change has caused price increases in various agricultural products, such as oranges in Brazil, cocoa in West Africa, olives in Southern Europe, and coffee in Vietnam.

|

The FAO Food Price Index has been on an upward trajectory since February 2024

|

According to a recent report by the United Nations Environment Programme (UNEP), the world is on track to witness a temperature increase of up to 2.9 degrees Celsius compared to pre-industrial levels. Agriculture is one of the sectors most directly affected by this change. In the next decade, some of the most important global food production volumes may be deficient due to rising temperatures. Moreover, more frequent extreme weather events also hinder harvesting activities. Thus, climate change is beginning to exert long-term inflationary pressure.

| The State Bank of Vietnam (SBV) also acknowledged that one of the challenges facing the economy is the inflationary pressure stemming from international and domestic factors, including risks of escalating geopolitical tensions, rising transportation and raw material costs, supply chain disruptions, and interest rate differentials between domestic and international markets. The salary policy reform that took effect on July 1, although only affecting a small proportion of employees, has created expectations of price increases. |

Meanwhile, analysts argue that if Donald Trump is re-elected president in the November elections, global supply chains could face another severe disruption as trade wars may intensify during his second term. This would cause a sharp rise in commodity prices, putting pressure on inflation not only in the US but also globally.

Regarding domestic factors, the prices of public services will continue to be one of the drivers of inflation in the coming period. In addition to healthcare and education services, which are still in the process of adjustment, another item is electricity prices, which are gradually being adjusted according to market mechanisms by fully reflecting input costs in the price structure. Notably, according to EVN’s 2023 consolidated financial statements, its net loss surged to VND 26,772 billion, a 29% increase compared to the loss of VND 20,747 billion in 2022.

EVN had previously proposed to be allowed to decide on electricity price hikes of less than 10%, up from the current threshold of 5%. Notably, in 2023, retail electricity prices were increased twice, with a total increase of 7.5%, equivalent to a rise of more than VND 142.35/kWh from VND 1,920.3/kWh to VND 2,062.79/kWh (excluding VAT). At the beginning of this year, the Ministry of Industry and Trade also proposed considering further adjustments in 2024.

According to Decision No. 05 of the Government on the mechanism for adjusting the average retail electricity price, which took effect on May 15, 2024, the minimum time between electricity price adjustments is three months from the previous adjustment. However, it has been more than seven months since the last adjustment, raising concerns that electricity prices may be adjusted upwards after the new base salary takes effect.

Vietnam’s Economic Landscape in the First Month of 2024

In January 2024, the country witnessed the reactivation of nearly 13.8 thousand businesses, which is 2.2 times higher than December 2023 and represents an 8.4% decrease compared to the same period in 2023. This resulted in a total of over 27.3 thousand newly established and reactivated businesses in January 2024, marking a 5.5% increase from the previous year.

The Prospects of Real Estate Market Recovery in 2024

The real estate market in 2024 is still challenging, but there are solid grounds for it to recover and continue growing in a safe, healthy, and sustainable way.

Optimistic Signals from Vietnam’s Economy in the New Year

The State budget revenue has achieved positive results, with strong growth in retail sales of goods and revenue from consumer services, attracting foreign direct investment with good results, and witnessing significant changes in disbursement of public investment capital. These are optimistic signals for a prosperous year 2024 for the Vietnamese economy.