Liquidity in the market increased compared to the previous trading session, with the VN-Index matching volume reaching over 726 million shares, equivalent to a value of more than 17 trillion VND. The HNX-Index reached over 63 million shares, equivalent to a value of more than 1.1 trillion VND.

The VN-Index opened the afternoon session with a tug-of-war below the reference level, despite the selling pressure still dominating. However, buying power at lower prices remained, causing the sideways trend to persist until the end of the session.

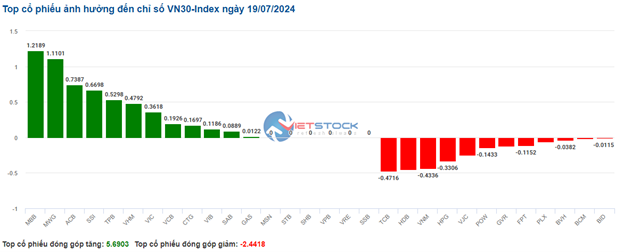

In terms of impact, GVR, BID, HVN, and VCB were the most negative stocks, taking away more than 4.1 points from the index. On the other hand, MBB, VHM, ACB, and SAB were the most positive stocks, contributing over 1.7 points to the VN-Index.

| Top 10 stocks with the strongest impact on the VN-Index on July 19, 2024 |

The HNX-Index also followed a similar trend, with negative influences from VCS (-2.74%), NTP (-4.25%), CEO (-2.92%), and DHT (-3.04%), among others.

|

Source: VietstockFinance

|

The plastics and chemicals production industry saw the sharpest decline in the market, falling by -2.91%, mainly due to GVR (-4.3%), DGC (-1.38%), DCM (-2.1%), and DPM (-1.11%). This was followed by the transportation and warehousing sector and the healthcare sector, which fell by 2.45% and 2.23%, respectively. In contrast, the retail sector witnessed a strong recovery of 0.69%, driven primarily by MWG (+0.92%), FRT (+1.15%), CTF (+1.6%), and CCI (+2.68%).

In terms of foreign trading, they returned to net selling on the HOSE with more than 380 billion VND, focusing on FPT (231.53 billion), TCB (105.19 billion), MSN (86.9 billion), and HSG (65.37 billion).

On the HNX exchange, foreign investors net sold more than 39 billion VND, focusing on PVS (24.31 billion), MBS (12.93 billion), SHS (3.13 billion), and TNG (2.93 billion).

| Foreign Trading Activity |

Morning Session: VN-Index Returns to Negative Territory

On July 19, after a positive trading signal in the first half of the session, sellers regained control, pulling the index down in the latter half. The VN-Index temporarily stopped at 1,270.37, a decrease of 4.07 points, while the HNX-Index fell by 1.58 points to 240.91 points. The market breadth was tilted towards decliners, with 430 stocks falling and 224 stocks rising. The VN30 basket followed a similar trend, with 18 stocks declining and 10 stocks advancing.

The trading volume of the VN-Index in the morning session reached over 339 million units, with a value of more than 8 trillion VND. The HNX-Index recorded a trading volume of nearly 28 million units, with a value of nearly 536 billion VND.

Regarding sector performance, most sectors witnessed negative trends, with 22 out of 25 sectors trading in the red. Among them, the agriculture, forestry, and fisheries sector experienced the sharpest decline of over 2%, mainly due to HAG (-1.625), VIF (-5.49%), and HNG (-0.99%). This was followed by the plastics and chemicals production sector, the healthcare sector, and the consulting and support services sector, which fell by 1.9%, 1.69%, and 1.51%, respectively.

The securities sector opened positively after many companies in the industry announced impressive second-quarter financial results. However, it later reversed course and fell by 0.14% by the end of the morning session. Only 3 out of 27 stocks managed to stay in the green, namely SSI (+1.31%), VND (+2.58%), and MBS (+1.43%).

On the other hand, the retail sector traded positively, rising by 0.5% mainly due to gains in MWG (+1.08%) and FRT (+0.115). The banking sector also maintained its momentum, increasing by 0.08% despite the lackluster market sentiment. However, stocks within the sector exhibited clear differentiation. While MBB, MSB, TPB, OCB, and NVB rose by more than 1%, HDB, TCB, STB, VPB, SHB, and CTG underwent corrections.

Foreign investors returned to net selling in the morning session, offloading more than 336 billion VND on the HOSE exchange. FPT continued to be the most sold stock, with a net selling value of nearly 108 billion VND. On the HNX exchange, foreign investors net sold over 7 billion VND, focusing their sales on IDC.

10:40 am: Tug-of-War Around the Reference Level

The buying and selling forces in the market were relatively balanced, resulting in a stalemate for the main indices. As of 10:40 am, the VN-Index had declined slightly by 1.97 points, hovering around 1,272 points, while the HNX-Index had dropped by 1.02 points to around 241 points.

Stocks within the VN30 basket exhibited a mix of green and red ticks, with a slight bias towards the upside. Specifically, MBB, MWG, ACB, and SSI contributed 1.22 points, 1.11 points, 0.74 points, and 0.67 points to the index, respectively. Conversely, TCB, HDB, VNM, and HPG faced selling pressure, deducting over 1.6 points from the VN30-Index.

Source: VietstockFinance

|

The banking sector continued to be the focus of the recovery, maintaining a solid gain of 0.35% despite some internal differentiation and a slight bias towards the upside. Notable gainers within the sector included VCB (+0.34%), CTG (+0.45%), MBB (+1.81%), and ACB (+1.01%)… Conversely, TCB (-1.05%), HDB (-0.8%), and BID (-0.1%) remained under selling pressure. As of 10:40 am, the total trading value of the sector had surpassed 1,886 billion VND, with a matching volume of over 85 million units.

Following closely behind was the securities sector, which also posted impressive gains. Standouts within the sector included SSI (+1.75%), VND (+2.9%), VCI (+0.31%), and HCM (+0.57%)… While there were still decliners, such as FTS (-0.86%), VIX (-2.36%), BSI (-0.63%), and CTS (-1.33%)…, the declines were not significant.

Additionally, the MBS stock continued its upward trajectory in the morning session of July 19, 2024, trading above the Middle Bollinger Band, indicating a positive short-term outlook. Moreover, the stock formed a series of higher highs and higher lows after a throwback to test the Neckline of the Cup and Handle pattern, while the MACD continued its upward trajectory, providing further confirmation of the long-term uptrend.

Source: https://stockchart.vietstock.vn/

|

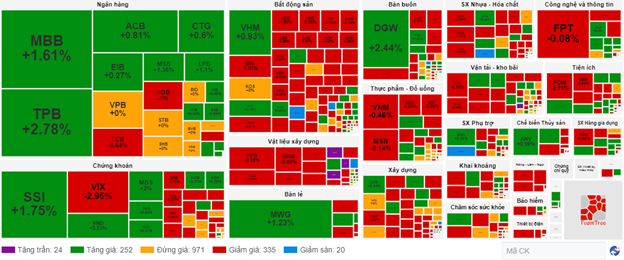

Compared to the opening, buyers and sellers engaged in a fierce battle, resulting in over 970 stocks trading flat and a slight advantage for the sellers, with 335 declining stocks (including 20 at the lower limit) versus 252 advancing stocks (including 24 at the upper limit).

Source: VietstockFinance

|

Market Open: Securities Sector Kicks Off on a Positive Note

At the start of the July 19 session, as of 9:40 am, the VN-Index opened higher, climbing more than 3 points to 1,278.05 points. In contrast, the HNX-Index edged slightly lower to 242.42 points.

Vinhomes Joint Stock Company (HOSE: VHM) announced its consolidated financial statements for the first six months of 2024, reporting a total net revenue of 36,429 billion VND. The consolidated net revenue, including revenue from Vinhomes’ operations and revenue from joint venture contracts (BCC), reached 47,904 billion VND. Consolidated post-tax profit stood at 11,513 billion VND, mainly attributed to the recognition of a large lot sale at Vinhomes Royal Island and ongoing deliveries at existing projects.

With sales revenue of 51,710 billion VND in the first six months and unrecorded sales of 118,660 billion VND as of the end of Q2 2024, Vinhomes is confident in achieving its announced business plan for 2024 as key mega-projects like Vinhomes Ocean Park 3 and Vinhomes Royal Island progress towards completion and handover.

In the morning session, VHM stock rose over 1% to nearly 40,000 VND per share, making it a significant contributor to the VN-Index‘s gains.