Market liquidity slightly increased compared to the previous trading session, with the matching trading volume of the VN-Index reaching more than 464 million shares, equivalent to a value of more than 10.4 trillion VND; HNX-Index reached more than 44.5 million shares, equivalent to a value of more than 915 billion VND.

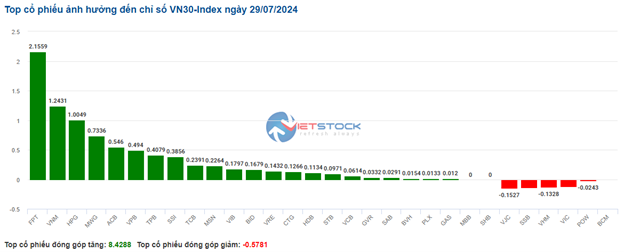

VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, with the former gaining a slight advantage, helping the index stay in the green until the end of the session. In terms of impact, BID, HVN, VNM, and HPG were the most positive influences on the VN-Index, contributing over 3.4 points to the index’s gain. On the other hand, VHM, MBB, VJC, and VGC were the most negative influences, taking away more than 1.3 points from the overall index.

| Top 10 stocks impacting the VN-Index on July 29, 2024 |

The HNX-Index also witnessed a positive performance, driven by gains in DTK (+6.47%), VIF (+6.1%), IDC (+1.39%), and NVB (+4.35%), among others.

|

Source: VietstockFinance

|

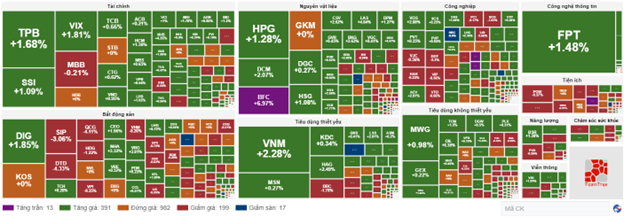

The telecommunications services sector was the top gainer, surging 5.78%, led by VGI (+6.35%), FOX (+6.37%), VNZ (+6.4%), and ELC (+3.18%). This was followed by the industrials and materials sectors, which rose 1.84% and 1.18%, respectively. On the flip side, the real estate sector witnessed the sharpest decline, falling by 0.14%, mainly due to losses in VHM (-1.72%), VRE (-1.81%), NVL (-0.45%), and KBC (-0.36%).

In terms of foreign trading activities, foreign investors net sold over 220 billion VND on the HOSE exchange, focusing on DCM (38.82 billion VND), PDR (38.42 billion VND), DBC (25.13 billion VND), and MWG (23.41 billion VND). On the HNX exchange, they net sold more than 73 billion VND, mainly offloading PVS (32.57 billion VND), NTP (17.56 billion VND), MBS (13.42 billion VND), and DTD (5.96 billion VND).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Gains Trimmed

The market opened the week on a positive note, largely thanks to the strong performance of large-cap stocks. However, the upward momentum started to wane towards the end of the morning session. The VN-Index temporarily stood at 1,244.84 points, up 2.73 points, or 0.22%. Meanwhile, the HNX-Index rose 0.18% to reach 237.07 points. Bullish sentiment prevailed, with 346 stocks advancing and 269 declining. The VN30 basket was a bright spot, with 16 gainers and 9 losers, and the VN30 index climbing 5.19 points (+0.4%).

Trading volume on the VN-Index improved compared to the low levels seen at the end of the previous week, reaching nearly 232 million units, equivalent to a value of almost 5.5 trillion VND. The HNX-Index recorded a trading volume of over 24 million units, with a value of nearly 502 billion VND.

Source: VietstockFinance

|

In terms of impact, BID, VNM, and HPG were the most positive influences on the VN-Index, contributing over 2 points to the index’s gain. Conversely, VIC and VHM, both from the Vin Group, were the most negative influences, causing the index to lose nearly 0.5 points.

Green dominated most stock sectors. The telecommunications services sector temporarily led the market, rising 1.7% and driven mainly by VGI (0.85%), FOX (+4.61%), and VNZ (+8.82%). However, stocks like CTR, ELC, and SGT in this sector remained in the red.

Following closely was the industrials sector, which climbed 1.41%. Notable gainers within this sector included ACV (+2.7%), VEA (+1.18%), and MVN (+7.8%), among others. Additionally, the information technology, materials, and consumer staples sectors also witnessed positive trading activities.

On the other hand, the real estate sector was the lone decliner, falling by 0.19%. Stocks within this sector exhibited mixed performances. While VHM, VIC, BCM, KBC, and PDR were in the red, others managed to stay in positive territory, including DIG (+1.23%), NVL (+0.45%), IDC (+0.35%), and CEO (+1.31%)…

10:35 am: Tilting Towards the Upside

VN-Index rose 5.23 points, hovering around 1,247 points. HNX-Index gained 1.2 points, trading around 237 points.

Most stocks in the VN30 basket witnessed strong upward momentum. Notably, FPT, VNM, HPG, and MWG contributed 2.16 points, 1.24 points, 1 point, and 0.73 points to the VN30 index, respectively. Conversely, VJC, SSB, VHM, and VIC were among the few stocks facing selling pressure, but their declines were not significant.

Source: VietstockFinance

|

The telecommunications services sector led the market’s advance, with most stocks sporting healthy gains. Specifically, VGI rose 2.4%, FOX climbed 4.83%, ELC inched up 0.42%, and FOC gained 3.62%… The remaining stocks in this sector were either unchanged or faced mild selling pressure, such as CTR, SGT, and EID.

Following closely was the information technology sector, which also contributed to the market’s overall positive performance. FPT rose 1.48%, CMG gained 0.53%, ITD climbed 3.58%, and CMT advanced 1.32%…

Meanwhile, the real estate sector was the only group that exhibited mixed performances. Large-cap stocks like VHM fell 0.13%, VIC declined 0.36%, and BCM slipped 0.28%… although the declines were not significant.

Source: VietstockFinance

|

Compared to the opening, buyers continued to hold a slight advantage. The number of advancing stocks exceeded 390, while declining stocks numbered over 190.

Source: VietstockFinance

|

Opening: Maintaining a Mild Upswing

On July 29, as of 9:40 am, the VN-Index climbed over 6 points to reach 1,248.1 points. Similarly, the HNX-Index also edged higher, settling at 238.02 points.

Green dominated most industry sectors, with several large-cap stocks witnessing positive momentum right from the opening bell. For instance, TPB rose 2.52%, FPT gained 1.56%, HPG advanced 1.46%, and PLX inched up 0.63%.

Large-cap stocks like HPG, FPT, and BID propelled the market higher, contributing a combined gain of over 1 point to the index. Conversely, VIC, SSB, and HNG were the most negative influences, but their impact was limited, resulting in a loss of less than 0.5 points for the market.

The banking sector maintained its stable growth trajectory from the opening bell, with stocks like TPB rising 2.24%, STB climbing 0.69%, ACB gaining 0.62%, TCB advancing 0.44%, MBB inching up 0.41%, VPB rising 0.82%, and VCB increasing by 0.34%…