Oil Drops Over $1

Oil prices fell more than a dollar on August 1st as global supply seemed largely unaffected by concerns over a widening crisis in the Middle East after a Hamas leader in Iran was assassinated. Investors refocused on demand worries.

Brent crude futures settled down $1.32, or 1.6%, at $79.52 a barrel, while U.S. West Texas Intermediate (WTI) crude fell $1.6, or 2.1%, to $76.31.

A meeting of top OPEC+ ministers left production policy unchanged, including a plan to gradually unwind output cuts from October 2024.

Investors remain concerned about long-term demand from China. Newly released Chinese manufacturing data further fueled worries about the country’s oil demand outlook.

Gold Falls from Two-Week High

Gold prices edged lower on Thursday as the dollar strengthened, after hitting a two-week high earlier in the session on expectations of a U.S. rate cut in September and increased safe-haven demand. The market’s focus also shifted to U.S. non-farm payrolls data, due on Friday.

Spot gold was down about 0.4% at $2,438.32 per ounce. However, U.S. gold futures for December delivery rose 0.3% to $2,480.80.

While the Federal Reserve kept interest rates unchanged at its policy meeting on Wednesday, Chairman Jerome Powell indicated that rates could be cut as early as September if the U.S. economy evolves as expected.

Iron Ore Climbs

Iron ore futures rose to their highest in over a week on Thursday, buoyed by leading producer Rio Tinto’s optimistic demand outlook for top consumer China and hopes for further stimulus from the world’s second-largest economy.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange (DCE) ended daytime trading up 2.35% at 783.5 yuan ($108.28) a ton. During the session, prices hit 790.5 yuan, the highest since July 23.

Singapore Exchange (SGX) data showed that the September iron ore contract climbed 1.91% to $102.85 per ton.

Weaker-than-expected Chinese economic data has raised hopes for new stimulus measures from the government.

Copper Slides on Weak Chinese Factory Data

Copper prices slid on Thursday after disappointing factory data from top consumer China, with rising inventories highlighting a supply glut.

Three-month copper on the London Metal Exchange (LME) fell 1.9% to $9,048 a ton, after gaining 2.8% in the previous session.

Investors were disappointed that China has not announced significant stimulus measures to boost its economy.

Copper inventories in LME-registered warehouses have doubled since early June, reaching their highest in nearly three years, further pressuring prices downward.

A stronger U.S. dollar index also weighed on metals, making dollar-denominated commodities more expensive for buyers using other currencies.

Rubber Declines

Rubber prices on the Tokyo Commodity Exchange (TOCOM) fell on Thursday, pressured by weak Chinese economic data and a stronger yen.

The most active rubber contract for January delivery on the Osaka Exchange (OSE) ended the session down 3.8 yen, or 1.21%, at 311.3 yen ($2.80) per kg.

September rubber on the Shanghai Futures Exchange (SHFE) rose 110 yuan to 14,260 yuan ($1,970.51) per ton.

The yen strengthened by nearly 1% to 148.51 against the dollar, its highest since mid-March, before stabilizing at 149.95 after the Bank of Japan’s policy shift.

Coffee Falls

Robusta coffee futures for September delivery fell 0.7% to $4,233 per ton, after touching a four-week low of $4,158.

Arabica coffee for September delivery declined by 0.9% to $2,2725 per lb, after hitting a near one-month low of $2,2525.

Raw Sugar Drops as Indian Crop Outlook Improves

Raw sugar futures ended lower on Thursday as rains in India’s cane-growing regions improved crop prospects.

October raw sugar fell 0.44 cent, or 2.3%, to 18.50 cents per lb.

India will likely experience above-average monsoon rains in August and September as the weather pattern La Nina forms, boding well for agricultural output and growth in the third-largest Asian economy.

October white sugar fell 2.1% to $523.50 per ton.

Corn Hits Four-Year Low, Soybeans Also Fall, Wheat Rises

U.S. corn and soybean prices fell to their lowest in nearly four years as favorable weather forecasts and concerns about demand from China pushed back expectations for export growth. Wheat prices, however, rose.

The most active corn futures on the Chicago Board of Trade (CBOT) ended down 1-1/4 cents at $3.98-1/2 per bushel, after touching $3.95, the lowest since November 2020. Soybean futures fell 6 cents to $10.16-1/2 a bushel.

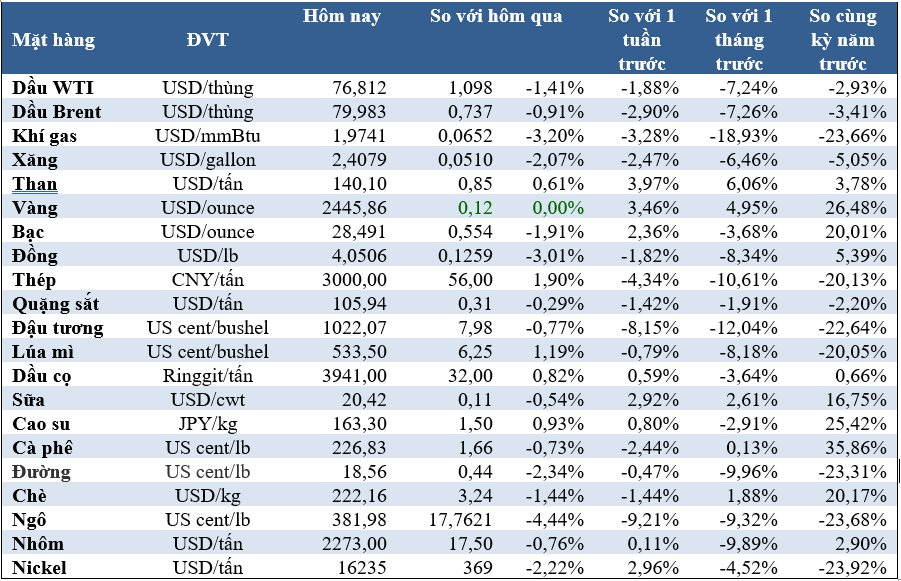

Prices of Key Commodities on August 2: