Mr. Pham Thanh Hung (Shark Hung), Vice Chairman of the Board of Directors of Century Real Estate Joint Stock Company (Cen Land), registered to buy 5 million shares through matching or agreement from 08/06/2024 to 09/04/2024, for personal investment purposes.

If the transaction is successful, Shark Hung will increase his ownership from nearly 13.3 million shares (2.86%) to nearly 18.3 million shares (3.94%) in Cen Land.

Notably, CRE shares are currently at their lowest point in the past year. At the close of the trading session on August 1st, CRE share price stood at VND 6,830 per share, a decrease of more than 20% compared to the beginning of the year.

Cen Land’s Q2 profit declines

In terms of business performance, in Q2/2024, Cen Land recorded net revenue of over VND 333 billion, a 20% decrease compared to the same period last year. The revenue structure mainly came from the company’s brokerage and real estate investment segments. After deducting cost of goods sold, gross profit improved to VND 61.5 billion, up 5%.

The decline in financial revenue and high expenses eroded the company’s Q2/2024 profit. As a result, CRE reported a net profit of VND 8.6 billion, a 9% decrease compared to the same period last year.

For the first six months of the year, Cen Land recognized net revenue of over VND 827 billion, up 82%; net profit of over VND 16 billion, 11.4 times higher than the same period last year.

In 2024, CRE has ambitious plans with a target revenue of VND 3,250 billion and a pre-tax profit of VND 220 billion, 3.5 times and nearly 45 times higher than 2023, respectively. The company has only achieved 10% of its profit target in the first six months.

VND 1,100 billion stuck in Louis City Hoang Mai project

As of June 30, 2024, Cen Land’s total assets were recorded at VND 7,121 billion, almost unchanged from the beginning of the year. Of this, the company has VND 45 billion in cash and over VND 123 billion in term deposits.

Short-term receivables accounted for VND 4,074 billion. Of this, receivables from business cooperation with Galaxy Land JSC and Trustlink Service and Investment JSC for the Louis City Hoang Mai project amounted to nearly VND 1,198 billion, an increase of VND 30 billion from the beginning of the year.

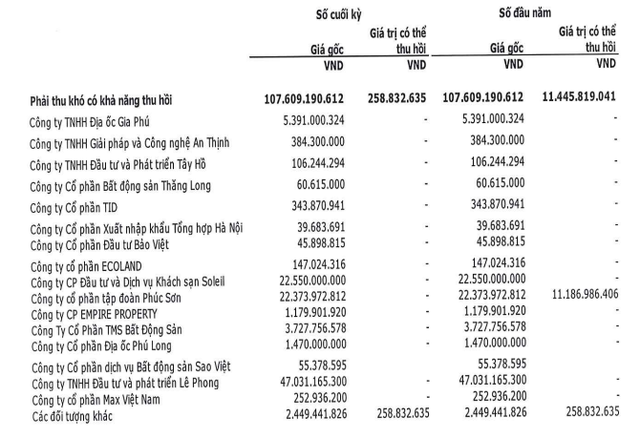

Notably, Cen Land still recorded bad debts of up to VND 107 billion from real estate enterprises such as Soleil Hotel Investment and Service JSC (a subsidiary of Tan Hoang Minh Group); Phuc Son Group Joint Stock Company, etc. However, the recoverable value is less than VND 259 million.

Source: CRE

On the other side of the balance sheet, Cen Land’s liabilities stood at VND 1,488 billion, including VND 787 billion in short-term financial debt.

Currently, the company has over VND 353 billion in bonds due, for which it has negotiated with bondholders to extend the payment deadline to January 31, 2025.

On July 30, Cen Land reported on the progress of rectifying the situation of its securities being warned due to the auditor’s exception opinion on the 2023 audited financial statements.

According to CRE, the Louis City Hoang Mai project, developed by Urban Development and Investment Joint Stock Company, owes the state land use fees for phase 3 amounting to over VND 1,400 billion. As of the end of March, the developer had paid about VND 758 billion, with the remaining debt of over VND 668 billion.

Explaining the reason for the developer’s failure to pay the full amount, CRE cited several objective reasons such as the large amount of land use fees requiring time for arrangement; the current economic challenges, and the impact on the developer’s business and sales activities, resulting in a delay in generating the expected revenue for payment.

In Q2/2024, the developer paid an additional VND 110 billion, and in July, they continued to pay VND 180 billion in land use fees. Thus, the total amount paid so far has exceeded VND 1,048 billion. Going forward, the Company will continue to closely monitor the progress and urge the developer to arrange funds to pay the remaining debt.

Regarding the recovery of receivables from Hong Lam Xuan Thanh and related parties, CRE stated that the Company has been actively working with Hong Lam Xuan Thanh to understand their financial capacity and the reasons for tax arrears.

Hong Lam Xuan Thanh has an estimated tax debt and late payment of about VND 70 billion, mainly in value-added tax. However, their current VAT credit balance is about VND 40 billion. Therefore, if the tax authority agrees to offset this amount, the actual amount of tax debt to be paid is only about VND 30 billion. From May 31 to date, Hong Lam Xuan Thanh has paid VND 1.23 billion in tax debt to the state budget.

Currently, the receivables from Hong Lam Xuan Thanh mainly comprise deposits for the purchase of products in the Xuan Thanh Service and Resort project in Xuan Thanh commune, Nghi Xuan district, Ha Tinh province (known as Hoa Tien Paradise).

In Q3-Q4/2024, upon receiving a suitable proposal from Hong Lam Xuan Thanh, Cen Land will sign a contract for the sale and purchase of future houses for the properties that have been deposited. This will enable the settlement and offsetting of financial obligations between the two parties.