|

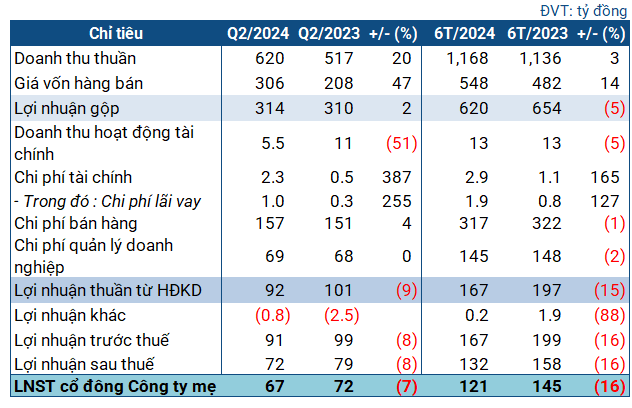

Traphaco’s Business Performance in Q2 2024

Source: VietstockFinance

|

In the second quarter, Traphaco’s revenue reached VND 620 billion, a 20% increase compared to the same period last year. However, the cost of goods sold surged to VND 306 billion, a 47% difference. After deductions, gross profit stood at VND 314 billion, a 2% increase year-over-year.

Both selling expenses and administrative expenses increased and remained at high levels, while financial income decreased by more than half, reaching only VND 5.5 billion. Ultimately, Traphaco’s net profit was VND 67 billion, a 7% decrease compared to the previous year’s quarter.

Although the results showed a decline, the performance in the second quarter was still higher than the previous three quarters. Additionally, it is important to note that the company’s performance in the same period last year was also impressive. In 2023, the company achieved a net profit of VND 263 billion, the second-highest in its history, surpassed only by the year 2022.

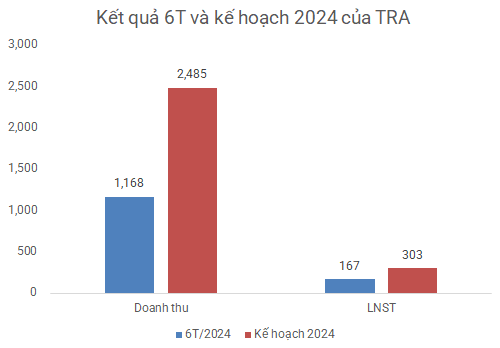

For the first six months of the year, Traphaco recorded nearly VND 1,170 billion in net revenue, a 3% increase year-over-year, and a net profit of VND 121 billion, a 16% decrease. Compared to the plan approved by the 2024 Annual General Meeting of Shareholders, the company has achieved 47% of its revenue target and over 55% of its annual after-tax profit plan.

Source: VietstockFinance

|

As of the end of June, the company’s total assets amounted to nearly VND 2,000 billion, a 6% decrease from the beginning of the year. Short-term assets slightly decreased to over VND 1,400 billion. Cash and cash equivalents held were VND 569 billion, a 25% reduction. Inventories increased by 7%, totaling over VND 500 billion.

On the capital side, all of the company’s payables were short-term, amounting to VND 472 billion, a 26% decrease from the beginning of the year. The total short-term debt was lower than the amount of cash held, indicating no concerns about the company’s ability to meet its upcoming debt obligations.

Regarding borrowings, the company had a short-term loan of VND 75 billion (a 55% decrease), which was a bank loan.