Stable Investment Environment Recovers

Savills’ APIQ Q2 2024 report noted that Vietnam’s consumer price index for the first five months of 2024 increased by 4.0% year-on-year. Standard Chartered Bank recently revised down its forecast for Vietnam’s 2024 GDP growth to 5.3% in Q2, slightly lower than the bank’s Q1 forecast of 5.7%.

While this indicates a slowing trend, the overall recovery is still on track. Challenges such as geopolitical tensions, global inflationary pressures, and low investment demand may extend into Q3, potentially impacting the recovery.

Savills’ Executive Director, Troy Griffiths, commented: “Economic challenges may persist in Q3 amid weak global demand, geopolitical tensions, and inflationary pressures. However, positive FDI and domestic infrastructure investment will boost the economy.”

According to Troy Griffiths, a 7.8% year-on-year increase in FDI disbursement in May to $8.3 billion is a positive sign for the economy. The industrial real estate sector will witness stable demand, supported by FDI inflows and infrastructure development.

“This will encourage developers to expand their portfolios, such as VSIP, which is building a 600-hectare industrial park in Lang Son, and Gaw NP Industrial, which is introducing nearly 100,000 sqm of built-ready factories and warehouses in Ha Nam,” he illustrated.

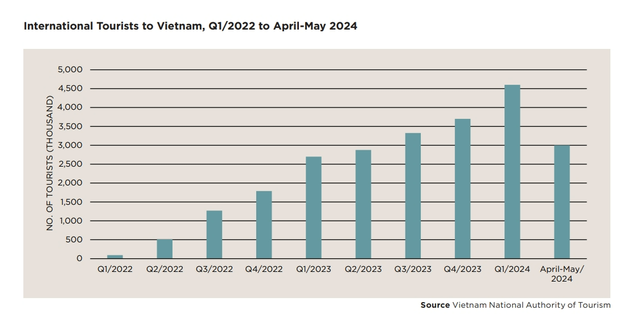

International Visitor Arrivals to Vietnam from Q1 2022 to April-May 2023. Source: Savills APIQ Q2 2024

From another perspective, Vietnam’s tourism industry recovered in the first five months of 2024, with approximately 7.6 million international visitors, up 64.9% year-on-year, surpassing the pre-pandemic level by 3.9%. Savills’ report assessed the tourism industry’s recovery as encouraging, but the long-term outlook for the sector depends on the unpredictable global travel pattern.

Residential and Industrial Projects Attract Investment

The residential real estate market is progressing cautiously. Amid economic uncertainties and potential homebuyers adopting a wait-and-see approach, developers continue to launch new projects to gauge market sentiment.

For instance, Masterise Homes introduced a 7.2-hectare residential project in Hai Phong, while Ecopark launched a 1.3-hectare project in Nghe An. In Ho Chi Minh City, Gamuda unveiled The Meadow project with 212 townhouses in Q2. Simultaneously, Vinhomes collaborated with Japan’s Nomura to co-develop two subdivisions in the Vinhomes Royal Island project, offering 821 low-rise units. In the hospitality segment, VCRE debuted 264 premium apartments in Danang, partnering with the renowned Nobu Hospitality brand.

In the commercial real estate for lease segment, rising rents and limited space are prompting businesses to relocate outside city centers. In Hanoi, 48% of new office space is projected to be in emerging CBD/urban areas like Tay Ho by 2025, while Ho Chi Minh City is witnessing a shift towards Thu Thiem with new green-certified development projects.

Some notable M&A transactions include:

· Kim Oanh Group (Vietnam) partnered with NTT Urban Development, Sumitomo Forestry, and Kumagai Gumi Co Ltd (Japan) to develop The One World, a 50-hectare residential project in Binh Duong.

· Nishi Nippon Railroad (Japan) acquired a 25% stake in the 45.5-hectare Paragon Dai Phuoc project from Nam Long Group (Vietnam) for approximately $26 million.

· Tripod Technology Corporation purchased an 18-hectare industrial land lot in Ba Ria-Vung Tau from Sonadezi Chau Duc.

Asia-Pacific Region Forecast to be Optimistic in the Second Half

The forecast for Asia-Pacific’s 2024 real GDP growth has been revised up to 3.9%, driven by India’s strong economic performance and a robust rebound in exports. However, the resilient US economy has pushed back the Fed’s timeline for interest rate cuts, and monetary policies are expected to remain unchanged in most major markets. The backdrop of higher interest rates is likely to persist until the end of the year, except for Japan and China.

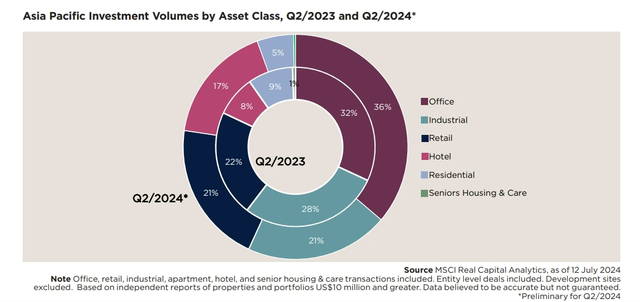

Investment Volume in Asia-Pacific in Q2 2024 compared to Q2 2023. Source: Savills APIQ Q2 2024

Investors remained cautious in their decision-making during Q2/2024 in the region, resulting in a 28.1% year-on-year decrease in preliminary investment volume, with a total investment value of $26.3 billion (for transactions valued at over $10 million, excluding development sites and pending deals).

“While investment volume remains subdued, there are signs of more positive growth in the region. The anticipated interest rate cuts are expected to contribute to a more optimistic second half, even as the US election and ongoing geopolitical tensions may slow down the recovery,” said Simon Smith, Head of Research and Consultancy at Savills.

The report showed that in the region, the commercial real estate segment, including office, retail, and industrial/logistics properties, continued to lead investment volume in Q2, accounting for over 75%. However, the investment ratio in hotels doubled in Q2, indicating a continued shift towards alternative assets that can offer potential investment yields.

Looking ahead, the report forecasts an interest rate cut towards the end of the year due to easing inflationary pressures and slower economic growth. Meanwhile, the regional real estate market is expected to gradually recover in the coming quarters. However, the US election and ongoing geopolitical tensions may impact the region’s recovery.

EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses…

Prime Minister: State-owned enterprises holding substantial resources need to be profitable

On the morning of February 5th, Prime Minister Pham Minh Chinh emphasized the importance of profitable operations and increased contributions to GDP growth and the state budget by working with 19 conglomerates and state-owned enterprises. These businesses possess significant resources and must strive to generate more profits.