Credit cards are a financial tool that allows you to spend now and pay later. Based on your income, spending history, and credit score, issuers will give you a credit limit, allowing you to spend within this limit.

With approximately 39 million cards in use, credit cards have become a familiar and powerful spending tool for many people, especially in urban areas. Here are some tips to help you use credit wisely, effectively, and maximize the benefits of this financial tool.

Always make payments on time

The first rule when using a credit card is always to make payments on time.

When spending with a credit card, you are essentially taking out an interest-free loan from a bank or financial company for a certain period. This interest-free period varies among banks but typically falls within 45 days. Some banks in the market, like Bản Việt Bank (BVBank), offer interest-free periods of up to 55 days. Taking advantage of this period gives cardholders more flexibility with their cash flow, especially in situations where they don’t have ready cash.

The 0% interest loan within the 45-55-day period is the biggest advantage of credit cards, even for business owners who use it to maintain a flexible cash flow in their businesses. However, if you fail to make the payment by the end of the interest-free period, your credit score will be affected, limiting your future bank loan options.

A small tip is to set up automatic monthly bill payments to avoid missing credit card due dates. At the same time, banks periodically send text messages or emails reminding customers of the statement closing date and the latest payment date. If you don’t have automatic bill payments set up, always pay attention to these messages to ensure timely credit card payments. If you are unable to pay off your credit card debt, you can also register with the bank to convert it into an interest-free installment plan to avoid late payments and bad debt.

Pay the full statement balance instead of the minimum

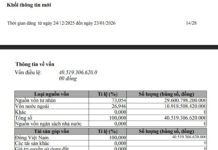

When it comes to credit card debt repayment, issuers usually offer three options: pay the minimum, pay the full amount of the statement, or pay any amount in between.

The minimum payment is the amount you need to pay within the interest-free period of 45-55 days to maintain your credit score and avoid late payment fees, which typically range from 3-7%, depending on the card type and the bank.

However, even if you make the minimum payment on time, you will still be charged interest on the remaining balance. Interest rates range from 1.5-3% per month, depending on the card type and the bank. Note that interest will be calculated on the total statement balance. So, to avoid paying interest, it’s best to pay off the full statement balance instead of just the minimum.

Choose the right credit card for your needs

Nowadays, there are numerous credit cards on the market, each with its own set of programs and benefits. Since everyone has different spending habits and preferences, there is no one-size-fits-all credit card.

Using a credit card tailored to your specific needs will benefit cardholders with rewards like cashback on groceries, tuition fees, insurance premiums, online shopping, or travel expenses.

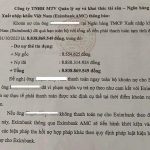

One of the first criteria for most people when choosing a credit card is a no-annual-fee feature. This option helps cardholders save a significant amount and avoids the psychology of paying fees for using banking services. BVBank, for example, offers six different no-annual-fee cards: VISA inStyle, JCB Sense, Visa Joy, JCB Cheer, JCB 7-Eleven, and JCB Link.

Depending on more specific needs, each card has its own strengths. For shopping enthusiasts who frequent malls or duty-free shops, the inStyle card is the optimal choice, offering 3% cashback on such transactions. Mothers or family budget managers can opt for the Visa Joy card, which doubles reward points for supermarket spending. Online shoppers and cosmetic enthusiasts should consider the Ms. card, designed exclusively for women, offering 10% cashback on e-commerce purchases and 5% cashback at Grab, Be, and cosmetic stores.

Meanwhile, the JCB Sense card is ideal for frequent travelers and socializers, offering a 3% discount on restaurant spending and free international airport lounge access, along with benefits at golf courses, restaurants, and hotels.

Spend within your repayment ability

If you’re new to credit cards, experts advise starting with one credit card with a limit of one to two times your monthly income. Get accustomed to using this first card before opening additional ones to suit your needs.

In reality, swiping a credit card, according to behavioral psychology studies, creates a feeling of less “loss” compared to spending cash. Using a credit card can lead to a more relaxed and less considered spending mindset. Therefore, for those who don’t regularly monitor and plan their finances, credit card spending needs to be controlled to avoid overspending and accumulating debt beyond one’s repayment ability.

Have clear financial goals and start by creating a savings and spending budget before using a credit card. When you notice that your monthly expenses exceed your budget, you can temporarily stop unnecessary purchases and be more considerate before swiping your card.

How to use credit cards without turning “borrow 8 million into debt of 8 billion”?

Knowing how to use and spend credit cards may seem straightforward, but not everyone grasps it fully. If you don’t understand it completely and use it correctly, you can end up with unnecessary expenses, fall into the “debt trap,” or even face legal consequences for intentionally maxing out your credit cards.