AGM stock has seen a downward adjustment in the last three sessions, falling to 3,080 VND per share on August 1st, with over 317,000 shares matched. Compared to its peak this year, AGM’s market price has dropped by nearly 62% in over four months.

| AGM Share Price Movement since the Beginning of 2024 |

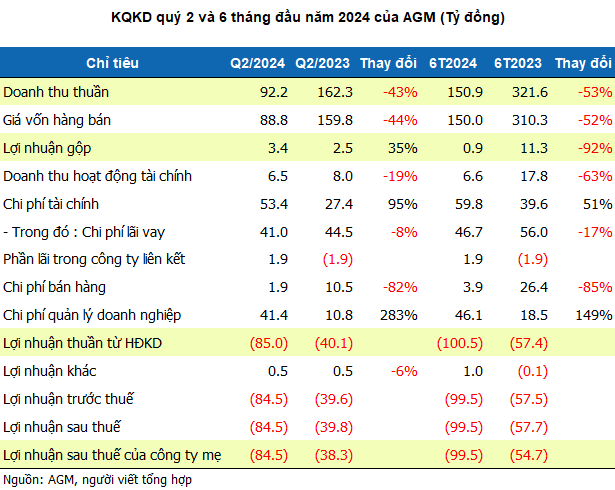

The share price took a negative turn after Angimex announced its Q2 2024 consolidated financial statements, which showed unfavorable figures. Specifically, revenue reached over 92 billion VND, a 43% decrease compared to the same period last year, and incurred a net loss of 84.5 billion VND, heavier than the loss of over 38 billion VND in Q2 2023.

The company attributed the loss to high fixed costs, including depreciation, interest expenses, and provisions. Financial expenses nearly doubled from the previous year to over 53 billion VND, with interest expenses alone amounting to 41 billion VND.

For the first six months of the year, AGM’s revenue was nearly 151 billion VND, 53% lower than the same period last year, due to the absence of revenue from Honda vehicle sales, spare parts, and repair services. Conversely, revenue from rice sales increased by 67% to over 118 billion VND, constituting the most significant portion of the revenue structure.

The high cost of goods sold, coupled with fixed expenses, resulted in a net loss of 99.5 billion VND for the company.

For 2024, Angimex revised its profit-before-tax target downward to 5 billion VND, an 81% reduction from the previous plan. However, the company has yet to turn a profit. As of June 30, 2024, the accumulated loss increased to nearly 260 billion VND, causing Angimex’s equity to fall to almost 78 billion VND.

On the balance sheet, Angimex’s total assets as of the end of Q2 were 1,165 billion VND, a 6% decrease from the beginning of the year, or a difference of 72 billion VND. However, the company only had over 6 billion VND in bank deposits and less than 15 million VND in cash. On the liabilities side, the total amount payable was 1,243 billion VND, an increase of 28 billion VND from the beginning of the year, including over 959 billion VND in loans.

To address these challenges, Angimex has been actively selling off assets to repay debts, generate cash flow, and restore business operations. In the first six months, the company recorded 6.5 billion VND in net profit from liquidating investments in other entities and nearly 343 million VND from the sale and disposal of fixed assets.