The VN-Index’s downward trajectory towards the 1,200-point mark is an unwelcome prospect for Vietnamese stock investors, but it’s a scenario that is unfolding before their eyes. After shedding nearly 2% in the previous session, the index is now less than 27 points away from the dreaded 1,200 mark. Just one more slip, and investors will once again witness this all-too-familiar number.

This is a disappointing outcome, as many investors had been anticipating the VN-Index to breach the 1,300-point level, with some even bolder forecasts. Several securities companies predicted that the index could reach the 1,400-1,500 range by the end of the year, while the foreign fund Pyn Elite Fund went as far as projecting a potential high of 1,700 points.

Various arguments were put forward by market participants to support these projections, including: (1) the Fed’s impending decision to cut interest rates, which would ease pressure on exchange rates; (2) the positive assessment of corporate profit growth, supported by bright spots in second-quarter data; and (3) the efforts of regulatory authorities and market members during the upgrade process.

While it is too early to conclude whether these assertions were overly optimistic, the VN-Index’s repeated failures to breach the 1,300 threshold and subsequent retreat towards the 1,200 level have undoubtedly left investors disappointed. In reality, the 1,200 mark has been a persistent source of anxiety for Vietnamese investors for many years.

Historically, the VN-Index came close to the 1,200-point threshold in March 2007. At that time, the Vietnamese stock market was still in its infancy, with only 107 listed stocks, making it susceptible to excessive speculation. According to the International Monetary Fund (IMF), the P/E ratio of the VN-Index even reached a staggering 73 times.

It took more than a decade for the VN-Index to officially surpass the 1,200-point mark for the first time in April 2018. Since then, the index has crossed this threshold nine times, going back and forth. Notably, the periods when the VN-Index remained above 1,200 points were typically brief. The longest stretch occurred from April 2021 to mid-May 2022, while the other instances were mostly measured in weeks.

In contrast, the VN-Index has often lingered below the 1,200-point level for extended periods, sometimes lasting for months or even years. The longest stretch was observed from the first time it breached 1,200 points in early April 2018 until early April 2021, meaning it took three years for Vietnamese investors to witness this level again.

In essence, the past three months could be likened to a “long dream” for Vietnamese investors. If the “nightmare” of the 1,200-point threshold materializes and brings everything back to reality, it wouldn’t come as a complete shock, as this scenario has played out numerous times before. The lack of new and high-quality investment options on the exchange has made long-term capital hesitant to fully commit to the market.

The sluggish pace of privatization and divestment, coupled with a sparse queue of potential “blockbuster” listings, further dampens enthusiasm. The most prominent candidates for listing are already giant companies trading on the UPCoM, such as ACV, VGI, BSR, and MVN. However, their path to a formal exchange listing is fraught with complexities that cannot be easily resolved overnight.

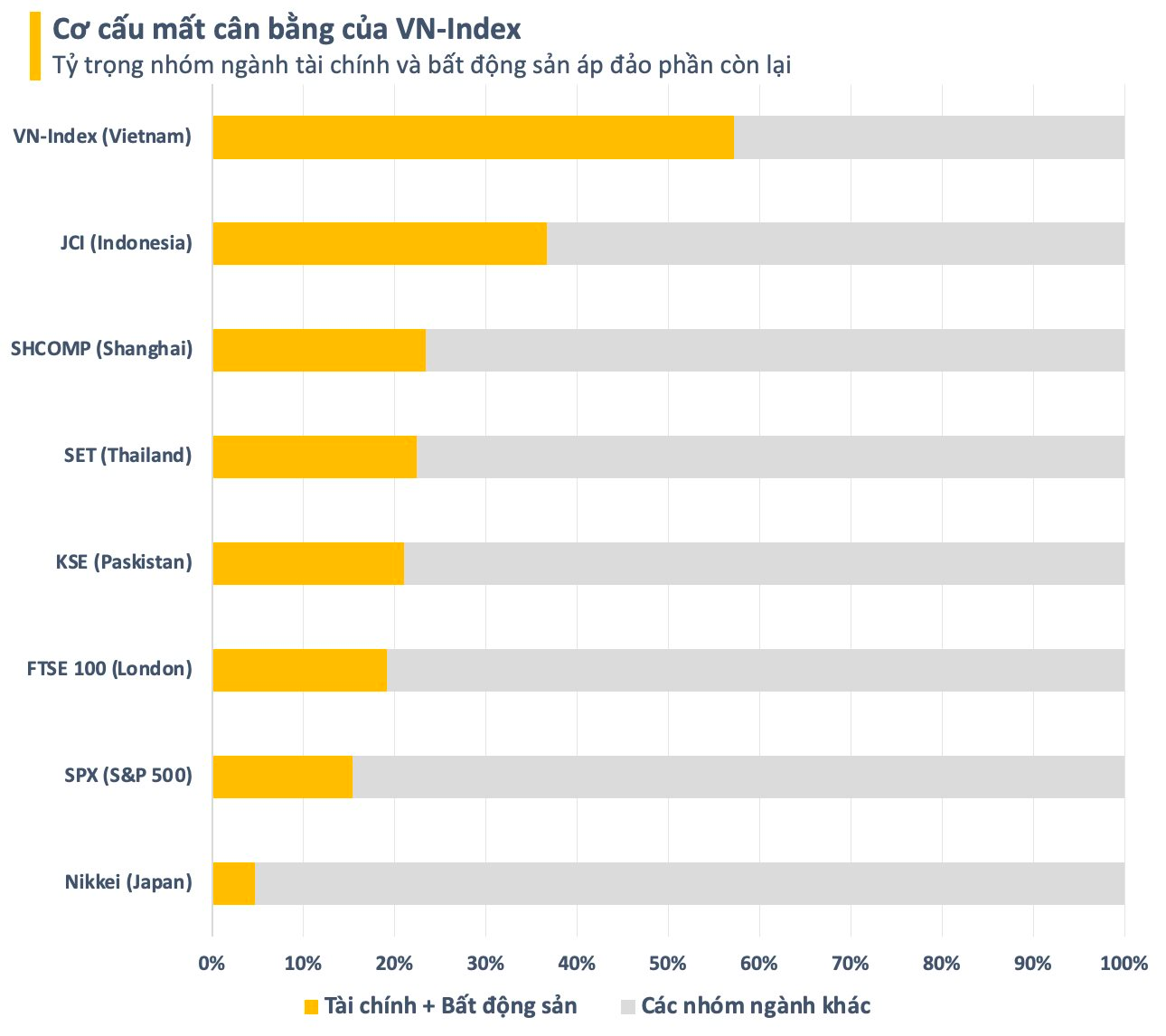

It is undeniable that the structure of Vietnam’s stock market is undergoing a certain shift towards greater diversity in terms of sectors and fields. Nonetheless, the financial and real estate sectors continue to dominate the “framework,” and this trend is expected to persist in the short term. This transformation will require considerable time for new entrants to supplant the old guard of Bluechips.

This imbalance poses a significant barrier to the inflow of long-term capital into the Vietnamese stock market, even with the anticipated upgrade to emerging market status. In theory, Vietnam’s stock market could attract tens of billions of dollars in foreign capital with a promotion from a frontier to an emerging market.

However, the number of stocks that meet the stringent criteria for inclusion in the portfolios of large-scale emerging market funds is relatively limited. Conversely, the potential outflow from dedicated frontier market funds could be substantial, creating considerable downward pressure on the market.