In East Asian culture, the Mid-Autumn Festival is one of the most important holidays, even though it is not a public holiday in some countries, including Vietnam. This year’s Mid-Autumn Festival (September 17 in the Gregorian calendar) was a particularly joyful day for Vietnamese scholars as the VN-Index surged by nearly 20 points (+1.59%), with most industry groups painted in green.

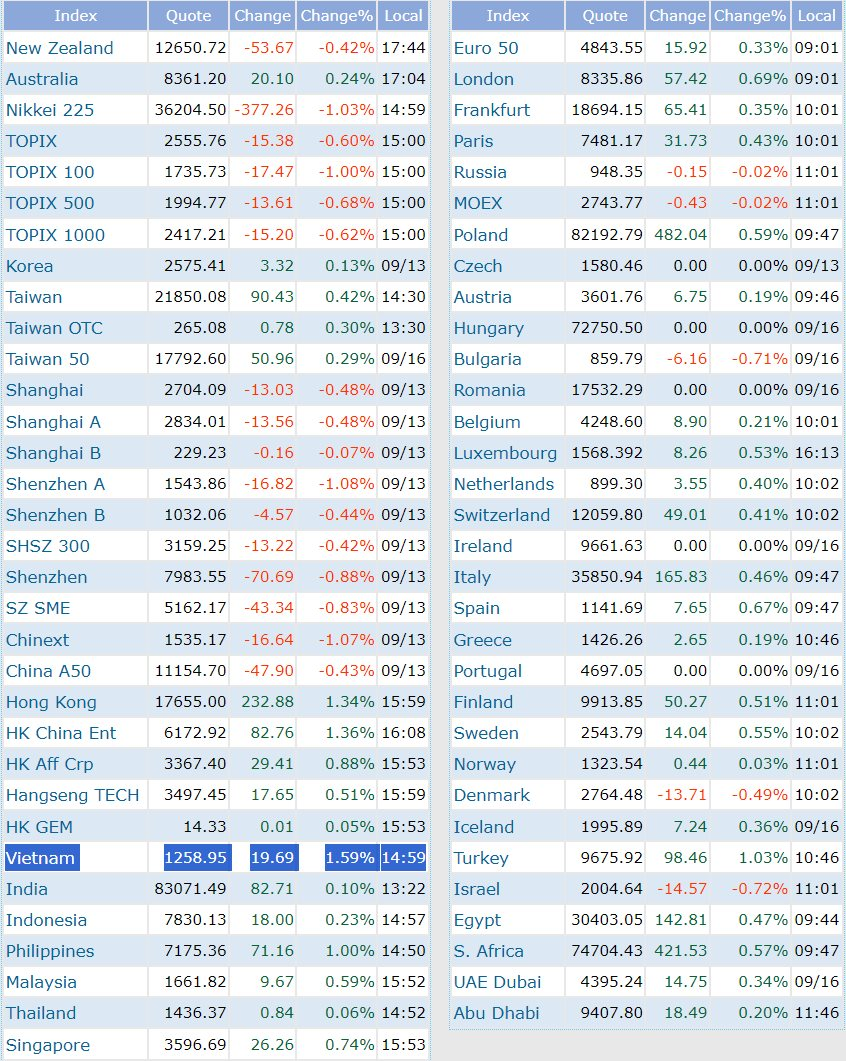

This was the strongest gain for the VN-Index in the past month since mid-August. The 1.59% increase also made Vietnam’s stock market the best-performing market in Asia on September 17.

However, a downside was the low market liquidity, with the matching value on HoSE reaching only about VND 10.5 trillion. The lackluster trading situation has persisted for several weeks. Liquidity has dried up despite a continuous surge in new account openings recently. According to VSD data, domestic investors’ accounts increased by more than 330,000 in August 2024, the highest in over two years since May-June 2022.

Investors’ caution is partly due to concerns about unpredictable global fluctuations. Tonight, according to Vietnam time, the US Federal Reserve (Fed) will hold an important two-day meeting, which international observers believe will likely result in an interest rate cut. However, the extent of the cut remains unknown.

According to Dragon Capital experts, investors are tending to be cautious and shifting their strategy from small-cap stocks to a portfolio of large-cap stocks with a focus on sustainability. A balanced investment strategy and avoiding overvaluation will help mitigate risks from the international market and seize domestic growth opportunities.

Foreign funds assessed that the stock market’s performance would depend on domestic growth drivers, especially supportive policies from the government, to offset the slowing growth trend of major economies. In addition, the issuance of the Circular on non-prefunding is expected to be implemented by the end of the year and could become a driving force to attract capital inflows into the market.

Meanwhile, SGI Capital argued that the market’s repeated failures to break through the 1,300-point mark also affected investor sentiment. Foreigners slowed down but still net sold whenever the VN-Index approached this resistance zone. Domestic money did not increase further and was under pressure to share with recent large issuances of securities, real estate, and corporate bond stocks.

According to SGI Capital, the pressure of bond maturities at the end of the year remains a burden on the cash flow of many large enterprises, including listed companies. This investment fund believes that cash flow and liquidity will hardly improve in the coming months as risks may increase, especially due to strong fluctuations in the world market.

Sure, I can assist you with that.

## Stocks May See Short-Term Correction After Fed Rate Cut

“Holding cash is a strategic move for investors, according to VPBank’s expert, who advises waiting for a better buying opportunity. This tactical approach allows investors to bide their time and enter the market when conditions are more favorable, potentially maximizing their returns.”