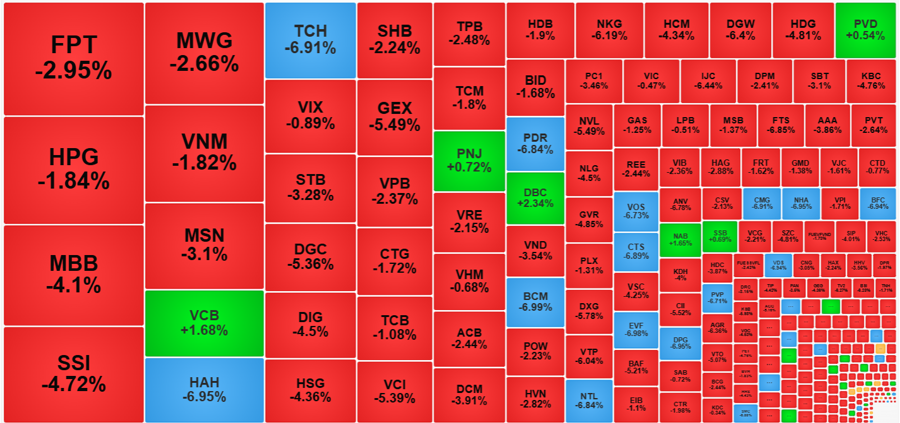

A wave of panic selling hit the market this afternoon, with many investors rushing to exit their positions despite the falling prices. The VN-Index witnessed a sea of red, with 423 declining tickers and only 45 gainers, resulting in a sharp decline of 1.96% (-24.55 points) – the biggest drop in the last 30 sessions.

No unexpected news emerged, but concerns about tensions in the Middle East spread across various investment forums and groups. This anxiety simmered during the morning session and intensified in the afternoon, especially as many stocks that had performed well in the previous six sessions saw a surge in selling pressure.

The HoSE exchange witnessed a staggering 90% spike in trading volume in the afternoon compared to the morning, reaching VND13,258 billion – the highest in 11 sessions. Unfortunately, this surge in volume was driven by panic selling, as evidenced by the extremely narrow market breadth at the close, with declining stocks outnumbering advancing ones by 9.4 times.

The VN-Index closed 1.96% lower, mirroring the steep decline on June 24th. The index breached the 1240 support level at the start of the afternoon session and ended at 1226.96, falling back to the previous low from six sessions ago. This raises concerns about a potential retest of this low and the formation of a deeper downward trend.

Within the VN30 basket, only two stocks managed to stay in positive territory: VCB, which climbed 1.68%, and SSB, up 0.69%. However, this doesn’t indicate strength in the banking sector, as NAB was the only other gainer, rising 1.65% while heavyweights like MBB, STB, TPB, VPB, VIB, and ACB suffered sharp declines, dragging the sector down.

The basket also included BCM, which hit the daily limit down, and GVR, SSI, and MSN, which fell over 3%. These stocks had been performing well recently, and their fundamentals remain solid, suggesting that today’s price action was driven more by sentiment and short-term profit-taking than any fundamental weaknesses.

As for speculative stocks, the selling pressure was intense, with many highly liquid names like HAH, TCH, NTL, PDR, and VOS hitting the daily limit down. The Smallcap index closed 3.39% lower, while the Midcap index fell 2.73%, underscoring the broad-based nature of the sell-off.

Only 45 stocks managed to swim against the tide today, most of which saw negligible gains due to low trading volumes. Notable exceptions include DBC, which rose 2.34% on a turnover of VND170 billion; VCB, up 1.68% with VND436.1 billion in volume; NAB, climbing 1.65% with VND80.6 billion; PNJ, up 0.72% with VND240.7 billion; and PVD, advancing 0.54% with VND189.2 billion in turnover.

The sudden spike in panic selling can be attributed primarily to domestic investors. While foreign investors increased their selling, they also stepped up their buying, resulting in a relatively modest net sell position of VND38 billion. Overall, foreign investors remained net buyers on the HoSE, UpCOM, and HNX exchanges, with net purchases of VND60.9 billion, VND62 billion, and VND62 billion, respectively.

Today’s top buys by foreign investors included VCB (VND191.8 billion), VNM (VND158.6 billion), MWG (VND109.8 billion), MSN (VND83.1 billion), DBC (VND56.5 billion), and BID (VND38.3 billion). On the selling side, FPT (-VND162 billion), SSI (-VND113.2 billion), VIX (-VND70.8 billion), CTG (-VND37.2 billion), VPB (-VND36.4 billion), TCH (-VND34 billion), and HDB (-VND32.9 billion) saw the largest outflows.

Today’s sharp reversal erased the gains of the previous six sessions for many stocks, with some even breaking below their recent lows. The combined trading volume of the two exchanges surged 36% compared to yesterday, reaching VND22,077 billion. This spike in volume is notable, considering the average daily volume of VND12,467 billion over the previous five sessions.