The Vietnamese stock market experienced a volatile and panic-filled trading session today, August 1st, as panic selling intensified and spread with many investors trying to get out at any cost, even at the floor price.

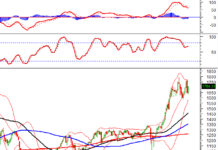

At the close, the VN-Index had 423 red codes but only 45 green ones, with the index losing 1.96% (-24.55 points), the strongest decline in the last 30 sessions. During the trading session, there was a time when the VN-Index fell nearly 29 points. This result has wiped out previous recovery efforts.

The market has just passed the peak of enterprises’ financial statement announcements, and information has been continuously pouring in in recent days, which is a good catalyst for the VN-Index recovery. However, the positive developments earlier completely reversed in today’s trading session.

Since the beginning of the session, selling pressure has appeared and increased, especially in the afternoon session. This shows that investors’ psychology is becoming more cautious and there is a tendency to take profits.

The stock market is in free fall on the first day of August. (Illustration: 24h)

Most sectors were under selling pressure, especially telecommunications, chemicals, securities, and real estate. Red dominated over 420 stocks on HoSE, with all sectors, from large-cap to small and medium-cap stocks, undergoing adjustments.

On the HoSE, nearly 30 stocks fell to the maximum daily limit, including EVF, AGM, BFC, CMG, CTS, DPG, HAH, LHG, NHA, QCG, SMC, and TLH. By the end of the day, many of these stocks still had a large volume of floor sell orders. Floor-priced stocks were concentrated in the real estate group.

Among the top 10 stocks that negatively affected the market’s decline today were FPT (-2.95%), GVR of Vietnam Rubber Group (-4.85%), MBB (-4.1%), BCM (-7%), and TCB (-1.08%).

In the VN30 basket, only 2 stocks rose, while the rest fell. Large-cap stocks such as FPT, GVR, MBB, and BCM significantly contributed to the index’s decline.

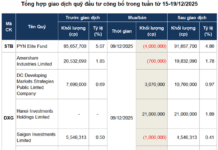

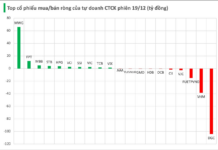

As the market fell sharply, foreign investors returned to net buy, with a net purchase value of VND 115 billion, focusing on VCB, VNM, MWG, MSN, and DBC.

Large-cap stocks became a burden on the VN-Index, with the decline of many stocks reaching 3-5%. GVR, FPT, MBB, BCM, BID, and VPB were the most negatively traded stocks. As one of the leaders in profit in the second quarter, MB was the most negatively traded bank stock, down 4.1%. A series of STB, TPB, VIB, ACB, and VPB were also in the red.

Sectors with significant influence and liquidity, such as securities, steel, and construction, also fell sharply.

On the HNX, the HNX-Index fell 6.13 points (2.6%) to 229.23 points. The UPCoM-Index decreased by 1.55 points (1.63%) to 93.52 points. Selling pressure pushed liquidity to soar, with the HoSE matching value reaching VND 20,200 billion. In particular, in the afternoon session alone, VND 13,000 billion was matched on the HoSE, twice the amount of money poured into this floor in the morning session.

Why did the stock market plunge?

Today’s sharp decline in the market has caught investors off guard, as the country’s macroeconomic indicators are showing positive signs and production activities are going well. At the same time, foreign direct investment (FDI) is also growing favorably.

Explaining this situation, many experts believe that the main reason is that investors’ psychology is being negatively affected and is spreading. Experts from VPS Securities Company believe that at this stage, many people are afraid of a deep market decline, along with international geopolitical risks, so investors’ psychology and behavior can lead to strong selling pressure even on stocks with good fundamentals and prospects.

On the other hand, some recent news may have caused investors to waver, such as the continuous increase in savings interest rates, the unclear trading trend of foreign investors, global geopolitical instability, and inflation.

Moreover, the market is likely in the process of retesting the support zone of 1,200 – 1,220 points. After rising to touch the resistance zone of 1,257 – 1,260 points, the indices easily fell deeply instead of fluctuating within the range of 1,255 – 1,260 points. The market is still in a “weak” phase after a prolonged correction period, so psychological and informational factors that are “testing the waters” also weigh on the market.

”

Today’s adjustment session is almost certainly due to investors’ psychology, not bad news from the macro economy. Therefore, investors need to keep calm and focus on re-evaluating their portfolios, instead of panic selling following the market “wave”.

“, an expert commented.