An Binh Securities (ABS) has demonstrated impressive performance in Q2, ranking among the top 10 listed securities companies in terms of return on equity, with a capital scale of over VND 1,000 billion.

Specifically, for Q2 2024, ABS posted operating revenue of VND 108 billion, up 66.7% year-on-year, with all business segments thriving. Net profit reached VND 40 billion, a remarkable increase of 248% year-on-year. For the first half of 2024, ABS recorded a net profit of VND 56.6 billion, up 83.9% year-on-year.

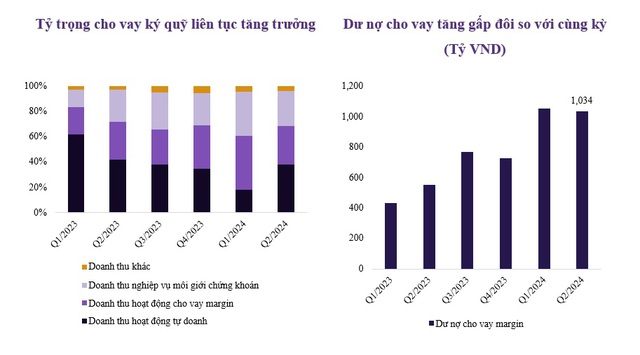

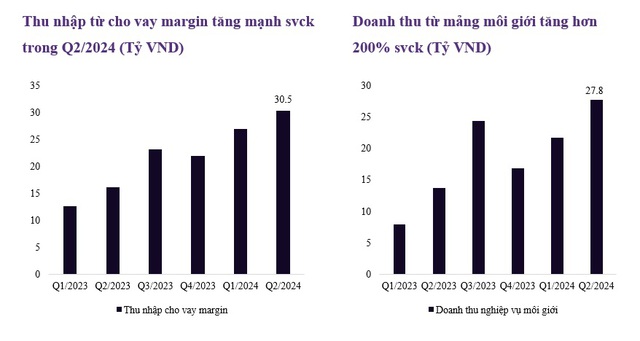

The largest contributor to this success was the margin lending and advance lending business, with interest income of VND 30.5 billion, an increase of 88.4% year-on-year, while total outstanding loans reached VND 1,034 billion, up 86.8% year-on-year. In terms of brokerage, profit from securities brokerage activities in Q2 2024 surged by over 96% year-on-year to VND 13.9 billion.

Net income from proprietary trading for the first half of 2024 stood at VND 91.8 billion, a significant growth of 44% year-on-year, mainly driven by income from held-to-maturity (HTM) assets. ABS’s financial assets primarily consist of bonds and certificates of deposit, providing a stable source of fixed income while eliminating almost all downside risks associated with the stock market.

Regarding capital structure, ABS’s total assets grew by a substantial 21.3% in just the first six months of 2024, reaching VND 2,790 billion. This growth was mainly driven by an expansion in short-term financial borrowings, which increased by 40% year-on-year to VND 1,315 billion. Despite the increase in borrowings, ABS maintained a stable debt structure, resulting in a 36% year-on-year decrease in interest expenses, which stood at VND 9.2 billion. With access to low-cost capital and ample credit limits, ABS is well-positioned to further strengthen its business operations in the upcoming quarters.

ABS’s robust performance is a result of its effective strategies and dynamic approach to the market.

A robust model and process for evaluating and ranking the quality of stocks for lending, along with the expertise of the operating and brokerage team, form the foundation for ABS’s strong growth in margin lending.

For margin lending activities, which serve investors looking to leverage their investments effectively, ABS believes that the securities company must be the first line of defense for its clients. Therefore, ABS has developed and implemented a comprehensive evaluation and ranking process that combines quantitative risk models for the market, portfolio, and individual stocks with regular reviews and assessments of companies by financial analysts. Additionally, as one of the first securities companies in the market, ABS leverages its strong understanding and experience in margin lending products and customer needs through its long-serving product operations and advisory teams. This ensures that their lending policies and services remain flexible, timely, safe, and convenient for clients looking to leverage their investments.

Focus on technology and building modern trading platforms, along with integrating products and services, enables ABS to continuously enhance its ability to meet the evolving investment needs of its clients.

Over the past three years, as part of its technology transformation strategy, ABS has launched ABS Invest, offering both a mobile app and a web version. These platforms provide comprehensive features, including market and stock data, conditional orders, smart quote boards, cash management tools, and portfolio management capabilities. Additionally, ABS has been consistently enhancing its reputation for delivering high-quality macro, industry, and stock research reports to serve its investors.

With its impressive performance in Q2 and the first half of 2024, ABS demonstrates its ability to achieve strong and sustainable growth. This success is built on a solid foundation of technology, human resources, dynamic policies, and innovative products. At the annual general meeting held in March this year, shareholders approved the plan to list ABS’s shares (code: ABW) on the Ho Chi Minh Stock Exchange (HoSE) in the future.

Experience the benefits of ABS’s products and services by downloading the ABS Invest app today. Open an account 100% online with just one click here to begin your journey towards successful investing.

Take advantage of the Golden Dragon promotion, offering a margin lending interest rate of just 6.99% for new customers.

Every day, Trần Đình Long, the owner of Hòa Phát, has to shoulder nearly 10 billion dong in loan interest.

In 2023, Hoa Phat’s borrowing costs amounted to nearly 3.6 trillion dong, increasing by over 16% compared to 2022 and reaching a record high since its inception.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.