|

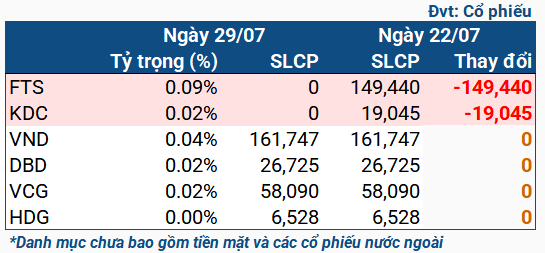

iShares ETF Fund Stock Changes from 07/22/2024 to 07/29/2024

|

During this period, the fund sold all of its holdings in FTS and KDC stocks, with volumes of 149,440 shares and 19,045 shares, respectively. As of July 29, the iShares ETF Fund held only four Vietnamese stocks, namely VND, DBD, VCG, and HDG. Among these, VND had the highest allocation at 0.04% – equivalent to 161,747 shares. Total asset value at this time exceeded 257 million USD, a decrease from the nearly 264 million USD recorded on July 22.

On June 11, 2024, asset management giant BlackRock announced that the iShares ETF Fund would cease trading and no longer accept creation or redemption orders after market close on March 31, 2025. Since then, the Fund has been aggressively selling off Vietnamese stocks.

Following the announcement of the fund’s closure, BlackRock surprisingly hit an impressive milestone: its assets under management for Q2 set a record of 10.65 thousand billion USD. This achievement was bolstered by the strong performance of the stock market and the influx of capital into the company’s ETF funds.

BlackRock is actively expanding its operations through strategic acquisitions. The company has recently agreed to acquire Preqin, a private market data provider, for nearly 3.2 billion USD. Prior to this, they also announced a 12.5 billion USD deal to acquire Global Infrastructure Partners, strengthening their position in the global infrastructure investment field.