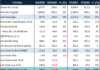

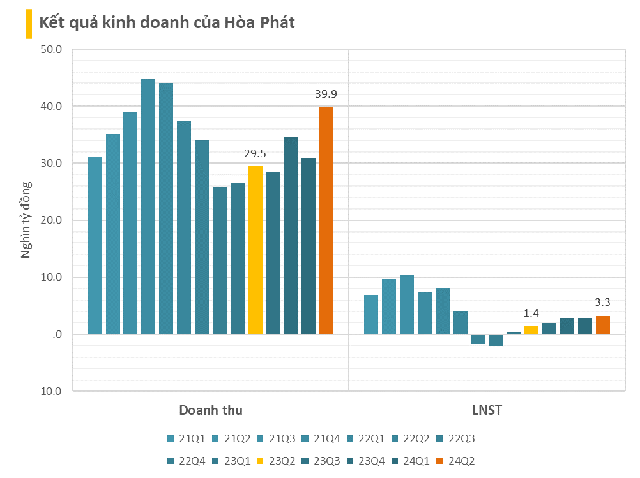

Hoa Phat Group (ticker: HPG) has released its Q2 2024 financial report, boasting impressive figures. With a revenue of VND 39,555 billion, the company witnessed a 34% surge compared to the same period last year. Gross profit stood at VND 5,247 billion, marking a 64% increase year-over-year, while the gross profit margin improved from 10.8% to 13.2%.

Financial income reached VND 645 billion, a 13% dip from the previous year due to a significant decrease in interest income. Meanwhile, financial expenses decreased by 21% to VND 1,065 billion as a result of lower interest expenses. However, selling and administrative expenses saw an upward trend during this period.

Consequently, the company recorded a remarkable pre-tax profit of VND 3,733 billion, reflecting a 120% jump from the same quarter last year. The after-tax profit attributable to the parent company’s shareholders amounted to VND 3,319 billion, an increase of 127%. This quarter’s performance also marked the company’s highest profit in the past two years.

According to Hoa Phat’s announcement, the Steel Group dominated the quarter, contributing 96% and 91% to the Group’s consolidated revenue and after-tax profit, respectively. The Agriculture sector came in second, accounting for 4% of revenue and 7% of after-tax profit.

Meanwhile, the Real Estate sector contributed 0.3% to revenue and 2% to after-tax profit, securing the third position. Construction steel output for Q2 reached 1.27 million tons, a 33% increase from the previous quarter’s 956,000 tons. In contrast, hot-rolled coil (HRC) consumption decreased by 10%, from 805,000 tons to 724,000 tons.

Hoa Phat maintained its leading position in the domestic construction steel market with a 38% market share. However, the company faced challenges in HRC consumption, both domestically and in exports. The influx of low-priced imported hot-rolled coils into the Vietnamese market in the first half of 2024 (6 million tons, a 50% increase from the same period in 2023) significantly impacted the domestic consumption of Hoa Phat’s HRC.

Additionally, HRC prices in the Vietnamese market, after a brief increase in February 2024, declined steadily from March through the end of Q2 2024. Export markets also presented difficulties due to the global surplus of hot-rolled coils and the implementation of trade defense measures by importing countries.

The robust growth in construction steel sales offset the decline in HRC revenue, driving Hoa Phat’s revenue growth this quarter. For the first six months, the company achieved a total revenue of VND 71,028 billion and an after-tax profit of VND 6,188 billion, representing increases of 26.6% and 238%, respectively, compared to the same period last year. Thus, the company has accomplished 62% of its annual profit plan.

As of June 30, Hoa Phat’s total assets amounted to VND 206,609 billion, a 39% increase from the beginning of the year. Fixed assets accounted for the largest portion, at 34%, totaling VND 70,074 billion. Inventories witnessed a significant rise, increasing by nearly VND 5,700 billion to VND 40,163 billion.

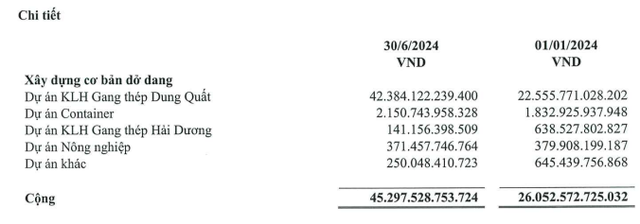

Cash and cash equivalents decreased by 18% from the beginning of the year to VND 28,346 billion. The most notable change in the company’s asset structure was the long-term work-in-progress asset, which stood at VND 45,360 billion, a 74% increase since the start of the year. This reflects the company’s substantial investments in various projects, with a significant portion directed toward the Dung Quat Integrated Steel Mill project.

The company’s total financial borrowings neared VND 73,000 billion, an increase of nearly VND 8,000 billion from the beginning of the year. Shareholders’ equity stood at VND 108,676 billion, including nearly VND 43,800 billion in undistributed after-tax profits.