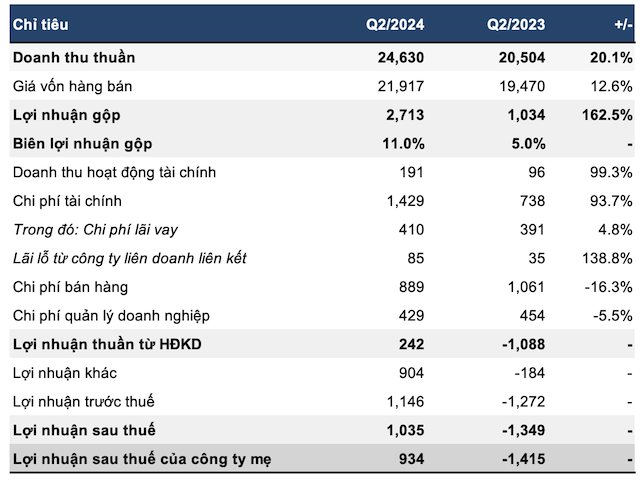

The national carrier’s Q2 financial report shows a strong recovery, with a 20.1% year-on-year increase in revenue to VND 24,630 billion and a 162.5% surge in gross profit to VND 2,713 billion. Notably, the gross profit margin improved from 5% to 11%.

Another positive aspect is the significant reduction in Vietnam Airlines’ selling and management expenses. In Q2 2024, selling expenses decreased by 16.3% to VND 889 billion, while management expenses fell by 5.5% to VND 429 billion.

Vietnam Airlines’ Q2 Financial Results

Unit: Billion VND

Source: VietstockFinance

|

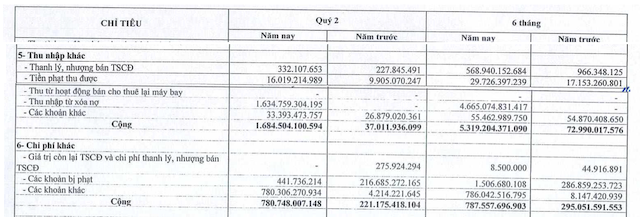

Further Debt Forgiveness

However, the highlight of Vietnam Airlines’ Q2 financial picture comes from other income. The airline recorded other income of VND 904 billion, compared to a loss of VND 184 billion in the same period last year. This was mainly due to debt forgiveness of nearly VND 1,700 billion, an important move to ease the financial burden on the national carrier.

Source: Q2 Financial Statements of Vietnam Airlines

|

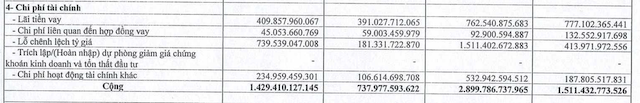

On the negative side, financial costs increased significantly. In Q2 2024, financial expenses surged by 93.7% year-on-year to VND 1,429 billion, mainly due to foreign exchange losses. Within this, interest expenses increased by 4.8% to VND 410 billion.

As a result, Vietnam Airlines recorded a net profit of VND 934 billion in Q2, a remarkable turnaround from a loss of VND 1,415 billion in the previous year.

Looking at the first half of the year, the airline’s business picture has brightened considerably. Vietnam Airlines posted revenue of nearly VND 52,600 billion, up 20% year-on-year. Net profit reached nearly VND 5,270 billion, partly due to debt forgiveness.

At the mid-year review conference held by the State Capital Investment Corporation (SCIC) on July 16, Mr. Dang Ngoc Hoa, Chairman of Vietnam Airlines, stated that after more than three challenging years due to the COVID-19 pandemic, the company’s business has shown positive signs of recovery. However, he also acknowledged that the airline still faces significant challenges.

Specifically, soaring fuel prices in the first half of the year added thousands of billions of dong to the company’s expenses. Additionally, the exchange rate has appreciated by 4.8% since the beginning of the year, creating further pressure on the company’s operations.

Another issue Vietnam Airlines is grappling with is a shortage of aircraft. Vietnamese airlines now have just over 160 aircraft in operation. Nevertheless, despite the reduced fleet size, Vietnam Airlines has increased flight hours compared to last year to meet passenger demand.

Looking ahead to the second half of the year, Mr. Hoa forecasts continued market volatility and intense competition from over 120 international airlines operating in Vietnam. To stay competitive, the airline must continuously enhance its services, quality, and safety standards.