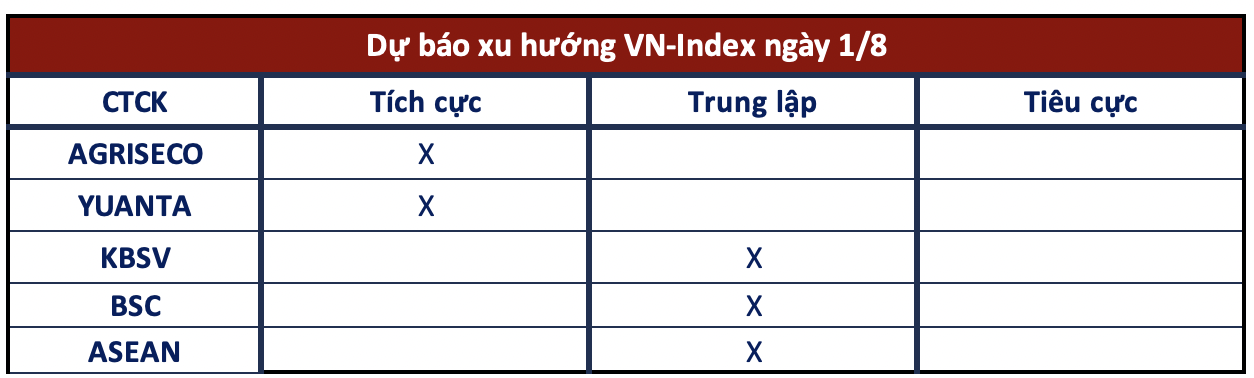

The market opened positively on July 31, gaining over 10 points at one point, and despite selling pressure in the afternoon session, strong buying power kept the green to the end of the session, with the VN-Index closing at 1,252 points, up 6 points from the reference level.

Most securities companies are of the opinion that the VN-Index is accumulating positively around the 1,245 point mark, and short-term movements have not yet confirmed that the accumulation tug-of-war has ended.

VN-Index Could Return to Uptrend

Agriseco Securities

With technical indicators giving positive signals, Agriseco Research expects the VN-Index to return to a short-term uptrend if it continues to hold the 1,250-point threshold in the coming sessions. Investors continue to hold stocks and can increase their proportions again at corrections with banks, the VN30 group, and leading stocks as their prices have been deeply discounted while the RSI indicator has retreated to the oversold region.

Yuanta Securities

The market is likely to continue its recovery in the next session, with the VN30 index possibly retesting the 1,305-point resistance level. Meanwhile, large-cap stocks are expected to continue outperforming other groups, attracting the majority of capital flows.

Market Yet to Bottom Out, Avoid Chasing

KBSV Securities

Supported and paced by large-cap stocks, the VN-Index maintained its upward trajectory, with momentum bolstered by rising trading volumes. However, short-term profit-taking pressure is likely to exert increasing pressure on the index during the recovery process as the short-term downtrend remains dominant. Investors are advised to prioritize defensive strategies, reducing holdings to low levels during early rebounds.

BSC Securities

Currently, capital is trending towards sector rotation. The VN-Index is accumulating positively around 1,245 points, and short-term movements have not yet confirmed that the accumulation tug-of-war has ended.

ASEAN Securities