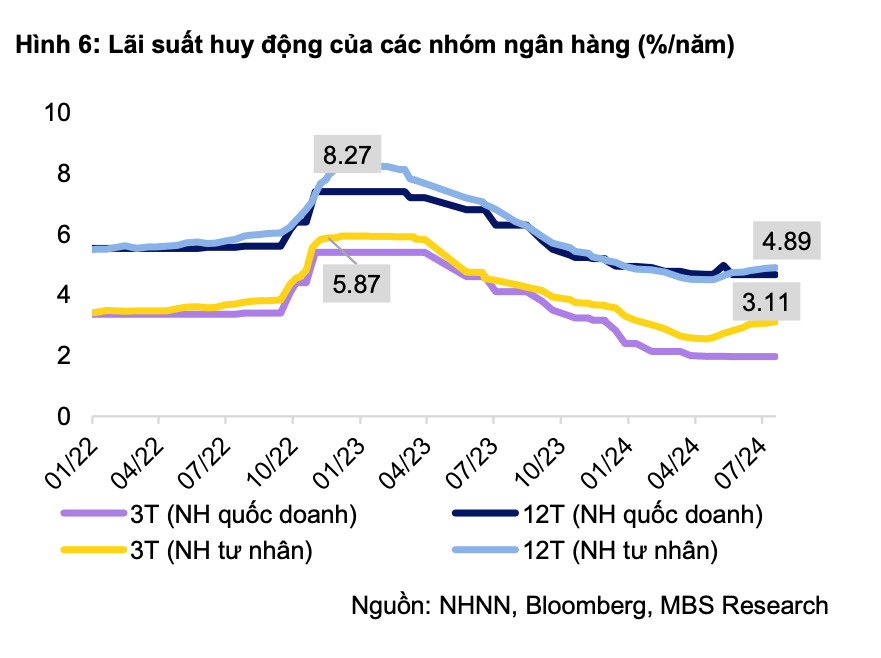

According to statistics from Military Commercial Joint Stock Bank (MB Securities), as of late July 2024, a total of 16 banks, including four large-scale commercial banks, MB, VPB Bank, Sacombank, and BIDV, have adjusted their deposit interest rates, with increases ranging from 0.1% to 0.7%.

Currently, interest rates at some banks have surpassed the 6%/year mark, such as NCB, OceanBank, and Cake by VPBank, which are offering deposit rates of 6%/year for long-term deposits of 12 months or more…

One of the factors driving up savings interest rates, according to MBS, is the rapid credit growth, which is three times faster than the increase in capital mobilization. According to the State Bank of Vietnam’s data as of June, the credit growth of the system reached approximately 6%, a significant increase considering the negative growth in the first two months of the year.

Deposit interest rates inch up at many banks

“This has prompted banks to aggressively increase deposit interest rates to enhance the competitiveness of savings accounts compared to other investment channels in the market. Following VietinBank, BIDV became the second state-owned commercial bank to adjust savings interest rates. Specifically, online deposit interest rates for 24- to 36-month terms were increased by 0.1 percentage points to 4.9%” – MBS expert analyzed.

Mr. Dinh Duc Quang, Director of the Monetary Business Block at UOB Vietnam, said that the adjustment in input interest rates is to better align with the capital supply and demand dynamics in the market, global USD interest rates, and investment yields compared to securities, real estate, and gold. The new interest rate equilibrium is appropriate.

Deposit interest rates are increasing but remain lower than pre-COVID-19 levels

“The current deposit interest rates are still lower than those before the COVID-19 pandemic, with interest rates for terms of less than six months being below the prescribed ceiling. It is predicted that VND interest rates in the second half of the year may continue to rise slightly by 0.25 to 0.75 percentage points to form a harmonious interest rate curve for all terms. Interest rates are expected to range from 3% to 6% by the end of this year, which is quite reasonable,” said Mr. Dinh Duc Quang.

MBS experts forecast that the 12-month deposit interest rate of large commercial banks may increase by 0.5 percentage points, returning to the range of 5.2% to 5.5% by the end of 2024. However, output interest rates will remain at the current level as regulatory authorities and commercial banks are striving to support businesses in accessing capital.