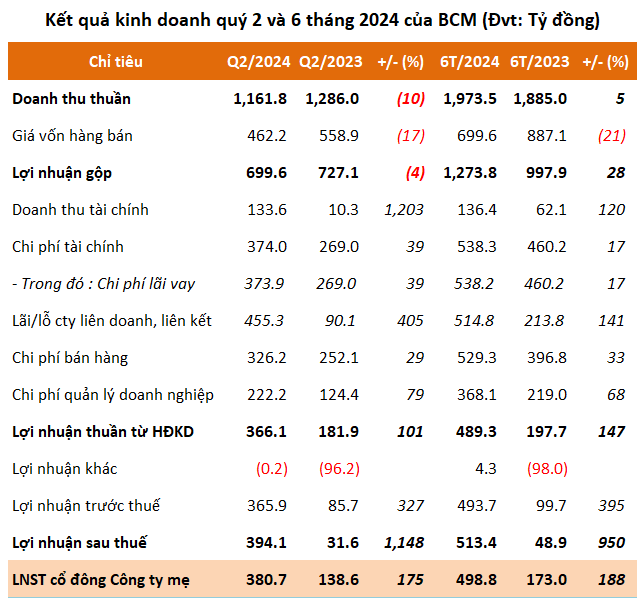

In the second quarter, the Binh Duong industrial zone giant recorded nearly VND 1,162 billion in net revenue, a 10% decrease compared to the same period last year. However, a deeper drop in cost of goods sold resulted in a gross profit of nearly VND 700 billion, a 4% decrease, and an improved gross profit margin of 60%, up from over 56%.

The bright spot this period came from financial activity revenue of nearly VND 134 billion, 13 times higher than the same period, thanks to a profit of over VND 123 billion from collaborative business ventures. Moreover, BCM earned more than VND 455 billion in profit from its joint ventures and associates, five times higher than the previous year. At the end of the second quarter, BCM recorded a net profit of nearly VND 381 billion, 2.7 times higher than the same period last year.

BCM’s Financial Performance from Q1 2020 to Q2 2024

With positive results in the second quarter, Becamex’s six-month tax profit exceeded VND 513 billion, 10.5 times higher than the same period. However, with an ambitious target of VND 2,350 billion in after-tax profit for 2024, the industrial zone giant has only achieved 22% of its annual profit plan.

Source: VietstockFinance

|

In 2024, BCM is expected to initiate several investment projects, including the Cay Truong industrial park, The One Residences housing project, and social housing projects in Viet Sing and Dinh Hoa. In addition, Becamex IDC is currently proposing several key transportation projects in Binh Duong province, such as the Ho Chi Minh City Ring Road 4 from Thu Bien Bridge to Saigon River, the Ho Chi Minh City – Thu Dau Mot – Chon Thanh expressway, the My Phuoc Tan Van road improvement project under the PPP model, and the National Highway 13 upgrade and expansion project.

The Binh Duong industrial zone giant has also set a target to raise a minimum of VND 33 trillion for the 2024-2025 period to meet its investment needs for production and business operations.

Furthermore, BCM aims to be one of the top 10 state-owned enterprises in terms of market capitalization, targeting a market capitalization of over $5 billion USD. The company has set a goal of reaching a stock market capitalization of $7.1 billion USD by 2025 and $10.8 billion USD by 2026.

On the balance sheet, BCM’s total assets as of the end of June exceeded VND 55,029 billion, a 3% increase from the beginning of the year. Of this, nearly VND 2,346 billion is deposited in banks, and inventory stands at nearly VND 20,648 billion, a 4% increase, with the majority comprising construction work in progress.

BCM has total liabilities of over VND 35,202 billion, a 4% increase from the beginning of the year, due to an 8% rise in financial debt to nearly VND 21,274 billion, accounting for 60% of total debt. Of this, nearly VND 12,245 billion is in bond principal debt.