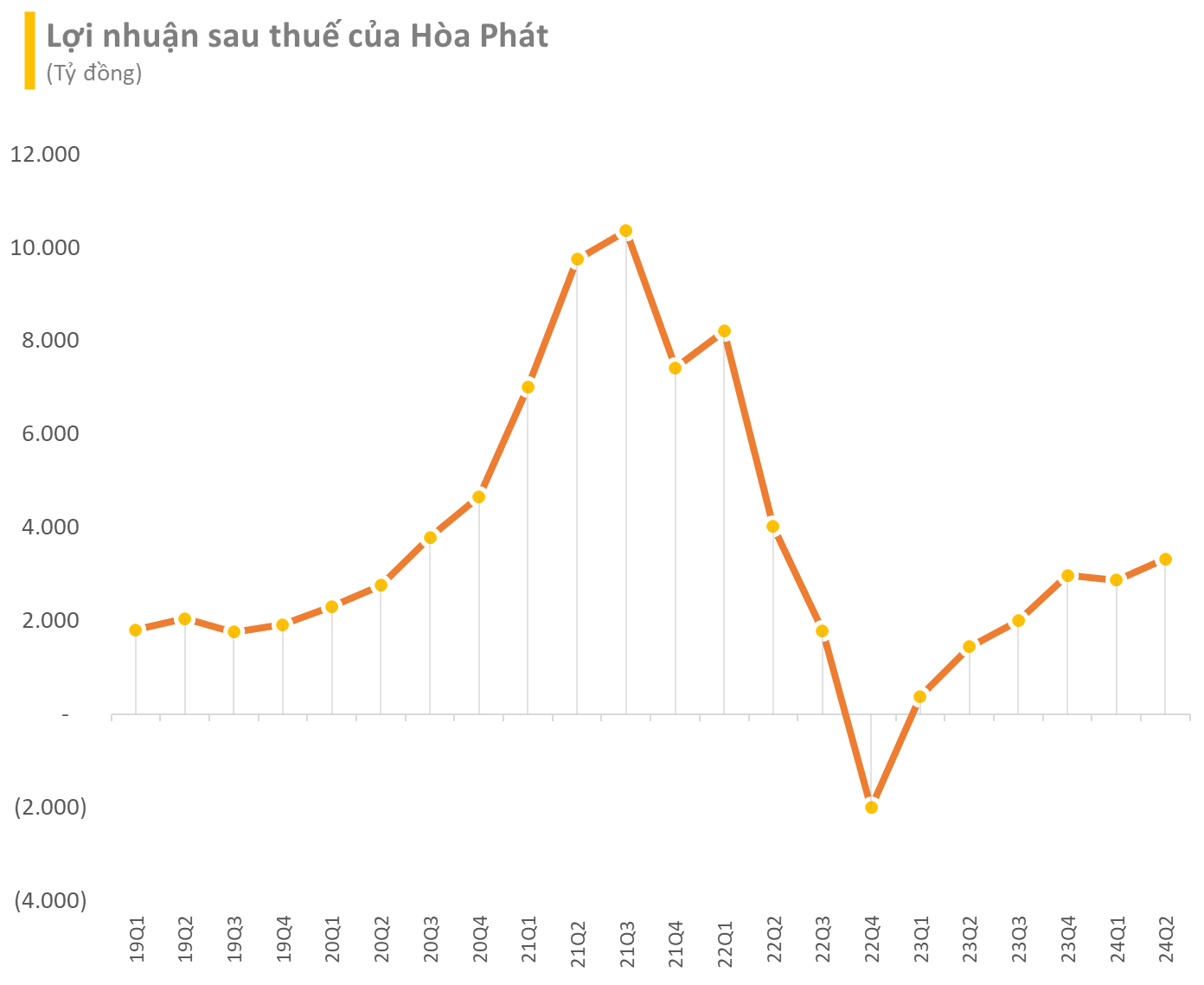

Hoa Phat Group (code: HPG) has released its Q2 financial report, showing positive results. Revenue reached VND39,555 billion, a 34% increase compared to the same period last year. Pre-tax profit surged 120% to VND3,733 billion, the highest in the past two years.

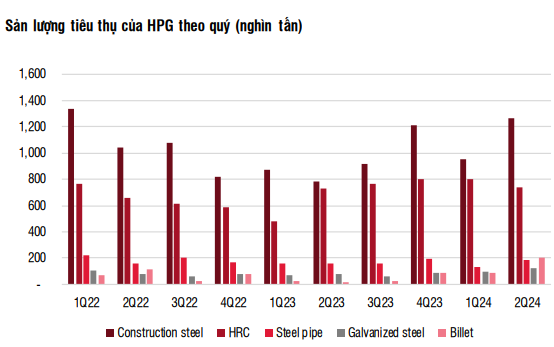

According to SSI Securities Corporation’s latest report, this impressive growth was driven by the consumption volume of construction steel. Additionally, profit margins remained stable compared to the previous quarter, as lower input costs offset the adjustment in HRC prices.

Export challenges and steel price pressures

Looking ahead, SSI Research anticipates that export activities to the European market will face increased pressure due to protective measures. The decision by the European Union to extend protective measures on imported steel until the end of June 2026 and apply a 15% quota for the “other countries” category is expected to reduce the HRC export quota from Vietnam to Europe by approximately 50% compared to 2023. Additionally, the European Commission (EC) has recently announced the initiation of an anti-dumping investigation into HRC imports from Vietnam.

In 2023, the European market accounted for about 37% of HPG’s total export revenue and contributed nearly 11% to the total revenue. However, Hoa Phat Group is expanding into new export markets such as the Middle East, Africa, and North America, reducing reliance on any single market.

Moreover, the company can increase its focus on the domestic market if export markets impose anti-dumping duties on HRC imports. In fact, Hoa Phat Group’s HRC export volume as a percentage of total HRC consumption volume has decreased from 42% in 2023 to 24% in Q2/2024.

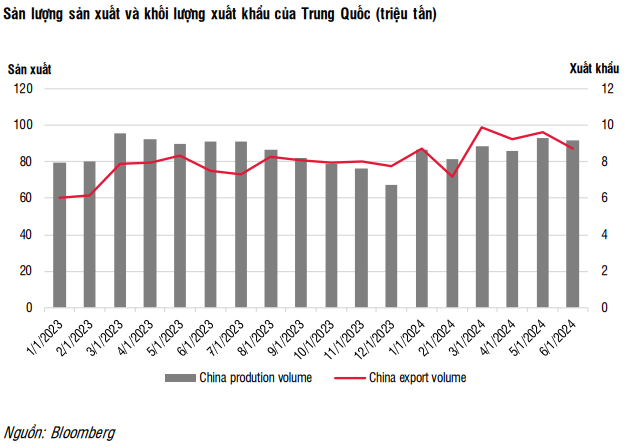

On another note, SSI Research believes that resuming steel production in China could exert pressure on regional steel prices. Production in China has risen to an average of 92 million tons per month in May and June, 10% higher than the 12-month average, due to improved profit margins at steel mills as a result of decreasing iron ore prices. Meanwhile, weak domestic demand has encouraged companies to boost exports.

In the first half of 2024, China’s steel exports increased by 22% year-on-year. This surplus has also led to a 10% decline in Chinese steel prices over the past two months.

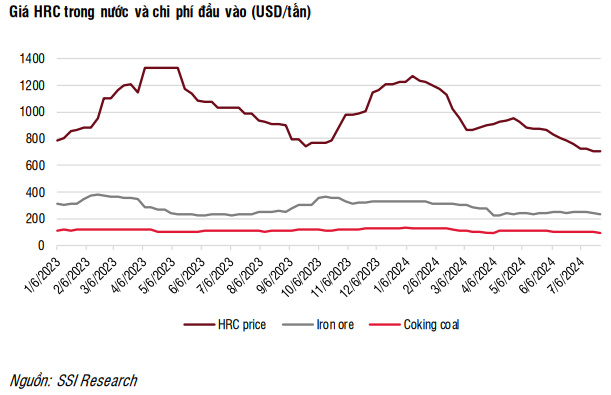

However, the drop in steel prices has supported HPG’s profit margins through lower input costs and stable construction steel prices. Following the decline in Chinese HRC prices, Vietnamese HRC prices have also decreased by 7% in the past two months. Nevertheless, SSI believes that this impact may be mitigated by the 8-9% decrease in iron ore and coke prices during the same period. Additionally, construction steel prices have remained relatively stable due to their lower correlation with regional steel prices compared to HRC products.

Net profit for 2024 may grow by 87%

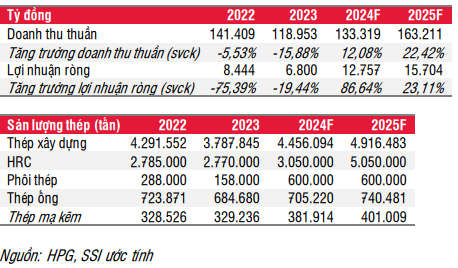

Given that the business results for the first half of the year are in line with projections, SSI expects Hoa Phat Group’s net profit for 2024 to reach VND12,800 billion, an 87% increase year-on-year. This performance would allow the company to exceed its 2024 business plan (net profit of VND10,000 billion). Specifically, construction steel and HRC production volumes are projected to reach 4.5 million tons (up 17.6% year-on-year) and 3.05 million tons (up 10%), respectively.

For Q3/2024, SSI forecasts a possible decrease in net profit compared to the previous quarter due to adjusted regional steel prices and reduced production during the low season.

Regarding 2025, net profit is expected to increase by 23% year-on-year to VND15,700 billion (a 6% reduction compared to the previous estimate) due to a 66% rise in HRC production volume to 5.2 million tons with the operation of the first blast furnace at Dung Quat 2. HRC prices may decrease by 6% in 2025 to stimulate consumption from the new plant, but lower input costs and anticipated stable construction steel prices could result in a slight decline in gross profit margin to 15%.

im