Foreign investors have been showing positive sentiments towards VNM stock. On August 2, VNM remained the stock with the strongest net buying in both volume and value, with VND 330 billion, equivalent to more than 2.8 million units. Previously, on July 31, foreign investors net bought VND 370 billion, marking the strongest net buying session for VNM since the beginning of 2024.

The net buying streak in VNM has extended to 10 consecutive sessions, with a total net buying value of VND 1,210 billion.

| Foreign investors net bought VNM for 10 straight sessions |

Along with the positive sentiment from foreign investors, the VNM stock price has also performed well in the stock market. Since July 22, the giant in the industry has seen its stock price surge by nearly 10% and break through the VND 70,000/cp mark, closing at VND 71,500/cp on August 2.

In addition to the stock price and trading volume from foreign investors, VNM‘s liquidity in recent sessions has also skyrocketed. The most notable was the session on July 31, with a record trading volume of nearly 21.6 million shares, equivalent to a value of more than VND 1,500 billion. As a result, the average liquidity in the past year reached more than 2.9 million units/session. Also in this historic session, foreign investors bought nearly 6.3 million VNM shares through matching orders, equivalent to a value of nearly VND 443 billion, marking one of the largest direct buy-sell transactions.

On August 2, 10.3 million VNM shares were traded, with a value of VND 731 billion.

| VNM stock surges |

|

Active foreign investor trading in recent sessions for VNM stock

Source: VietstockFinance

|

The net buying by foreign investors, along with improved liquidity and stock price, is supported by VNM‘s positive business results. Vinamilk had an outstanding second quarter with record-high consolidated revenue. More importantly, the Company achieved growth in all segments, including domestic, export, and subsidiaries, both locally and overseas.

According to the second-quarter 2024 consolidated financial statements, VNM‘s net revenue reached VND 16,655 billion, surpassing the previous record of VND 16,194 billion in the third quarter of 2021 to become the highest-revenue quarter. This quarter also witnessed the Company’s highest growth rate since the beginning of 2022, with a 9.5% increase year-over-year. Net profit reached VND 2,671 billion, up 21%.

These results were supported by the Company’s domestic and overseas business performance, with growth rates of 5.8% and 29.9%, respectively, compared to the same period last year.

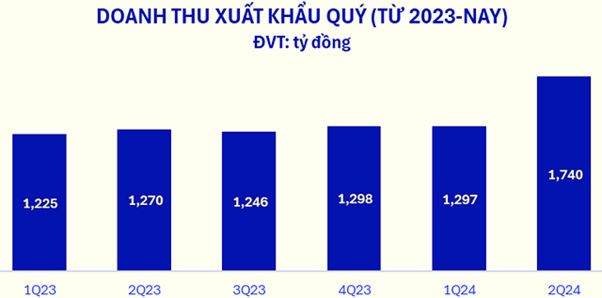

Overseas markets contributed 18.5% to the second-quarter 2024 consolidated revenue. Export revenue reached VND 1,740 billion, a 37% increase year-over-year. Continuous product innovation and strong relationships with partners in key export markets have been the foundation for Vinamilk‘s export growth.

In addition to strengthening its position in traditional markets, Vinamilk is exploring new opportunities by supplying to global chains. This strategy brings Vinamilk products to more regions in Oceania and potentially Africa and South America.

Source: VNM

|

Moving forward, Vinamilk will focus on emerging markets, leveraging free trade agreements, and building strategic partnerships. In the second quarter, the Company actively promoted trade facilitation and international business connections. Its sustainable development strategy was also leveraged as a competitive advantage in exports to create a new momentum.

With its overseas branches in Cambodia and the US, Vinamilk achieved a 21.8% year-over-year growth in revenue, reaching VND 1,384 billion in the second quarter of 2024.

“With encouraging results in the first half of 2024, we are confident in achieving our full-year plan and believe that Vinamilk will continue to be a bright spot in the market, delivering sustainable value to investors,” shared Ms. Mai Kieu Lien with investors.