Gold prices kicked off the new trading week on Monday morning (August 5) in a downward trend, mirroring the “sea of red” across Asian stock markets as investors worried about a potential US economic recession. Nonetheless, analysts believe that the likelihood of the US Federal Reserve (Fed) slashing interest rates to rescue economic growth will propel gold prices to new records.

As of 10 a.m. Vietnam time, the spot gold price in the Asian market fell by $2 per ounce compared to Friday’s close in New York, equivalent to a drop of nearly 0.1%, trading at $2,442.1 per ounce. Converted based on Vietcombank’s selling exchange rate, this price is equivalent to VND 74.4 million per tael.

At one point, gold prices dipped towards the $2,430 per ounce level but later recovered some ground.

Global gold prices have been retreating since Friday due to profit-taking by investors after several strong sessions, coupled with selling to cover losses in stock portfolios.

For the entire previous week, gold prices climbed 1.8% as mounting signs of economic weakness heightened bets on the Fed cutting rates three times this year. Gold futures for December delivery even breached the $2,500 per ounce level during Thursday’s session but failed to sustain that price.

According to data from the FedWatch Tool of the CME trading floor, the probability of the Fed cutting interest rates at the last three meetings of the year, held in September, November, and December, stands at 100%. Some analysts even predict the Fed will slash rates by half a percentage point each time during these meetings, instead of a quarter-point reduction.

Gold is a non-interest-bearing asset, so a low-interest-rate environment, especially a rapid and sharp decline, would benefit gold prices. However, in the short term, the sell-off pressure in global stock markets could weigh on the gold market, making it challenging for gold prices to surge or even decline.

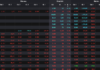

Soon after the opening bell on Monday, Japanese stocks plunged by up to 7% due to concerns about a US economic downturn and the impact of the Bank of Japan (BOJ) raising interest rates last week. As of 10 a.m. Vietnam time, the Nikkei 225 index of the Japanese stock market dropped by more than 4.6%.

The red trend was also observed across the board in other key regional markets at that time. Australian stocks fell more than 2.5%; the South Korean market dropped 5.4%; Hong Kong declined 0.6%, and the Chinese mainland slipped 0.2%.

“The stock market decline will create a safe-haven demand for gold. However, investors should note that recession fears will lead to heightened financial market volatility. Investors may be forced to sell assets in profitable positions to offset losses in stock portfolios. This will cause some gold sell-off pressure,” said Neils Christensen, an expert from Kitco News.

“We are seeing this happen… In the short term, gold prices could fall further. But in an environment like this, gold has matured enough to rise higher in the long term,” Mr. Christensen wrote on Friday.

In an interview with Kitco News, Naeem Aslam, chief investment officer of Zaye Capital Markets, expressed optimism about gold’s prospects. “The Fed’s policy mistakes have become evident as economic data shows that weakness has become a new trend in the US economy, and the Fed has been slow to cut interest rates. I think the path of least resistance for gold is upward, and we will see gold surge due to concerns about an impending recession,” said Mr. Aslam.

When asked how high gold prices could climb amid escalating recession fears, Michele Schneider, chief strategist at MarketGauge, predicted an additional increase of at least 8%. “Technically, the $2,450 per ounce level now is equivalent to the previous $2,350 mark. So, if this level holds, gold prices will surge to the $2,650-2,700 range,” Ms. Schneider assessed.