Mr. Vu Ngoc Son, Senior Advisor at Hai An Transport and Stevedoring JSC (coded HAH on the stock exchange), has recently registered to purchase 2 million HAH shares to increase his investment. Mr. Son is the father of Mr. Vu Thanh Hai, Chairman of the Board of HAH. Mr. Son had previously held this role for many years before stepping down.

The transaction is expected to be executed through matching or agreement from August 7 to September 5, 2024. If the transaction is successful, Mr. Son will increase his ownership from over 2 million shares (1.695% ratio) to over 4 million shares (3.343% ratio). In contrast, Chairman Vu Thanh Hai directly holds only 279,363 HAH shares.

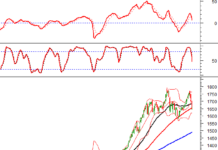

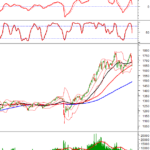

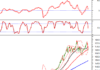

Mr. Son’s move comes as HAH shares are in a corrective phase after climbing to near their historical peak. In less than a month, the share price has dropped by almost 9% to 39,500 VND/share (as of the close on August 2). At this market price, Mr. Son may have to spend nearly 80 billion VND on this transaction.

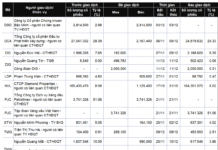

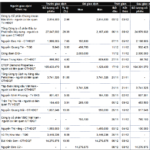

In the second quarter, HAH recorded a net revenue of 948.8 billion VND, a 55% increase compared to the same period last year, due to increased transport volume. Specifically, the revenue from ship operations reached 999 billion VND, port operations contributed 136 billion VND, and other activities generated 129 billion VND. After expenses, HAH’s after-tax profit for the second quarter was 126.5 billion VND, a 59% increase compared to the second quarter of 2023.

According to HAH, the profit growth was attributed to the addition of new vessels to their fleet (“Hai An Alfa” and “Hai An Beta”), the expansion of routes for both domestic (Nghi Son, Chan May, Long An, etc.) and international (Singapore, Malaysia, India, etc.) destinations, and a 6.5% increase in average freight rates compared to the previous year. Moreover, the increase in transport volume led to higher cargo volume and, subsequently, higher port revenue.

For the first six months of the year, HAH recorded a net revenue of 1,653 billion VND and an after-tax profit of 173.8 billion VND, a 31% increase and a 16% decrease, respectively, compared to the same period in 2023. For the full year of 2024, HAH has set a business plan with expected total revenue of 3,326 billion VND, a 25.2% increase compared to the previous year, and an expected after-tax profit for the parent company of 290 billion VND. With these results, the company has nearly achieved its profit target for the year, reaching approximately 59% of the planned figure.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.