In a recent transaction, Ms. Ha Thi Hue sold nearly 645,000 GDT shares on July 31st, reducing her ownership from 26.81% to 23.86% (equivalent to nearly 5.22 million shares). On the same day, Mr. Le Hong Thanh, a member of the Board of Directors of GDT, purchased the exact number of shares sold by Ms. Hue. The total transaction value exceeded VND 18.3 billion, equivalent to an average of nearly VND 28,400 per share. Following this transaction, Mr. Thanh’s ownership increased from 0.06% to 3.01% of GDT’s capital.

Notably, Mr. Thanh is one of the three children of Ms. Hue, alongside Mr. Le Hai Lieu, the Chairman of the Board of Directors, and Mr. Le Hong Thang, the Vice Chairman. Currently, Ms. Hue’s family holds nearly 38% of GDT’s charter capital.

On July 29th, the Board of Directors of GDT approved the dismissal of Mr. Le Hong Thang from his position as CEO due to the application of point b, clause 5, Article 162 of the 2020 Enterprise Law, which states that the company’s CEO cannot be a family member of the enterprise’s management (Chairman of the Board of Directors). Following his dismissal, Mr. Thang remains a member of the Board of Directors of GDT.

The three siblings of Ms. Le Hai Lieu. Source: GDT

|

Since the end of April, the price of GDT shares has increased by nearly 30% to a 2-year high of VND 32,150 per share on July 16th, before adjusting down to VND 27,600 per share in the afternoon session of August 5th, a decrease of more than 14% from its peak. The average trading volume since the beginning of the year has been nearly 68,000 shares per day.

| GDT Share Price Movement since the Beginning of 2024 |

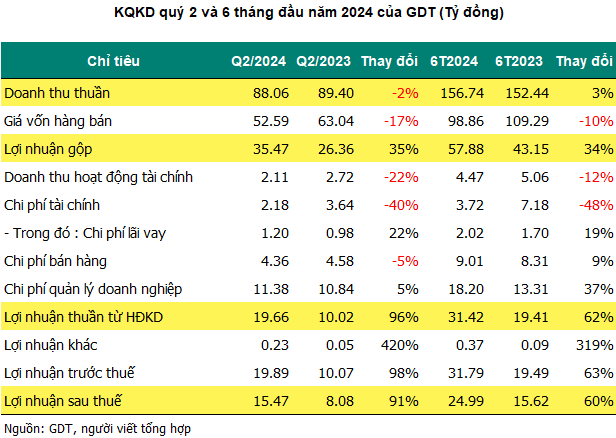

Net profit in Q2 increased by 91%

In terms of business performance, in Q2 2024, GDT recorded revenue of over VND 88 billion, a slight decrease of 2% compared to the same period last year, due to low domestic market demand. However, net profit increased significantly by 92% to nearly VND 15.5 billion, the highest in the past 8 quarters since Q3 2022.

The company attributed this improvement to enhanced production processes and the consolidation of two factories into one, which resulted in streamlined personnel, eliminated transportation costs, reduced management expenses, and improved production efficiency and labor productivity. Additionally, the company benefited from renting out the vacated factory premises.

In the first six months of the year, revenue reached over VND 157 billion, and net profit was nearly VND 25 billion, increasing by 3% and 60%, respectively, compared to the same period last year. These results represent 42% and 43% of the company’s annual revenue and profit targets, respectively.

For the full year 2024, GDT’s management remains optimistic due to recovering orders and bustling production activities, but they are also cautious about the unstable global situation.

Proposed dividend payout for 2023 at a rate of 10% in shares

Looking back at 2023, GDT experienced negative business results, with the lowest revenue in eight years at VND 311 billion and a net profit of only VND 37 billion, the lowest in a decade.

| GDT’s Financial Performance from 2013 to 2023 |

Given these results, the GDT General Meeting of Shareholders approved a reduction in the dividend payout ratio for 2023 from 30% to 20% to allocate funds for the purchase of a new factory. The company has already paid an interim dividend of 10% in cash, totaling nearly VND 21.5 billion (paid on January 26, 2024). For the remaining 10%, the General Meeting of Shareholders authorized the Board of Directors to issue shares, equivalent to nearly 2.15 million new shares. The timing of the share issuance will be decided by the Board of Directors. If successful, GDT’s charter capital will increase to over VND 236 billion.

Since 2010, GDT has maintained a practice of paying dividends to its shareholders in 2-3 installments per year, with rates ranging from 20-60% in cash and/or shares. Most recently, the total dividend payout for 2022 was 30% in cash. For the past 15 years, the company has consistently provided steady dividends to the family of Ms. Ha Thi Hue.