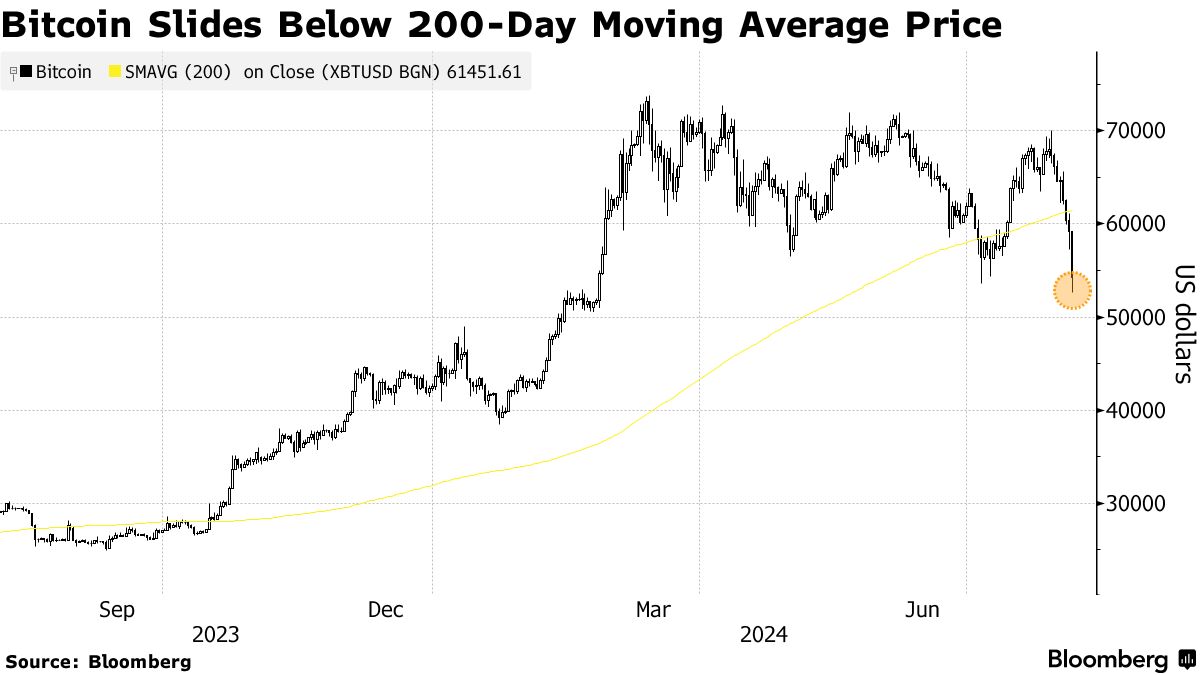

As of 10:40 a.m. in Singapore, Bitcoin traded at $54,100, marking an 8.5% decline. Notably, the cryptocurrency witnessed a 13.1% drop last week, the worst performance since the FTX exchange collapse.

Ether, the second-largest cryptocurrency in the market, also experienced a volatile trading day, plunging over 20% at one point before slightly rebounding to trade at $2,275.

This price drop occurs amid a sea of red in global stock markets. Investors are anxious about economic prospects and questioning whether the AI investment boom will live up to its expectations. Rising geopolitical tensions in the Middle East further add to the market’s concerns.

Hayden Hughes, Head of Cryptocurrency Investment at Evergreen Growth, attributes the decline in digital assets to the unwinding of carry trades based on interest rate differentials involving the Japanese Yen. “These investors are also facing higher costs for hedging volatility in the USD/JPY pair,” Hughes added.

Multiple factors influence the cryptocurrency market. The US presidential race heats up between Donald Trump, a pro-crypto Republican candidate, and Kamala Harris, a Democrat whose stance on digital assets remains unclear. Additionally, a looming threat hangs over the market: the possibility of governments auctioning off seized Bitcoin and the potential flood of cryptocurrencies returned to creditors through bankruptcy proceedings, which could significantly pressure prices downward.

However, there is a silver lining. Sean Farrell, a digital asset strategist at Fundstrat Global Advisors LLC, argues that the prospect of a Fed rate cut in September to bolster economic growth is “a good thing for the cryptocurrency market.”

Khushboo Khullar, a partner at Lightning Ventures, views this price dip as a “good buying opportunity.” However, she acknowledges that the broad-based stock sell-off has triggered some “panic,” prompting investors to scramble for liquidity to meet margin calls.

Despite the recent turbulence, Bitcoin has maintained a roughly 24% gain year-to-date, outperforming gold’s 19% rise and the 9% increase in global stock indices.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.