Notably, D17 is a newcomer to the stock exchange, having made its debut earlier this year on January 8, 2024. Specifically, nearly 5.3 million shares of D17 were officially traded on the UPCoM exchange at a reference price of 22,000 VND per share, valuing the company at nearly 116 billion VND.

Soon after its listing, the share price of D17 soared, reaching a peak of 107,800 VND per share on January 30, nearly five times the reference price in less than a month of trading. Subsequently, the market price of D17 reversed course and plummeted, hovering around the 38,000 VND per share mark for nearly two months, a decline of nearly 65% from its peak. Liquidity was low, with the highest trading volume reaching 2,600 shares on February 29, while many sessions saw no trading activity.

| Price movements of D17 shares since its listing |

Dong Tan (D17), formerly known as Dong Tan Limited Liability One Member Company, was established by Decision No. 556 dated August 11, 1993, of the Minister of Defense. Its initial focus was on industrial crop cultivation, animal husbandry, and services.

Image of D17

|

Since 1995, D17 has shifted its operations to mining and mineral exploitation. The company has also been granted land and mining licenses by the state for sand mining and the construction of civil and industrial infrastructure, transportation bridges and roads, and land leveling for the development of basic infrastructure. Additionally, they are engaged in house construction and trading.

On July 23, 2017, the Ministry of Defense issued Decision No. 2908 approving the scheme and transforming Dong Tan Limited Liability One Member Company, a subsidiary of Dong Hai Limited Liability One Member Company (Military Zone 7), into a joint-stock company. The charter capital of D17 is nearly VND 53 billion.

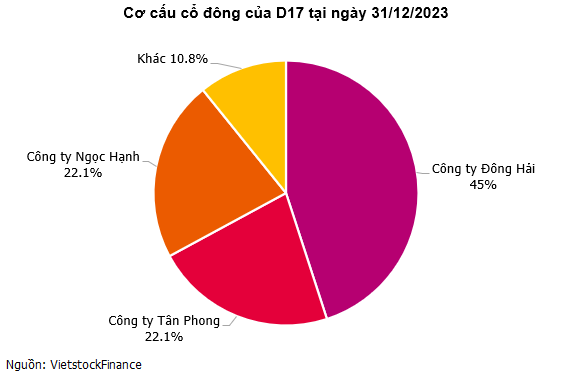

Currently, the largest shareholder of D17, with a 45% stake, is Dong Hai Company. Following closely behind, Tan Phong Gasoline Joint Stock Company and Ngoc Hanh Construction and Services One Member Limited Liability Company, both represented by Ms. Nguyen Kim Ngoc, jointly hold 22.1% of D17‘s capital.

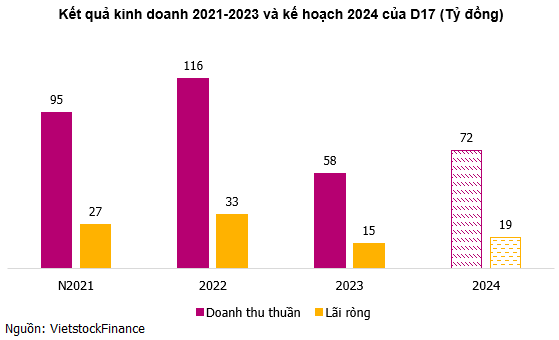

In terms of business performance, during the 2021-2023 period, D17 achieved an average revenue of nearly VND 90 billion per year, with an average net profit of VND 25 billion per year. The year 2022 marked a peak in both revenue and profitability, reaching VND 116 billion and VND 33 billion, respectively. The gross profit margin consistently improved year-over-year, ranging from 42% to 52%.

For the year 2024, D17 has set a target of over VND 72 billion in revenue and a net profit of VND 19.2 billion, representing increases of 14% and 24%, respectively, compared to the previous year. The company plans to maintain a dividend payout ratio of 15% in cash.

As of December 31, 2023, D17‘s total assets amounted to nearly VND 171 billion, the majority of which were short-term assets, accounting for 83% of total assets. The company held over VND 52.5 billion in bank deposits and nearly VND 4 billion in cash, while inventories stood at nearly VND 70 billion. On the liabilities side, payables amounted to over VND 51 billion, and there were no financial borrowings.