Executive Pay Rises Sharply at Top Vietnamese Real Estate Firms

In the first half of the year, Novaland Group (stock code: NVL) spent 131.8 billion VND on employees and company management, slightly down from 137.7 billion VND in the same period last year. However, the remuneration and salaries of the leaders increased significantly.

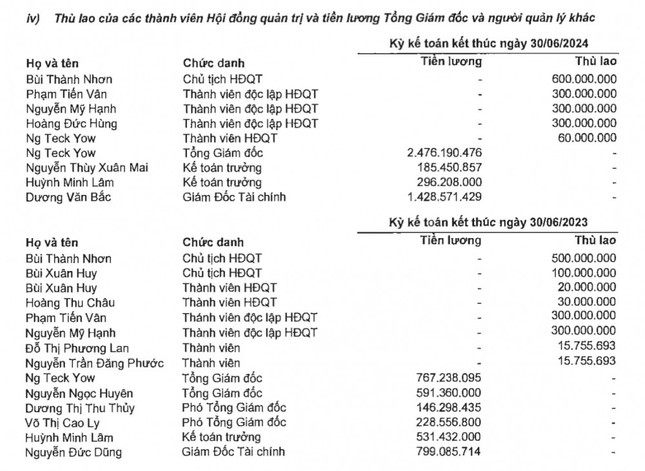

Mr. Bui Thanh Nhon, Chairman of NVL’s Board of Management, received 600 million VND in remuneration for the first six months, an increase of 100 million VND from the previous year.

Specifically, the highest-paid individual at Novaland was Mr. Ng Teck Yow, a member of the Board of Management and the General Director. Mr. Yow earned over 2.47 billion VND in the first six months, equivalent to approximately 412 million VND per month. In comparison, during the first six months of 2023, Mr. Yow received only 676 million VND in remuneration.

The second-highest-paid individual at Novaland was Mr. Duong Van Bac, the Chief Financial Officer. Mr. Bac earned over 1.42 billion VND in the first six months, equivalent to approximately 238 million VND per month. Mr. Bac’s salary is nearly double that of his predecessor. In the first six months of 2023, Novaland’s former CFO, Mr. Nguyen Duc Dung, earned nearly 800 million VND.

Details of Novaland’s leadership team’s income.

Mr. Bui Thanh Nhon, Chairman of the Board of Management, was the third-highest-paid individual at Novaland. Similar to previous periods, Mr. Nhon did not receive a salary but was remunerated 600 million VND for the first six months, equivalent to 100 million VND per month. This figure is higher than the first half of 2023, when Mr. Nhon received 500 million VND in remuneration.

Other members of the Board of Management, including Mr. Pham Tien Van, Ms. Nguyen My Hanh, and Mr. Nguyen Duc Hung, each received 300 million VND in remuneration for the six-month period.

The Chief Accountant, Mr. Huynh Minh Luan, earned a salary of 296 million VND.

Similarly, the income of the members of the Board of Management, the Executive Management Team, and other managers of Phat Dat Real Estate Development Joint Stock Company (stock code: PDR) in the second quarter totaled nearly 5.9 billion VND, slightly higher than the 5.8 billion VND recorded in the second quarter of 2023.

Specifically, General Director Bui Quang Anh Vu had the highest income among the leadership team, earning 1.4 billion VND, equivalent to 467 million VND per month. Mr. Vu’s income remained unchanged compared to the second quarter of 2023.

General Director Bui Quang Anh Vu had the highest income among Phat Dat’s leadership team, earning 1.4 billion VND.

However, Mr. Vu’s deputy saw a significant increase in income compared to the previous year. Deputy General Director Truong Ngoc Dung’s income rose from 459 million VND to 581 million VND, while Deputy General Director Nguyen Khac Sinh’s income increased from 418 million VND to 480 million VND. Among the deputy general directors, Mr. Phan Le Hoa had the highest income at 826 million VND, while Mr. Vu Kim Dien had no recorded income.

On the Board of Management, Chairman Nguyen Van Dat earned an income of 485 million VND, a slight increase from the previous year, equivalent to approximately 162 million VND per month. Vice Chairman Nguyen Tan Danh (son of Mr. Nguyen Van Dat) earned an income of 150 million VND in the past three months, a 30 million VND increase from the same period last year.

Details of the income of Phat Dat Real Estate Development Joint Stock Company’s leadership team.

Among the five members and independent members of the Board of Management, two individuals, Mr. Doan Viet Dai Tu and Mr. Khuong Van Muoi, had no recorded income in the second quarter. The remaining three members, Mr. Tran Trong Gia Vinh, Mr. Duong Hao Ton, and Mr. Le Quang Phuc, earned incomes ranging from 120 to 122 million VND.

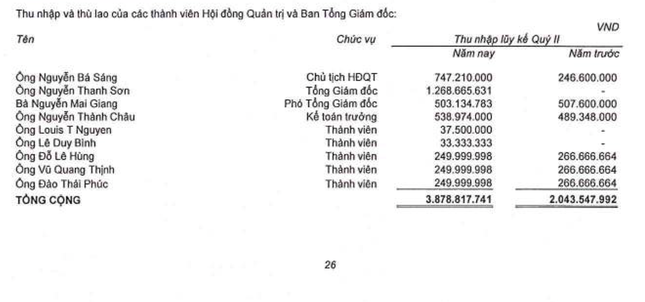

Mr. Nguyen Ba Sang, Chairman of the Board of Management of An Gia Real Estate Investment and Development Joint Stock Company (stock code: AGG), earned an income of over 747 million VND in the first half of this year. This figure represents a significant increase compared to the 246 million VND earned in the first half of 2023.

In the first six months, Mr. Nguyen Ba Sang, Chairman of the Board of Management of An Gia Real Estate Investment and Development Joint Stock Company, saw his income triple compared to the same period last year.

Thus, while Mr. Sang’s income at AGG was approximately 41 million VND per month in the first half of last year, it increased to nearly 125 million VND this year, triple the amount of the previous year.

However, the highest-paid individual at An Gia was not Mr. Sang but the General Director, Mr. Nguyen Thanh Son, who earned over 1.2 billion VND. It is worth noting that Mr. Son resigned from his position at AGG on June 3, 2023, after five months of service.

Details of the income of An Gia Real Estate Investment and Development Joint Stock Company’s leadership team.

The Chief Accountant of An Gia, Mr. Nguyen Thanh Chau, saw his income increase from over 489 million VND in the first half of last year to nearly 539 million VND in the first half of this year. Mr. Louis T. Nguyen, who joined the Board of Management on May 14, 2023, earned an income of 37.5 million VND.

Business Performance Amid Rising Executive Pay

Despite the significant increases in the income of real estate company leaders, the business performance of these companies has not been particularly impressive. In the case of Novaland, the first half of the year saw a revenue of 2,246 billion VND, and a profit after tax to the parent company of 374 billion VND, a substantial increase compared to the loss of over 1,000 billion VND in the previous year.

While the market has been lackluster, the income of real estate company leaders has risen sharply.

However, this result was not derived from the company’s main business operations but was primarily driven by financial investment activities. In the second quarter of this year, Novaland’s financial investment revenue reached 3,951 billion VND (more than five times the figure from the same period last year) thanks to profits from cooperation investment contracts totaling 2,885 billion VND. Currently, Novaland’s total liabilities stand at 194,531 billion VND.

Similarly, Phat Dat Real Estate Development Joint Stock Company recorded only 8.5 billion VND in gross revenue but benefited from 202 billion VND in financial investment revenue, resulting in a pre-tax profit of 87 billion VND, a 77% decrease compared to the previous year. In the first six months, Phat Dat’s revenue was 170 billion VND (a 13% decrease), and its net profit was 102 billion VND (a 65% decrease compared to the same period last year).

As of June 30, An Gia Real Estate Investment and Development Joint Stock Company’s consolidated net profit decreased by over 131 billion VND, equivalent to a 99% decrease compared to the same period last year. According to the company’s explanation, this decrease was due to a reduction in gross profit compared to the previous year.