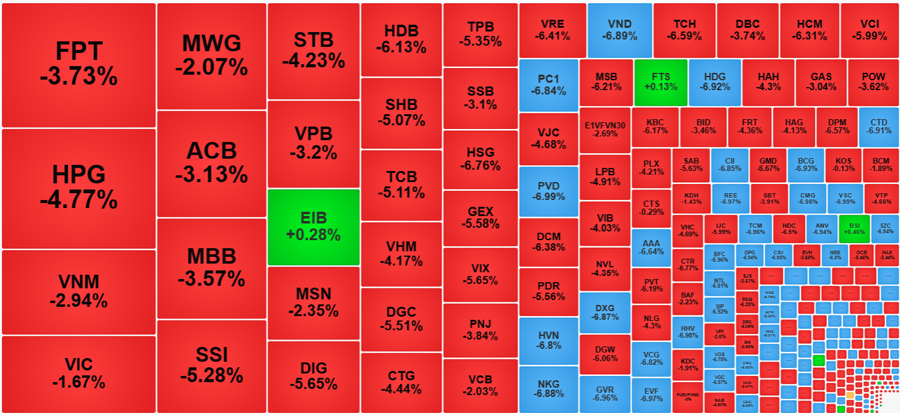

A shockwave from the international stock market triggered a massive sell-off in the Vietnamese stock market this afternoon. More than 1 billion shares changed hands on the two main exchanges, with the VN-Index plunging 3.92% (-48.53 points) to near its April 2024 low. Today’s drop was also the biggest since the 4.7% freefall on April 15, 2024.

Why did the market panic so much, especially after the release of positive macroeconomic figures for July and a string of optimistic Q2 earnings reports? In reality, this sell-off wasn’t entirely homegrown but was influenced by external factors: a steep decline in global stock markets coupled with a flood of news about the tense situation in the Middle East. The market is currently grappling with a deluge of unfavorable information.

Consecutive sessions of sharp declines have pushed a slew of stocks into a state of substantial losses, and if investors employed leverage, there’s undoubtedly pressure to liquidate positions. The intense selling pressure this afternoon caused the VN-Index to break below the psychological support level of 1200 points, settling at 1188.07 points, just above the index’s April low (the lowest closing price was 1174.85 points).

Trading volume on the HoSE in the afternoon session nearly doubled that of the morning, reaching 15,488 billion VND, the highest in 13 sessions. While there were only 5 stocks that hit the daily limit down in the morning, this number soared to 91 by the close of the afternoon session. Across all three exchanges, a staggering 127 stocks hit their daily limit down. On April 15, the VN-Index saw 111 stocks hit their limit down.

The HoSE’s breadth was extremely negative at the close, with 24 gainers versus 448 losers. Although today’s point loss was smaller than that of April 15, and there were fewer stocks hitting the limit down, the breadth ratio was much worse, with only 0.07 gainers for every loser, compared to a ratio of 1:0.09 on April 15.

Today’s selling pressure was extraordinarily intense. Among the 91 stocks that hit the limit down on the HoSE, 10 had trading volume exceeding 100 billion VND. Additionally, 202 stocks on this exchange fell by more than 4% (while the VN-Index dropped by 3.92%), equivalent to nearly 54% of the stocks traded today. Furthermore, this group of stocks accounted for 63.3% of the exchange’s total trading value.

The VN30-Index closed 3.82% lower, with no stocks in the green, and GVR hitting the limit down. The top 10 stocks by market capitalization witnessed steep declines: BID fell by 3.46%, GAS by 3.04%, FPT by 3.73%, HPG by 4.77%, CTG by 4.44%, TCB by 5.11%, and VHM by 4.17%. The least affected stock in the VN30 basket was VIC, which still lost 1.67%, and half of the basket (15 stocks) declined more sharply than the representative index.

The most vulnerable stocks remained speculative small-cap and micro-cap stocks, which had seen their prices pushed to unreasonable levels recently. 90 of the stocks that hit the limit down belonged to the mid-cap and small-cap categories, with the Midcap index closing 5.04% lower and the Smallcap index falling 4.62%. The list of stocks subjected to the sell-off is extensive, and the most liquid stocks at the limit down price were VND with 237.8 billion VND, PC1 with 208.7 billion, PVD with 199.8 billion, NKG with 186.4 billion, HDG with 165.7 billion, DXG with 141.6 billion, HVN with 138.4 billion, CTD with 105.3 billion, and AAA with 101.6 billion.

Foreign investors continued to sell today, although their selling intensity eased slightly. Specifically, they injected new capital of about 1,317 billion VND, double that of the morning session, but their selling also increased by 40% to 1,566.6 billion VND. Thus, net selling still stood at 249.6 billion VND, lower than the morning session’s 481.3 billion VND. Today’s foreign sell-off on the HOSE accounted for only 11.4% of the exchange’s total trading volume, indicating that domestic investors were the primary drivers of the sell-off.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.