Vietnam’s Macroeconomic Outlook for 2024: Positive Growth and Recovery

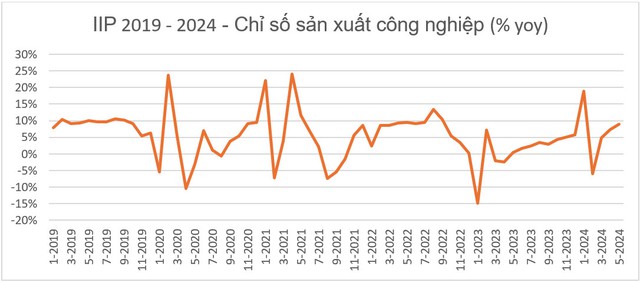

Vietnam’s economy is on a path to recovery in 2024, as evident from various indicators such as quarterly GDP growth, rebounding IIP (Index of Industrial Production), robust PMI (Purchasing Managers’ Index) for manufacturing and services, strong trade activities, and continued FDI (Foreign Direct Investment) inflows. This positive trajectory is reflected in the macroeconomic data for June and July 2024. The Processing and Manufacturing sector grew by 9.5% in July 2024, while the Electricity Production and Distribution sector achieved a remarkable 12.4% growth rate. Over the first seven months of 2024, the overall Industrial sector expanded by 8.5% year-on-year, providing a strong impetus for the VN-Index to maintain its mid-to-long-term growth trajectory in line with the economic recovery cycle.

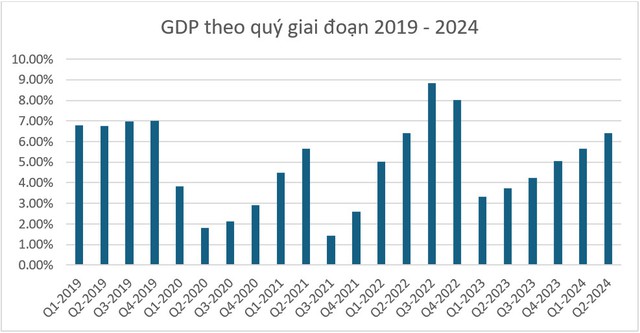

GDP growth data indicates a recovering Vietnamese economy

IIP reflects a rebound in the Industrial sector

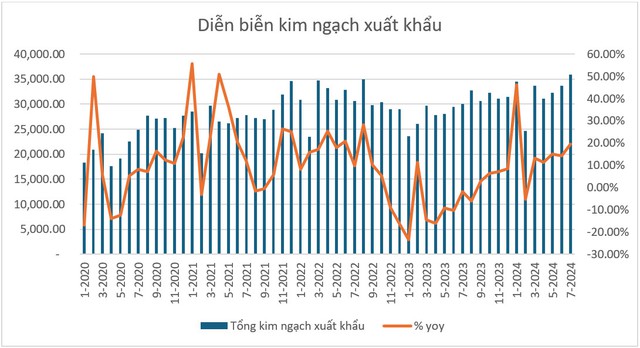

Performance of key export sectors as of July 2024

VN-Index Remains in an Uptrend in the Medium Term

Mr. Nguyen Minh Hoang, Director of Analysis at VFS, shared his insights: “Since bottoming out around 900 points in late 2022, the VN-Index has been in a mid-term uptrend and has not violated the trendline. In the short term, VFS experts believe that the VN-Index is undergoing a correction from the short-term peak of 1300 in June 2024. Looking at a broader perspective, the distribution phase (or the profit-taking phase) of the five-month rally from November 2023 to March 2024 has been taking place since April 2024. This distribution phase has been relatively positive, with the VN-Index forming higher lows in late April and July 2024. Profit-taking has been evident, especially in the midcap stock group, which witnessed an average decline of 20-30% from their recent highs, including stocks like VTP, CRT, VGI, FOC, DBC, SMC, HVN, DPG, FOX, DDV, and TCH. In the most optimistic scenario, the VN-Index may find support and stabilize around the current level of 1220, backed by large-cap stocks. In a less favorable scenario, the index may seek balance around the strong support level of 1190 (+/-10)

“.

VN-Index is Expected to Reach the 1,400 Mark

The VN-Index’s current P/E ratio stands at nearly 14, slightly below the average but still within a reasonable range. With a conservative estimate of a 12% growth in corporate profits in 2024, the forward P/E for the VN-Index is expected to be around 12, making it a relatively attractive valuation, especially considering the strong economic recovery. Therefore, investors can remain optimistic about the VN-Index reaching the 1,400 mark by the end of the year.

According to VFS experts, the investment strategy for the second half of 2024 remains focused on economic recovery. The VN-Index has exhibited significant differentiation across sectors since the beginning of the year, which is typical during the initial stages of economic recovery when challenges like exchange rates and inflation are still prevalent, and sectoral recoveries are uneven. “Investors should pay attention to sectors such as Banking, Exports (Garments and Seafood), Retail, and Electricity Production and Distribution (Hydropower) in the latter half of the year, as these sectors are expected to benefit from favorable conditions and lower input costs,” said Mr. Hoang.

Enhance your financial journey with VFS Expert and a team of experts

Mr. Nguyen Minh Hoang is one of the five senior experts in the VFS Expert program launched by Viet Capital Securities (VFS) in July 2024. This exclusive program offers personalized 1:1 consulting, customized investment portfolio advice, and in-depth stock analysis. Subscribers to VFS Expert also receive continuous market updates, including market outlook reports, fundamental and technical stock analysis, recommended portfolios, and market alerts.

Join hands with our team of experts on your financial journey. Click here to learn more.