Vietnam Electrical Construction JSC (VNECO) has recently encountered some challenges. The company, with the stock code VNE, announced that it received an unusual notification from the Danang People’s Court regarding the acceptance of an application for bankruptcy proceedings.

This development comes after VNECO and Song Da 11 JSC (SJE) entered into a construction contract for Package 6 of the “500kV power line connecting Nghi Son 2 Thermal Power Plant to the national grid,” with a total value of over VND 37 billion.

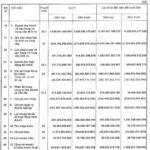

While VNECO has made payments and offset debts to Song Da 11 amounting to over VND 30 billion, there is still an outstanding balance of nearly VND 7 billion. This includes overdue payments of VND 4.4 billion and retention money of VND 2.7 billion, which is typically released after project completion and final settlement.

Song Da 11 has filed for bankruptcy against VNECO due to the delayed payments. Additionally, VNECO is facing internal challenges, as the necessary documents and procedures related to payments and debts during the previous CEO Tran Quang Can’s tenure have not been handed over since his departure.

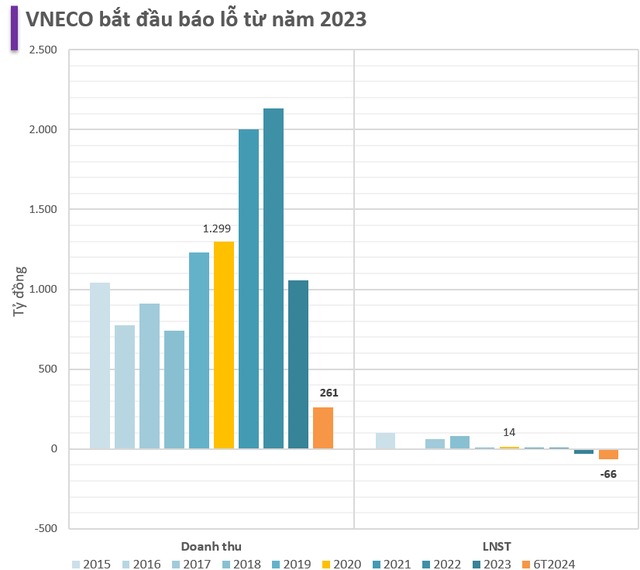

The company has also failed to organize its 2024 annual general meeting of shareholders, despite the board’s decision to extend the deadline to June 30. VNECO, a leading electrical construction company, has experienced a decline in financial performance in recent years, reporting losses in 2023 and the first half of 2024.

One of the main reasons for the company’s losses is the high interest expense. As of June 30, the company’s total financial borrowings stood at VND 1,700 billion, 1.8 times its equity. In contrast, their cash and bank balances were only around VND 42 billion.

Moving forward, VNECO needs to address its financial challenges and improve its debt situation to regain stability and pursue new projects. The company’s prospects in the electrical construction industry remain promising, especially with the upcoming implementation of the 500 kV Mach 3 extension project (Quang Trach – Pho Noi), where VNECO is expected to play a significant role in the construction phase.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.