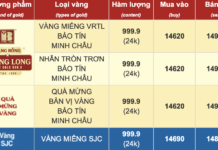

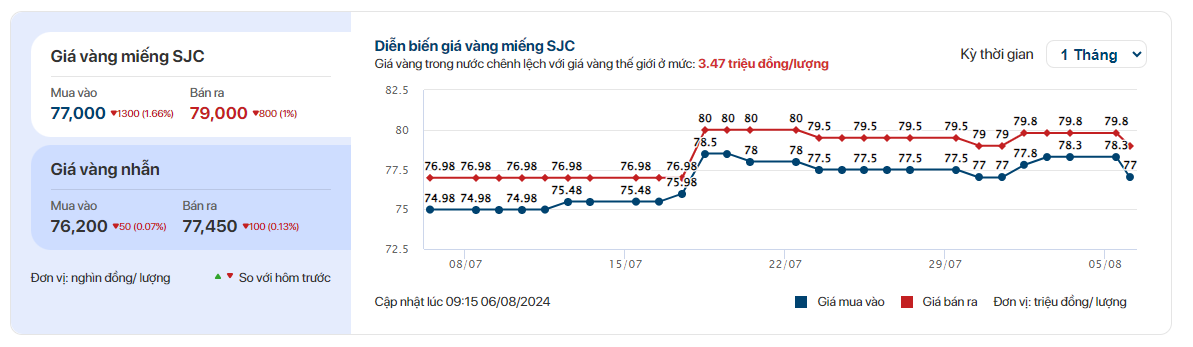

Gold prices witnessed a downward trend today, with SJC gold being quoted at 77.0-79.0 million VND per tael, a decrease of 1.3 million VND per tael for buyers and 800 thousand VND per tael for sellers compared to yesterday.

Gold ring prices also decreased by 50-100 thousand VND per tael across the board. At SJC, these rings were priced at 76.2-77.45 million VND per tael. Bao Tin Minh Chau listed them at 76.28-77.48 million VND per tael, while DOJI and PNJ offered rates of 76.25-77.45 million VND per tael and 76.2-77.45 million VND per tael, respectively.

In the international market, gold prices experienced a turbulent ride. The precious metal plummeted from $2,458 per ounce to $2,360 per ounce, a massive drop of $98, on the evening of August 5 (Vietnam time). However, by the early morning of August 6, gold staged a strong recovery, surging back above the $2,400 per ounce mark. At 9:30 am, the spot gold price stood at $2,411 per ounce, equivalent to approximately 74.5 million VND per tael, excluding taxes and fees.

The plunge in gold prices on August 5 was attributed to a wave of sell-offs as investors sought to cover margin calls on other assets. “The volatility in gold signals the level of panic gripping the stock market,” said Adrian Ash, research director at BullionVault. Global stock markets have been in a downward spiral, with Japan’s stock market experiencing its worst Black Monday since 1987. The Topix and Nikkei 225 indices plummeted more than 12% on August 5 and are poised to enter a bear market. US stocks are also taking a hit, with Dow Jones futures down a staggering 1,050 points, or 2.6%, as of 7:30 pm, August 5 (Vietnam time), following a 611-point drop last Friday.

The global stock market rout is fueled by fears of an economic recession in the US, prompting investors to dump risky assets. Data released last Friday revealed that the US unemployment rate surged to 4.3% in July, increasing the likelihood of a rate cut by the Federal Reserve in September, with expectations of a 50-basis-point reduction.

Analysts suggest that gold is temporarily impacted by the stock market sell-off. According to Kitco News, Han Tan, market analyst at Exinity Group, stated: “Escalating geopolitical tensions and expectations of Fed rate cuts will create supportive conditions for gold bullion. Ultimately, gold could reach new record highs as anxieties ease.”

Market Update on February 3rd: Crude oil, gold, copper, iron and steel, and rubber all decline together.

At the close of trading on February 2nd, the prices of oil, gold, copper, steel, rubber, and coffee all saw a simultaneous decrease, with iron ore hitting a two-week low.