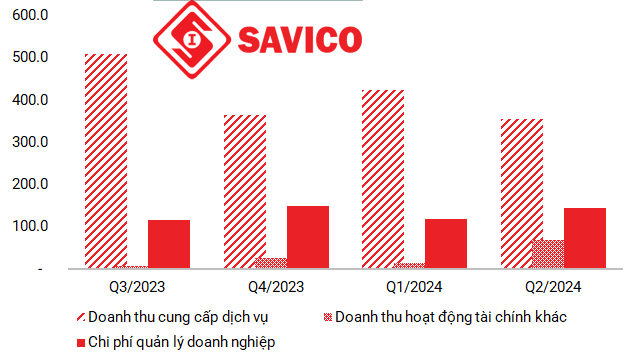

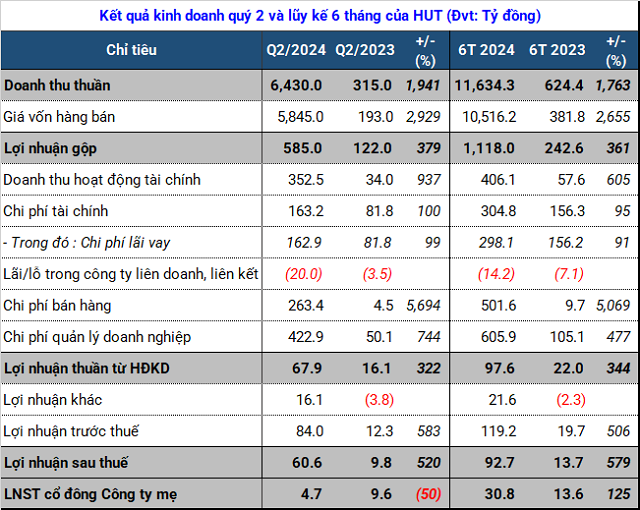

It comes as no surprise that HUT’s Q2 revenue surged to 20 times that of Q2 2023, reaching over VND 6.4 trillion. This significant growth is primarily attributed to the additional VND 5.3 trillion contributed by the company’s automobile business segment, which was not recognized in the previous year. The traditional toll collection business, on the other hand, brought in VND 322 billion, a 17% increase.

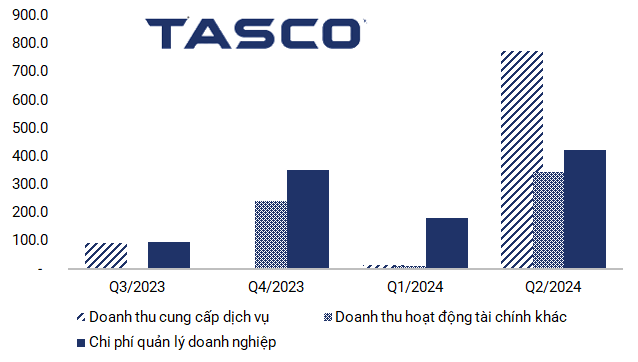

When compared to the consolidated figures for Q1 2024, Q2 revenue increased by 24%, thanks not only to automobile sales but also to the service segment’s remarkable performance of VND 775 billion, a 60-fold increase from Q1. Similarly, other financial activities tripled, generating VND 346 billion in revenue. Administrative expenses amounted to VND 423 billion, more than doubling.

|

Changes in HUT’s Revenue and Expenses since the Merger with Tasco Auto (in VND trillion)

Source: Author’s Compilation

|

|

Revenue and Expenses of SVC, a Subsidiary of Tasco Auto (in VND trillion)

Source: Author’s Compilation

|

HUT’s net profit after tax soared sixfold compared to the same period last year, surpassing VND 60 billion, thanks to a gain of VND 16 billion in other income. However, only VND 4.7 billion was attributed to the parent company’s shareholders, a 50% decrease and the lowest since the merger. In Q1, the net profit was over VND 26 billion.

For the first six months, revenue reached VND 11.6 trillion, achieving 50% of the full-year plan. Meanwhile, net profit stood at VND 31 billion, a 125% increase year-on-year, but only 14% of the annual target.

Source: VietstockFinance

|

As of June 30, 2024, HUT’s total assets amounted to approximately VND 27.2 trillion, remaining relatively unchanged from the beginning of the year. Over half of the short-term assets, about VND 6 trillion, comprise accounts receivable. The company holds highly liquid assets, including cash, cash equivalents, and investments held to maturity, totaling VND 2.1 trillion, or 20% of the total.

Notably, other short-term receivables increased by nearly VND 1 trillion to VND 4.2 trillion, mainly from third parties, but specific details were not provided.

As of the reporting date, the company’s total liabilities exceeded VND 15.6 trillion, with short-term and long-term borrowings accounting for half of this amount, at VND 3 trillion and VND 5.6 trillion, respectively, showing a slight decrease. Other payables, including short-term and long-term portions, amounted to VND 2.7 trillion and VND 1.6 trillion, respectively.

Looking ahead, HUT’s management believes that the challenges faced by the automotive industry are temporary, and the long-term prospects remain promising. As a result, the company intends to prepare resources for expansion, including increasing the number of showrooms and introducing new automotive brands to meet future demand.

HUT will continue to develop its non-stop toll collection service, payment intermediary, and VETC e-wallet to offer transportation solutions for cashless fuel payments, financial overdrafts, airport fees, parking, and more. The used car trading platform, Carpla, will also be further promoted.

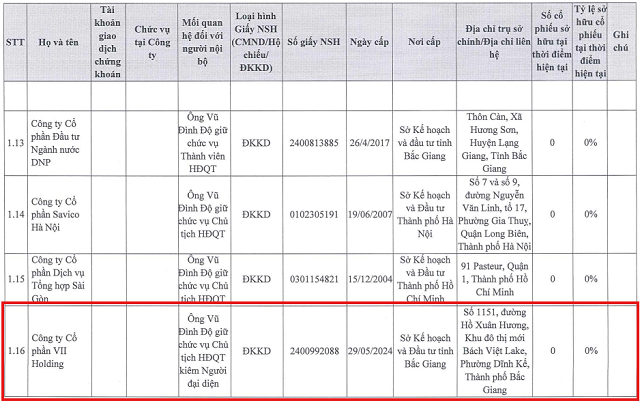

Last year, shareholders approved the transfer of a portion or all of the shares from the shareholders listed in the share swap list with SVC Holdings (now Tasco Auto) to VII Holding, a company chaired by Vu Dinh Do, without the need for a public offering. This transaction could potentially result in VII Holding owning more than 25% of the voting shares in HUT. However, the semi-annual governance report for 2024 indicates that VII Holding has not yet taken any action, and its ownership of HUT remains at 0% as of June.

Source: HUT

|

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.