The VN-Index plunged in the afternoon session as sell orders flooded the market, causing a sudden spike in liquidity. Approximately VND 15,000 billion changed hands on the HoSE in just two hours of afternoon trading, nearly two and a half times the value of matched orders in the entire morning session.

The number of stocks hitting the floor rose rapidly, reaching 91 by the end of the session as buying and selling forces were imbalanced. Sellers dominated the market while bottom-fishing funds remained cautious. Bottom fishers from the past two weeks failed to reap T+ profits and are now facing losses.

Hundreds of stocks plummeted during the first session of the week.

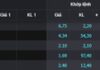

Floor-priced stocks appeared in almost every sector, from large-cap to small and medium-cap speculative stocks. GVR from the VN30 basket hit the floor. Several large-cap stocks witnessed strong selling pressure, resulting in high liquidity, such as FPT, which fell 3.7% with a trading value of over VND 1,254 billion, the highest on the exchange.

Similar to the tech stock rout in some global markets, FPT and numerous other stocks in the industry experienced negative trends in the domestic market. CMG, ST8, and ITD hit the floor, while ELC dropped close to the floor price and VNZ closed with a loss of more than 4.7%. Another stock that witnessed trillion-dollar trading value today was HPG, with approximately VND 1,200 billion. The stock closed with a 4.7% loss. Stocks in the same industry, including VCA, TLH, NKG, and SMC, fell to their daily limit.

Real estate stocks dominated the list of floor-priced stocks, including DXS, HPX, DXG, SIP, ITA, SZC, QCG, IDI, HTN, SCR, ASM, HDG, HHS, and LDG. Although no floor-priced stocks were observed in the banking sector, more than half of the stocks witnessed declines of over 4%. The significant and uniform declines among large-cap stocks, the heaviest-weighted sector in the market, further exacerbated the market downturn. VCB alone caused the VN-Index to lose 2.5 points, followed by BID, TCB, and CTG.

The downward adjustment in Vietnam’s stock market is in line with the trend in regional and global markets. In Asia, both the Nikkei 225 and Topix in Japan suffered sharp declines, with Nikkei erasing all its year-to-date gains and closing 5/8 down 13.57%.

The downward trend began at the end of last week after the Bank of Japan signaled its intervention in the yen, causing the currency to strengthen to just below 150 yen to the dollar. The stronger yen triggered a sell-off in stocks that benefit from a weak yen.

The Kospi index in South Korea fell 8.1% before trading was halted at 2:41 pm (Seoul time) due to the excessive drop, which triggered the exchange’s circuit breaker. In South Korea, trading is halted when fluctuations exceed the 8% threshold.

Chinese stocks are also deep in the red, with the Shanghai Composite down 1.54% and the ShenZhen Component down 1.85%. The Hang Seng Index declined by 1.56%.

The Nasdaq Composite Index in the US has dropped over 10% from its mid-July peak as the number of Americans filing for unemployment benefits hit a near one-year high. This has heightened concerns about the health of the world’s largest economy.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.