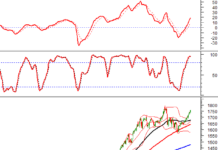

The US stock market underwent a relentless sell-off on Monday (Aug. 5), as part of a global market rout amid investor concerns about the risk of a US economic recession and the soaring Japanese yen.

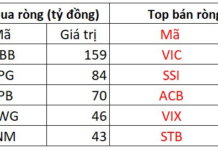

Investor skepticism about the market grew after Berkshire Hathaway, Warren Buffett’s company, revealed over the weekend that it had sold about half of its Apple stock holdings and was holding a large amount of US Treasury bonds.

The fact that the legendary investor dumped a hot tech stock and turned to government bonds, considered an ultra-safe asset, is seen as a signal that the bull market may be nearing its end.

However, according to Buffett’s long-held view, market corrections like the ones we’ve seen in recent sessions are not a big deal for long-term investors. He believes that a wise investor ignores short-term ups and downs in the stock market.

“If you’re afraid of corrections, you shouldn’t be in the stock market,” Buffett said in a 2025 interview with financial news site The Street. “It’s a terrible mistake to try and dance in and out. If you’re going to be a net buyer of stocks in your lifetime…then you are going to benefit from them being on sale.”

“If you’re investing in stocks for your savings, say for retirement, then you don’t need to be concerned about what happens today, or tomorrow or next week or next year,” said the billionaire with a illustrious investment career.

“If you buy a stock, occasionally it will go down. So what? You’ve got a reason to be happy. You get to buy more of it cheaper. It’s only what it’s selling for that day that makes you happy or sad,” Buffett emphasized.

Regarding the stocks Buffett favors, he is famous for investing in value stocks. These are stocks that are considered to be trading at a discount to their intrinsic value. Of course, Buffett and other professional investors have dedicated their careers to researching and identifying such stocks in the market. For individual investors, Buffett suggests a simpler approach.

He once told CNBC that for long-term investors, owning a diversified portfolio of low-cost index funds is “the most sensible thing to do at any time.”

“Just keep buying a low-cost index fund…and keep buying it regularly and the best time to buy it, according to him, is when things look the worst,” Buffett said back in 2017.

With Buffett’s perspective, the recent steep declines in US stocks and some other markets may have presented a good buying opportunity.

The S&P 500 index, the broadest measure of US stocks, is currently down about 8% from its all-time high set on July 16. If it falls another 2 percentage points, the S&P 500 will enter correction territory, defined as a 10% or greater decline from its recent peak. Meanwhile, the Nasdaq index entered correction territory as of last Friday.

However, compared to the beginning of the year, the S&P 500 is still up 10.5%.