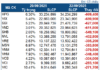

The Ho Chi Minh City Stock Exchange (HOSE) has announced a supplementary list of stocks that are ineligible for margin trading.

According to the announcement, HOSE has added AAM shares of Mekong Fisheries Joint Stock Company to the list due to negative audited after-tax profit in the semi-annual reviewed financial statements for 2024.

Previously, HOSE removed QNP shares of Quy Nhon Port Joint Stock Company from the list of stocks ineligible for margin trading as the company had rectified the conditions for margin trading eligibility.

As of August 6, there are 78 stocks on the HOSE that are ineligible for margin trading, a decrease of one stock compared to the previously announced list. This list still includes familiar stocks that are under warning or control, such as AAT, AGM, APH, ASP, BCE, C47, CIG, CKG, CRE, DAG, DLG, DTL, DXV, EVG, FDC, GMC, HAG, HBC, HNG, ITA, ICT, JVC, KPF, LGL, MDG, NVT, OGC, PIT, PMG, PSH, RDP, SMC, TVB, TTF, VAF, VNE, and more.

Notably, TVB, the stock of Tri Viet Securities, is the only securities company stock on the list that has been cut off from margin lending due to being under control.

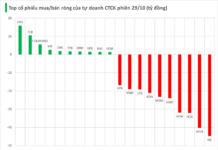

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.